In an attempt to equalise the benefits of superannuation between higher and lower income earners, an additional tax of up to 15% is payable if you earn more than $250,000 per year in personal income this is known as the division 293 tax. If you are under 18 years old at the end of the financial year in which you made the contribution, you can only claim a deduction for your personal super contributions if you also earned income as an employee or carrying on a business.

Mary then claims a tax deduction of $10,000 in her tax return, reducing her taxable income to $70,000 for the year (ignoring any other income and deductions).

Personal tax deductions for any superannuation contributions. Mortgage interest, rates and land tax; If you are aged between 67 and 74 years of age, you�ll need to pass the work test to make a tax deductible contribution. Tax return deductions for gp�s superannuation contributions.

A car expense or an amount of fringe benefits tax payable for a car fringe benefit where a car is used partly for private. Contributions to a personal super fund may be deducted from your taxable income if the contributions are already made from money that you have already paid in taxes, like savings or pay from your household income. Claiming tax deductions on super contributions when you pay your employees’ super, it’s helping to set them up for their retirement.

If you are under 18 years old at the end of the financial year in which you made the contribution, you can only claim a deduction for your personal super contributions if you also earned income as an employee or carrying on a business. And the end of the next income year. Paying your employees� super is mandatory so it’s something that businesses need to budget for.

To make personal deductible contributions you must be eligible to contribute to super.; Mary then claims a tax deduction of $10,000 in her tax return, reducing her taxable income to $70,000 for the year (ignoring any other income and deductions). Personal superannuation contribution deductions are you eligible?

When they lodge personal income tax return; Personal super contributions tax deduction. 04 jun 2021 qc 23225.

Contributions as a tax deduction if you meet the eligibility criteria. These amounts will then count towards an individual�s concessional contributions cap and be subject to 15% contributions tax in the fund. Claiming deductions for personal super contributions.

In the case of the gp�s themselves, i. And the end of the next income year. To claim a tax deduction for a personal contribution, you will first need to make an eligible personal contribution to superannuation.

People eligible to claim a deduction for personal contributions include people who get their income from: After $1,500 (15%) of contributions tax is deducted, mary is left with a net contribution to her super of $8,500. A 15% contributions tax is deducted from any superannuation contribution that has been claimed as a tax deduction.

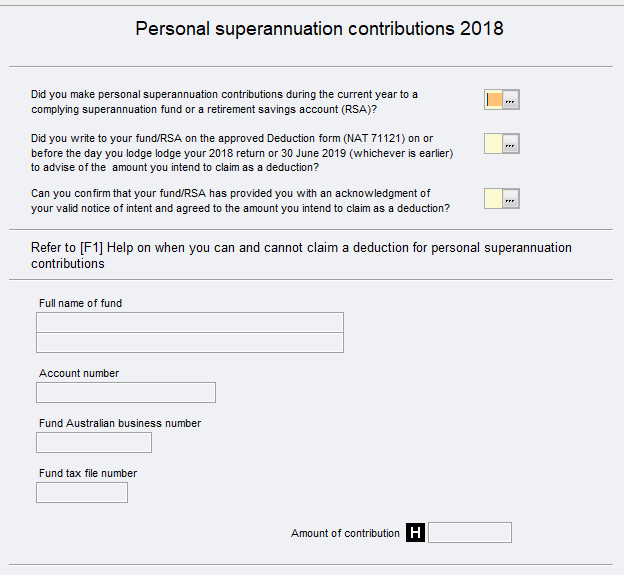

This will depend on your personal tax. To be eligible to claim a tax deduction for a personal superannuation contribution, you must: Notice of intention to claim.

Section 290‑170 (1) requires that, in order to claim a deduction for a personal superannuation contribution, a taxpayer must give to their super fund a notice of intent to deduct the contribution and the notice ‘ must ’ (emphasis added) be given before the earlier of: Tax return deductions for gp�s superannuation. The funds a gp practice receives from the nhs are reduced by various sums, included within which are superannuation contributions being employer contributions at 14% and employee contributions at 6%.

The notice is required to be lodged with the super fund by the earlier of the date of the. Does super contribution reduce taxable income? Claiming your contributions as a tax deduction may reduce the amount of tax you need to pay on your income.

Contributions tax is deducted from the contribution amount and then the net amount is allocated into your superannuation member account. Tax deductible contributions can be split with a spouse. The standard contributions tax rate is 15%.

A car expense for each car used solely for business purposes; When they lodge personal income tax return; Reportable employer super contributions shown on your annual payment summary.

Be under age 75 make a personal contribution to a complying superannuation fund submit a valid notice of intent to claim a deduction for personal super contributions, in the approved form, to the superannuation fund trustee within required timeframes. It’s important to ensure you don’t end up crossing the contribution limit. In an attempt to equalise the benefits of superannuation between higher and lower income earners, an additional tax of up to 15% is payable if you earn more than $250,000 per year in personal income this is known as the division 293 tax.

The good news is, you are able to claim a tax deduction for any employer contributions you make. Tax on your personal contributions once you advise esssuper of your intention to claim a tax deduction for your personal contributions, esssuper is required to deduct 15% tax from those contributions. To claim the super contribution as a tax deduction, you need to submit a valid notice of intent form with your super fund, and receive an acknowledgement.

Contributions tax for high income earners. Generally, you are eligible to contribute to superannuation if you are: Personal deductible contributions count towards your concessional contributions cap and penalties may apply if the cap is exceeded.;

So, if a total of $10,000 in concessional contributions were paid into your super account during a year, only $8,500 would actually be applied to your account balance.