0.00 the rrsp contributions . For tax year 2018 and on, unreimbursed employee expenses and home office tax deductions are typically no longer available to employees.

Luckily, you can claim a credit worth up to 45 percent of the withheld tax.

Ontario tax deductions for employees. Providing training credits to students in canada. Expenses related to the digital news subscription. The tool then asks you to enter the employee’s province of residence, and pay frequency (weekly, biweekly, monthly, etc.).

11.16% on the portion of your taxable income that is more than $92,454 but not more than $150,000, plus. To calculate the amount you should deduct from a salary: Costs associated with medical care.

What expenses are tax deductible in ontario? The total cost was $114.07 (*765). Income tax calculator ontario 2021.

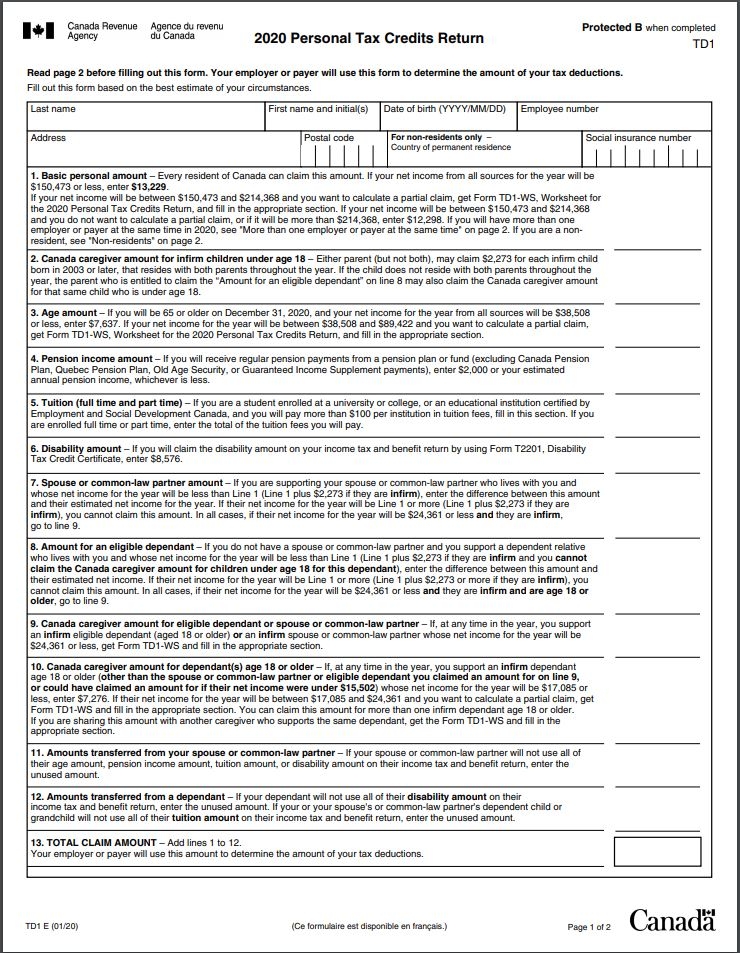

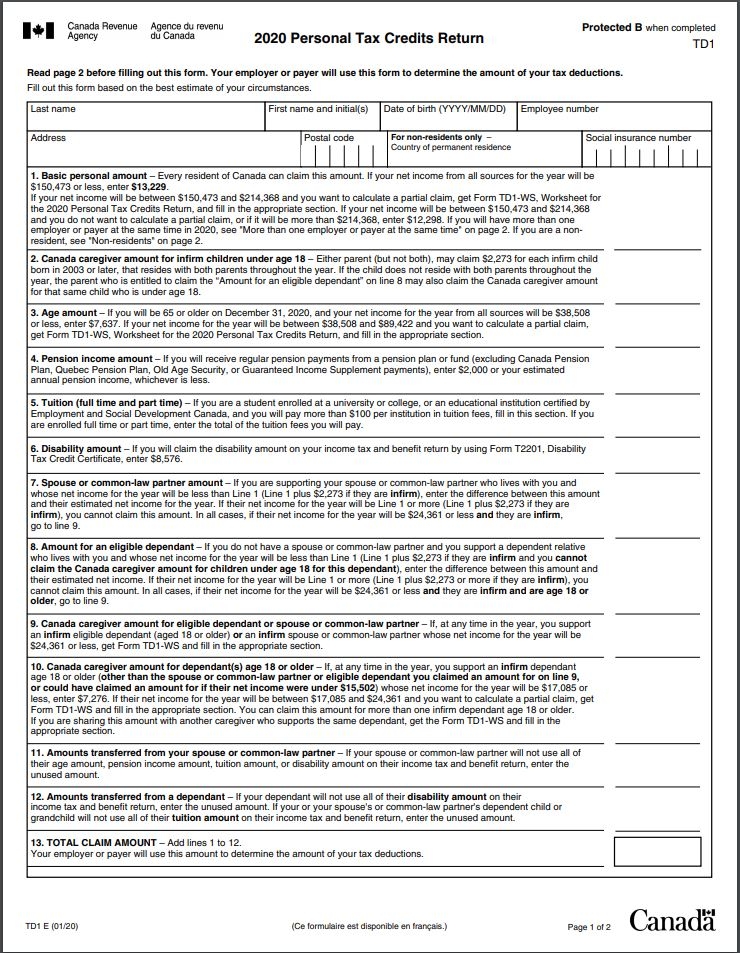

You assume the risks associated with using this calculator. Td1on 2022 personal tax credits return. Employees’ tax deductions for medicare ( 45%) are deducted from their paychecks.

How much do you have to deduct? 12.16% on the portion of your taxable income that is more than $150,000 but not more than $220,000, plus. This publication is the payroll deductions tables for ontario effective january 1, 2022.

(2) minus the other amounts authorized by a tax services office. You will provide two copies to your employee, keep one for your records, and send a copy of the t4/t4a slips for all your employees to the cra. Claiming this credit involves both your federal and tp1 québec tax returns.

Using the payroll stubs, deduct all applicable taxes (federal and provincial) to get your net income. What are the tax deductions for 2021? Federal & provincial income tax.

Claiming deductions, credits, and expenses. This marginal tax rate means that your immediate additional income will be taxed at this rate. The reason for this is commission employees are often required to pay additional expenses that.

Your average tax rate is 27.0% and your marginal tax rate is 35.3%. Enter the amount from line 9368 on form t777s or form t777 on line 22900 other employment expenses on your tax return. How much income tax is taken off in ontario?

That means that your net pay will be $37,957 per year, or $3,163 per month. $155,625 or less enter $14,398; (1) gross remuneration for the pay period (weekly) $1,200.00.

Claim the deduction on your tax return. 5 rows maximum employer premium: Your average tax rate is 27.0% and your marginal tax rate is 35.3%.

Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions. If you make $52,000 a year living in the region of ontario, canada, you will be taxed $14,043. To do this, they have to give a federal form td1 to their employer that shows how much more tax they want deducted.

What expenses are tax deductible in ontario? Request for more tax deductions from employment income. This is any monetary amount you receive as salary, wages, commissions, bonuses, tips, gratuities, and honoraria (payments given for professional services).

Transferring income tax withheld in ontario if you work in ontario, your employer may have withheld federal income tax from your paycheque as if you were a resident of ontario. It will confirm the deductions you include on your official statement of earnings. Use our income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

For tax year 2018 and on, unreimbursed employee expenses and home office tax deductions are typically no longer available to employees. This amount stays the same until they give their employer a new form td1. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculate the weekly pay for the above employee at $1,500 by adding 7 = $1,500. Do not include your supporting documents. If you make $52,000 a year living in the region of ontario, canada, you will be taxed $14,043.

Form t777s or form t777 must be filed with your tax return. In general, motor vehicle expenses can only be claimed as expenses related to “on the job” travel. Divide the result by 12 to get the monthly deduction.

The employer contribution is currently 1.4 times the employee deduction. 0.00 the rrsp contributions *. Employees can choose to have more tax deducted from the remuneration they receive in a year.

The number of employees working from home has grown. Form t2200s or form t2200 is kept by you and is not included with your tax return. Luckily, you can claim a credit worth up to 45 percent of the withheld tax.

9.15% on the portion of your taxable income that is more than $46,226 but not more than $92,454, plus. It reflects some income tax changes recently announced which, if enacted by the applicable legislature as proposed, would be effective january 1, 2022. Commission employees are often able to benefit from certain tax deductions that salaried employees do not have access to.

The tax cuts and jobs act of 2017, however, banned such workers from taking the deduction from 2018. You must report each employee�s income and deductions on an appropriate t4 or t4a slip. That means that your net pay will be $37,957 per year, or $3,163 per month.

Home office expenses for employees. The employer must complete form t2200 “declaration of conditions of employment” in order for the employee to be able to deduct employment expenses from his/her income. October 20, 2020 | 3 min read.

Multiply the annual salary up to the maximum amount by the factor provided by the cra. For deductions based on different income levels, see: These must be received by the last day of february of the following year to avoid penalties.

Tax benefits for disabled individuals.