The 2020 increase for deductions of cash contributions is extended one year into 2021. There�s also a limit on how much you can deduct.

The 2020 increase for deductions of cash contributions is extended one year into 2021.

Limits on tax deductions for charitable contributions. 1, 2026 (for cash contributions to public charities and private operating foundations). Key points if you made cash donations to eligible charities in. Normally, people who use the standard deduction can’t take any charitable contribution deductions.

Special 2021 rules standard deductions for 2021 and 2022 taxes. The main change for 2021 was allowing all taxpayers to deduct up to $300 in charitable contributions ($600 for joint filers) without itemizing their deductions. That’s because the limit allows you to deduct up to 50 percent of your adjusted gross income to most of the common types of charities, including churches, educational organizations and publicly supported charities.

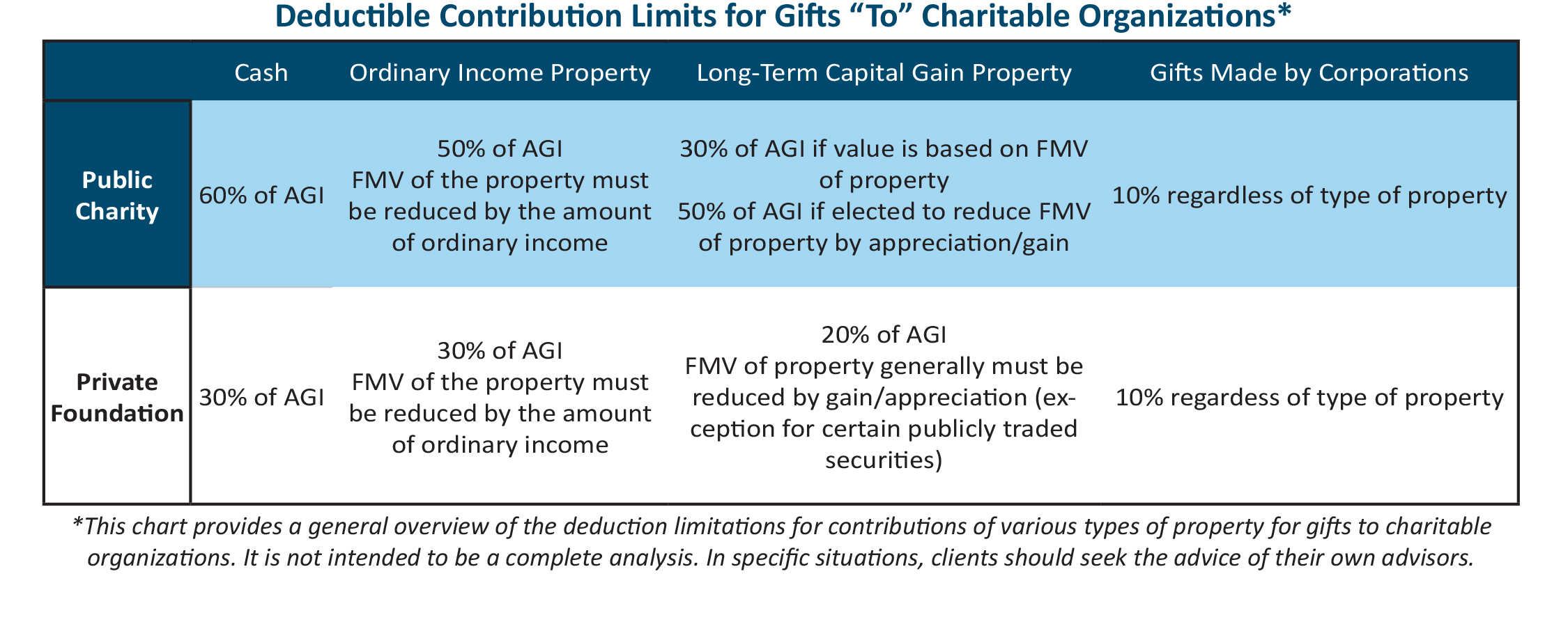

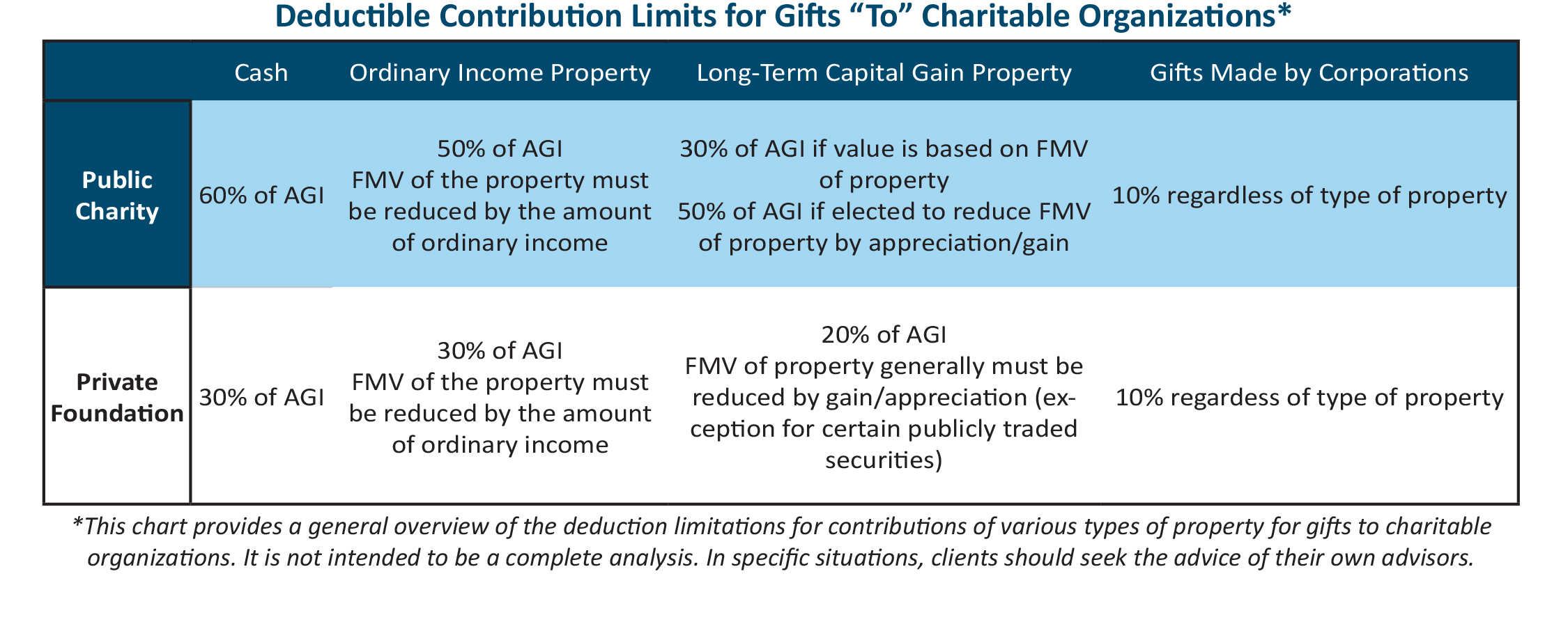

These limits typically range from 20% to 60% of adjusted gross income (agi) and vary by the type of contribution and type of charitable organization. In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. The caps are a bit lower for gifts to other types of nonprofits.

If you itemize your deductions, donations made by december 31 to qualifying charities may reduce your 2020 taxable income and could help bring you a larger refund in 2021. For example, prior to 2020, an individual with an adjusted gross income of $1,000,000 would have been capped at $600,000 in giving that could be claimed as a charitable deduction. The amount of your charitable contribution to charity x is reduced by $700 (70% of $1,000).

However, the cares act increased the deduction limit, reduced by other contributions, from 10% of taxable income to 25% for 2020 and the caa subsequently extended the 25% threshold for 2021. Many charitable contributions are eligible for deduction from your federal and state adjusted gross income. Following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in 2021.

However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private. Click to see full answer. Under the new law, a c corporation is now entitled to deduct qualified contributions of up to 25% of its taxable income.

Under the new rules, that same individual could theoretically donate and claim the entire $1,000,000 as a charitable deduction. The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t itemize. If you claim the standard deduction on your federal income tax return, you may still.

