The credit is available if you. They also both get an additional standard deduction of $1,350 for being over age.

They reduce your taxable income, which, in turn, lowers the amount of tax you pay.

New tax deductions for seniors. For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. If you are legally blind, your standard deduction increases by $1,700 as. Your eligibility depends on which province or territory.

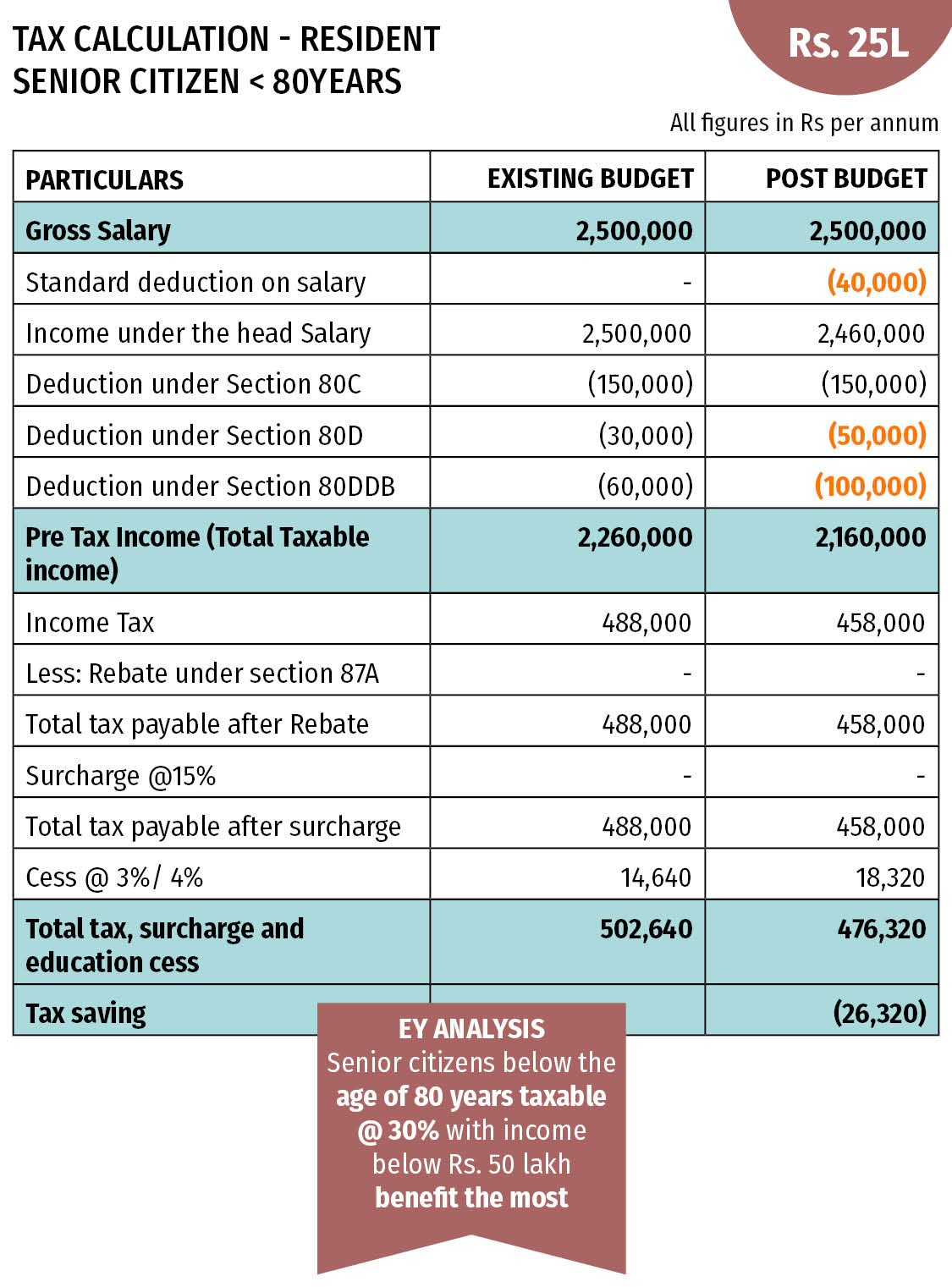

The additional deduction for those 65. As per the latest changes in the income tax act, the standard deduction for senior citizens is ₹50,000. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

For instance, did you know that individuals age 65 or older may qualify for a higher standard deduction than younger adults? Seniors 65 and older and blind taxpayers taxpayers who are 65 or older as well as those who are blind generally qualify for an extra boost to their standard deductions. The eitc is one of the federal government�s largest refundable tax.

Tax credits, on the other. A good way to make sure you aren’t missing out on deductions is to get. Local governments and school districts in new york state can opt to grant a reduction in property taxes paid by qualified seniors, by reducing the home’s assessment by as.

For the 2019 tax year, seniors over 65 may increase their standard deduction by $1,300. If you are legally blind, your standard deduction increases by. If both you and your spouse are over 65 and file.

If you are legally blind, your standard deduction increases by. The credit is available if you. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

There are many provincial tax credits available to seniors who paid for ease of living or lifestyle improvements this year. Goods and services tax / harmonized sales tax credit related provincial or. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

En español | in the world of taxes, deductions are good things: They reduce your taxable income, which, in turn, lowers the amount of tax you pay. The standard deduction amount in 2020 is $12,400 for single filers, $24,800 for married couples, and $18,650 for heads of household.

This means that only those expenses in excess of 7.5% of a taxpayer�s agi are deductible. What is the personal exemption for 2021? They also both get an additional standard deduction of $1,350 for being over age.

For 2020, the standard deduction is. This tax credit offers a tax reduction of up to 50% of your contributions to an ira or any other retirement plan provided by your employer, such as your 401 (k). Changes to the earned income tax credit for the 2022 filing season.

When you’re over 65, the standard deduction increases. The limit is 7.5% of a taxpayer�s adjusted gross income (agi) for 2019 and 2020. As a senior, you may be eligible for benefits and credits when you file your return, such as the: