He has to pay 15.3% self employment (se) tax plus income tax. Make an appointment now to experience professional tax expertise from block advisors.

Client(s) who actually operate business.

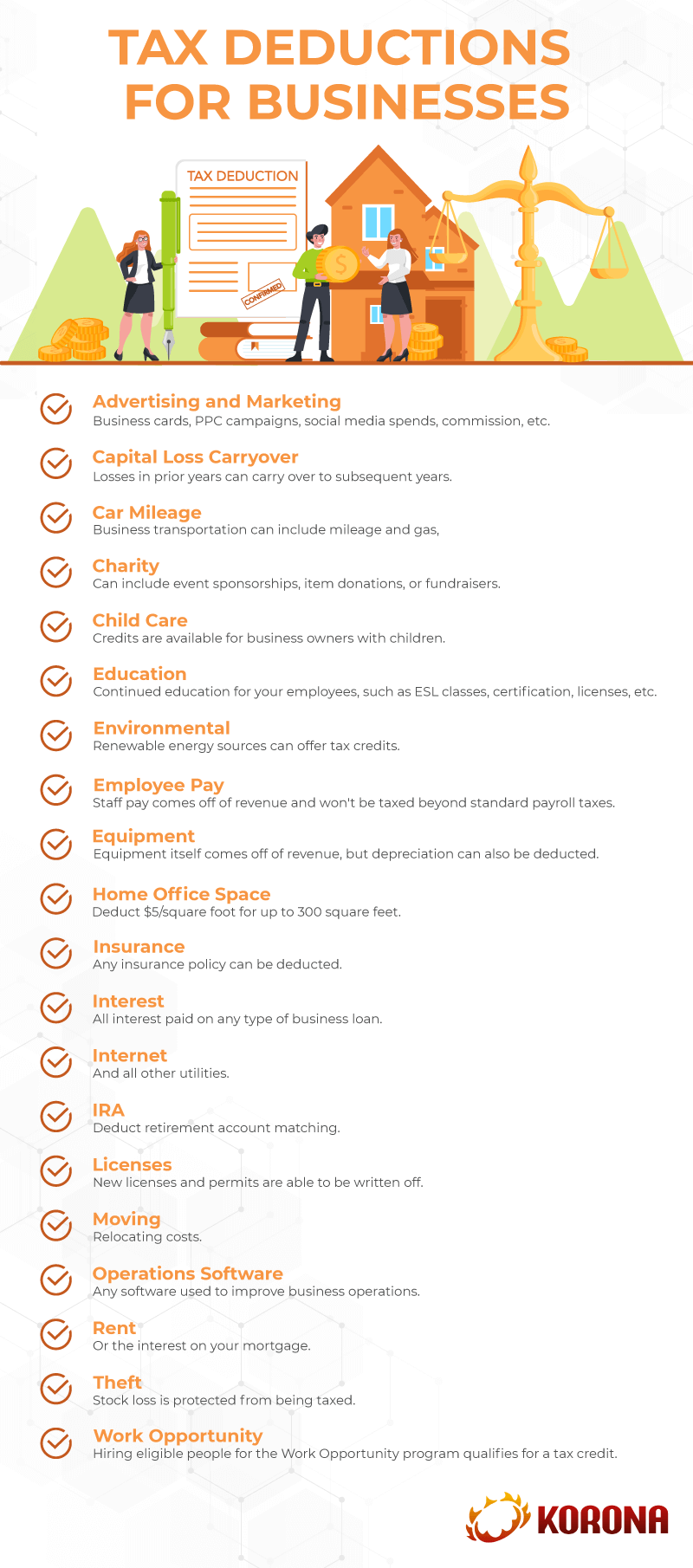

Small business tax deductions for 2021. Ad participating companies are eligible to receive significant tax breaks & cash grants. For llc and sole prop you’ll take the standard irs mileage rate of.56 for 2021on every mile driven for business. Make an appointment now to experience professional tax expertise from block advisors.

Tax year 2021 small business checklist. In 2021, internet and telephone services are vital for nearly all small businesses and organizations. Tax season might be months away, but now is the time to determine if.

This is an excellent question and we will answer this question in detail below. Effective january 1, 2021, the amount of this business tax credit was increased to 70% of qualified wages, including the cost of health benefits, with a max of $7,000 per employee per. Discover the right location, the best talent, & all of the incentives available to you.

Under the american rescue plan, the employee retention credit (erc) is extended for small businesses through december 2021 and is available for all four quarters of the year. Many americans have been working from home. Ad our tax advisors are dedicated to finding every tax deduction your business deserves.

Filing taxes for your small business is likely one of your least favorite things about being your own boss. 2021 ultimate list of small business tax deductions tax dates. Client(s) who actually operate business.

These can be deducted from your taxable income. Discover the right location, the best talent, & all of the incentives available to you. Small business owners should see if they qualify for the home office deduction.

Small business owners can deduct the contributions made to employee retirement plans, as well as their own. He has to pay 15.3% self employment (se) tax plus income tax. Each state has its own standard deductions, but the irs automatically sets the federal standard deductions for 2020 taxes to be filed in 2021:

For 2020, you received one credit, up to a maximum of four credits, for each $1,410 ($1,470 for 2021) of income subject to social security taxes. When filing taxes, knowing the deadlines is an essential part of being organized and prepared. Withdrawn for business use other expenses relating to inventory items closing.

Ad our tax advisors are dedicated to finding every tax deduction your business deserves. Credits for leave taken in 2021 (between january 1 and march 31) can be claimed when you file your 2021 taxes. Ad participating companies are eligible to receive significant tax breaks & cash grants.

Therefore, for 2020, if you had income (self. Make an appointment now to experience professional tax expertise from block advisors. Let’s look at an example.