A clothing or household item for which a taxpayer claims a deduction of over $500 does not have to meet this standard if the taxpayer includes a qualified appraisal of the item with their tax return. Prior to the act, a c corporation’s charitable contribution deduction generally was limited to 10% of its taxable income. Individuals who do itemize may claim a deduction for charitable cash contributions made to qualifying charitable organizations, subject to certain limits.

Under the law known as the tax cuts and jobs act, p.l. Donations made to a qualified charity are deductible for taxpayers who itemize their deductions, within certain limitations.typically for cash contributions made between 2018 and 2025, the amount that can be deducted is limited to no more than 60% of the taxpayer’s adjusted gross income (agi). How the charitable contributions deduction works.

However, most of us don’t have to worry about it. 31, 2017, and before jan. The basic rule is that your contributions to qualified public charities, colleges and religious groups generally can�t exceed 60 percent of your adjusted gross income (agi) (100% of agi in 2020 for qualified charities).

For the tax year 2022 (returns are typically filed in 2023), the standard. The amount of tax deductible charitable contributions is typically limited to 60% of your gross income (agi). Charitable limitations of 50%, 30% and 20%, unchanged by the cares act contributions limited to the first category of “50% limit” organization (60% for.

Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. At present, there will not be a $300 charitable deduction in 2022. Likewise, people ask, is there a limit on charitable donations for 2019?

The amount you can deduct for charitable contributions generally is limited to no more than 60% of your adjusted gross income. Qualified donations are not subject to these limitations. In 2021, corporations may continue to deduct charitable gifts up to 25% of taxable income.

Individuals can deduct up to 100% of their adjusted gross income, while corporations can deduct up to 25% of their taxable income. There�s also a limit on how much you can deduct. 21 hours agodon�t miss this charitable donation tax deduction worth up to $300 per individual.

Your deduction may be further limited to 50%, 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of organization you give it to. The 2020 increase for deductions of cash contributions is extended one year into 2021.