1 day agomaking the most of tax deductions in 2022. You can either take the $12,000 and change, no questions asked, or you can itemize your personal deductions on.

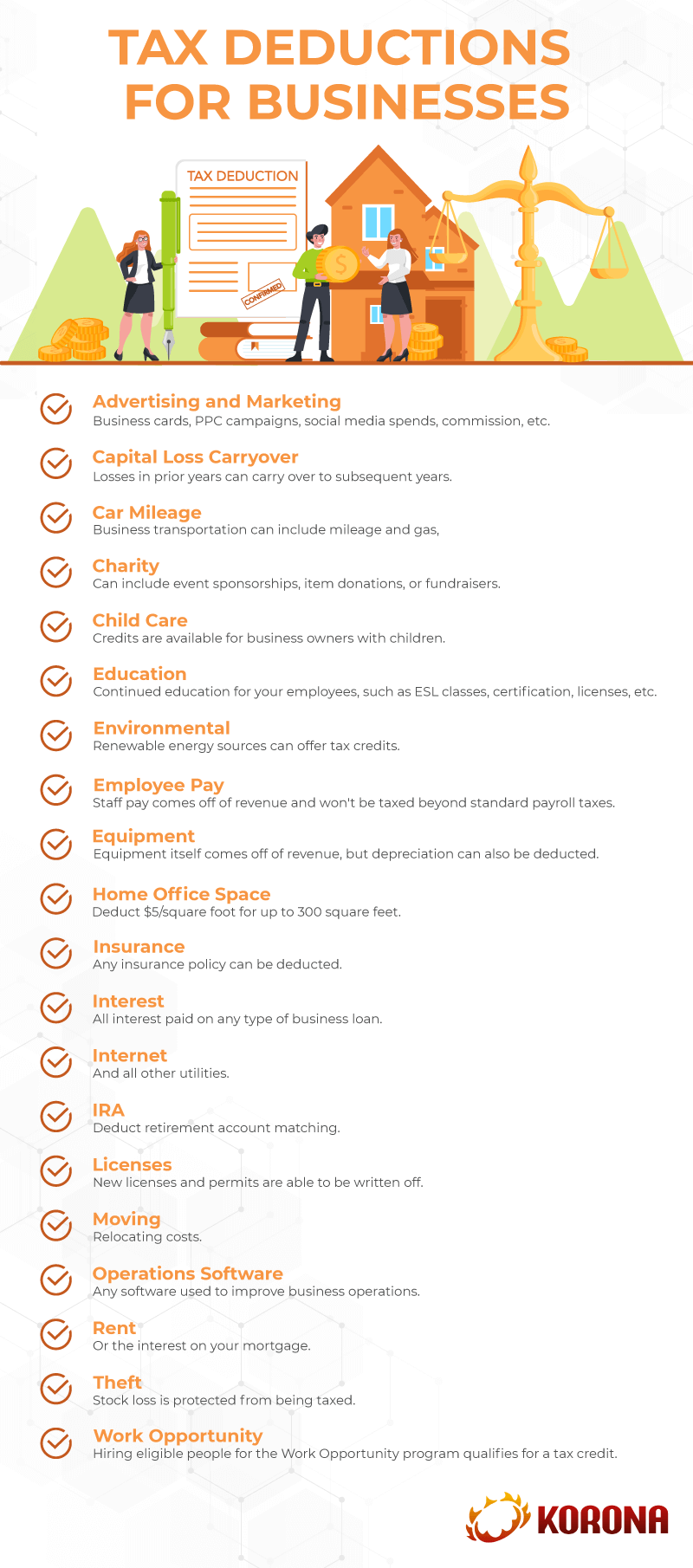

Standard small business tax deductions.

Personal tax deductions for small business. Larry gray, cpa, cgma national association of tax professionals. Mobile phones, internet and other easy tax deductions. You can either take the $12,000 and change, no questions asked, or you can itemize your personal deductions on.

Get every credit and deduction your small business deserves. The tcja (mentioned above) created a new deduction for. Personal tax deductions for business owners charitable contributions.

If you itemize, you may deduct your state and local taxes. How to calculate qualified business income (qbi) on the 1040 1 presented by: This includes (1) property taxes, and (2) state income or sales taxes, whichever is greater.

Mortgage interest mortgage interest can be deducted from your income tax if you own a home and have a mortgage. In the past, there was no limit on this. There are restrictions, but if you use part.

Small business tax deductions related to your staff if you have any employees, including yourself, there are several deductions available to you. For the 2021 tax year, there is a way for taxpayers who don�t itemize to benefit from charitable tax deductions. Standard small business tax deductions.

New 20% qualified business income deduction. If you’re just starting your business, you can claim up to $5,000 before the launch of your business in startup expenses. Get every credit and deduction your small business deserves.

Business use of personal property if you use your home or car for business purposes, you may be able to deduct some of your living expenses. 21 hours agothis device is too small. Here are the ten small business tax deductions you need to know:

While there are a few prerequisites to consider, the costs. There’s good news for small businesses too. When it comes to the standard deduction, you�ve got a choice.

Ad block advisors offers tax service expertise for your small business! Sole proprietorships, llcs, and partnerships cannot deduct charitable contributions as a. Ad block advisors offers tax service expertise for your small business!

Huge cut in corporate tax. Twenty percent small business deduction: Following are the major ones.

The corporate tax rate went from 35% down to 21%. You already know that providing amazing goods and services isn’t enough to make your business succeed. 1 day agomaking the most of tax deductions in 2022.