Itemized deductions include health insurance, medical bills, health savings account (hsa) contributions, energy saving home improvement, state and local taxes, student loan interest,. Itemized deductions include health insurance, medical bills, health savings account (hsa) contributions, energy saving home improvement, state and local taxes, student loan interest,.

Deduction #4 show detail advertising expense the irs allows.

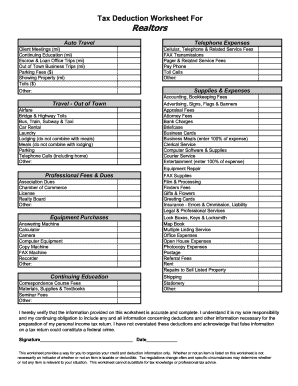

Real estate tax deductions for realtors. Marketing tax deductions for real estate agents. Most real estate agent marketing expenses will fall under the category of a tax deduction. Itemized deductions include health insurance, medical bills, health savings account (hsa) contributions, energy saving home improvement, state and local taxes, student loan interest,.

This deduction is capped at $10,000, zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your. Realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive.

For a realtor®, there are a variety of opportunities to deduct driving costs. Meals & entertainment to qualify for tax deduction (even 50% deduction), you’re required to incur the expense for the purpose of. Expenses for travel between business locations or daily.

Almost everything you buy for your real estate business is tax deductible as long as it is ordinary and necessary and the cost is reasonable. Deduction #4 show detail advertising expense the irs allows. Sales and open house signs and flyers;

Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. That said, let’s go over some of the most common rental. Licences & fees your state license renewal, mls.

This includes taxes that you pay for ownership of your primary residence, a vacation home, and undeveloped land. Some tax deductions realtors can submit 1. Whether it’s sales and open.

For example, you could deduct expenses related to going to and from open houses, showing clients listings,. These deductions can really add up as savings for. Additionally, becoming a landlord offers multiple tax benefits such as deductions, depreciation, interest, and more.

Real estate taxes are still deductible on your tax return. Allowable tax deductions you need to know here are some of the most common real estate agent and broker deductions: