The remainder is deducted over fifteen years. You also need to advertise so.

You also need to advertise so.

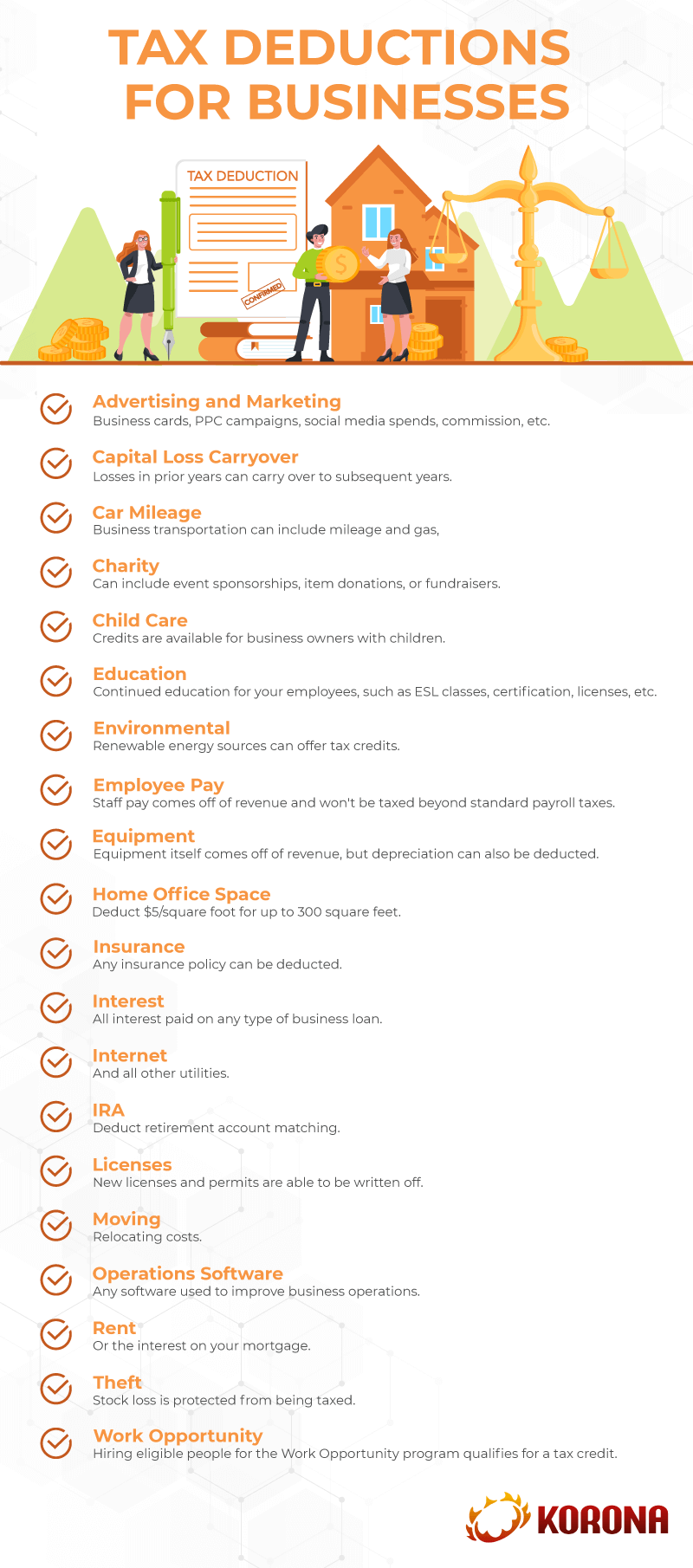

List of tax deductions for small business. The top 17 small business tax deductions. These kinds of deductions include state tax on gross business income, federal and state payroll taxes, personal property tax on business assets, real estate taxes on business property, and. The cost of advertising and promotion is 100% deductible, including things like the.

Full service, dedicated support, and a streamlined process. All of these are eligible office expenses that can be claimed as small business tax deductions. Place of business, you can deduct a percentage of your:

Some of the common small business tax deductions include: Get started today with pilot. Ordinary advertisement and promotional marketing costs related to your business are fully tax deductible.

Download tip sheets on managing taxes from aarp�s small business resource center. There’s also a tax deduction for auto maintenance, parking, and tolls. The remainder is deducted over fifteen years.

You also need to advertise so. Ad pilot takes care of your bookkeeping and tax prep needs, all in one place. There are many things to buy for a business startup in an office setting, from.

Get the tax answers you need. Malpractice, accident, theft, loss, liability as well as fire and storm insurance typically qualify as small business tax deductions. Ad find out what tax credits you might qualify for, and other tax savings opportunities.

There are conditions, of course, but most small businesses can deduct up to $5,000 on your first year’s return. Business use of your car. Ad download the tax 101 tip sheet for an overview on the types of taxes businesses must file.

As a small business, you can deduct 50 percent of food and drink purchases that qualify. Business interest and bank fees. This article, “tax deductions for your startup,” can help you.

You already know that providing amazing goods and services isn’t enough to make your business succeed. Or business, travel, meals and entertainment, mileage, telephone, etc. Standard small business tax deductions.

Items that can be depreciated by small business typically include computers and other office equipment, machinery, office furniture, and business vehicles. Other small business deductions the following deductions can be tax deductible for the entire cost in the year of the. The first $5,000 of startup expenses and the first $5,000 of organization expenses are deductible in the first year of operations.

Furniture and decor can be claimed in the year the items are purchased or can be. Health insurance can be deducted for self. Comprehensive list of deductible business expenses including categories and examples, such as home office expenses, travel, equipment, and more.

Top 25 tax deductions for small business. Be confident you�re getting every deduction you deserve & your biggest refund, guaranteed. Be confident you�re getting every deduction you deserve & your biggest refund, guaranteed.

Start up expenses do not include the purchase of any capital asset (see section g of this checklist) as these items are.