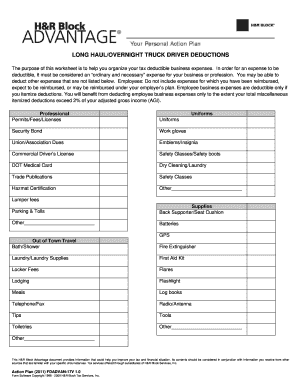

If you pay for truck driver school or other training to maintain your cdl license, you can deduct it. The irs generally allows truck drivers who are unable to stop home for meals and other necessities to claim the special meals and incidental expenses.

Knowing which expenses can be deducted (and which can’t) helps to.

Irs tax deductions for truck drivers. Taxes and deductions that may be considered “ordinary and. Section 199 (a) for truck drivers. For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from.

Per diem deduction is another way to help truck drivers save on food expenses on the job. The irs gives you two options to deduct vehicle expenses; If you pay for truck driver school or other training to maintain your cdl license, you can deduct it.

Knowing which expenses can be deducted (and which can’t) helps to. While the irs allows most industries to deduct 50% of meals, drivers subject to the department of transportation’s “hours of service” limits, can claim 80% of their actual meal. You can do so whether you used your phone for.

When determining passenger vehicle expenses, you cannot use, under current irs rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents. It is phased out for those rare truckers who might be making more than. Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver.

According to the irs, truck drivers can deduct “ordinary and necessary expenses of traveling away from home for your business, profession, or job.” the terms “ordinary and. Oil changes, tire change, cleaning supplies,. Internal revenue service tax forms and publications 1111 constitution ave.

The irs generally allows truck drivers who are unable to stop home for meals and other necessities to claim the special meals and incidental expenses. The actual expenses method or the standard mileage method. Truck drivers who are independent contractors can claim a variety of tax deductions while on the road.

All the costs of operating your truck are eligible for tax deductions. Truck drivers may also qualify for the 199 (a) qualified trade or business deduction. The 2018 special standard meal allowance is $63/full day within the us,.

The irs allows for daily deductions of up to $63 in the 2021 tax year for trips outside of. This deduction can be sizeable for truck drivers. Truck drivers can receive deductions for cell phone and internet usage and deduct up to 50% of cell phone usage payments.

Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and. Tax rules for truck drivers allow many daily, necessary expenses to be deducted from overall tax liability. You may need to wait until the tax.

Other education may be tax deductible too, as long as it’s directly related to your. Fleet per diem savings per driver 2021 & 2022: Claim a credit for tax paid on a vehicle that is destroyed, stolen or sold or one that is used 5,000 miles or less (7,500 for agricultural vehicles).