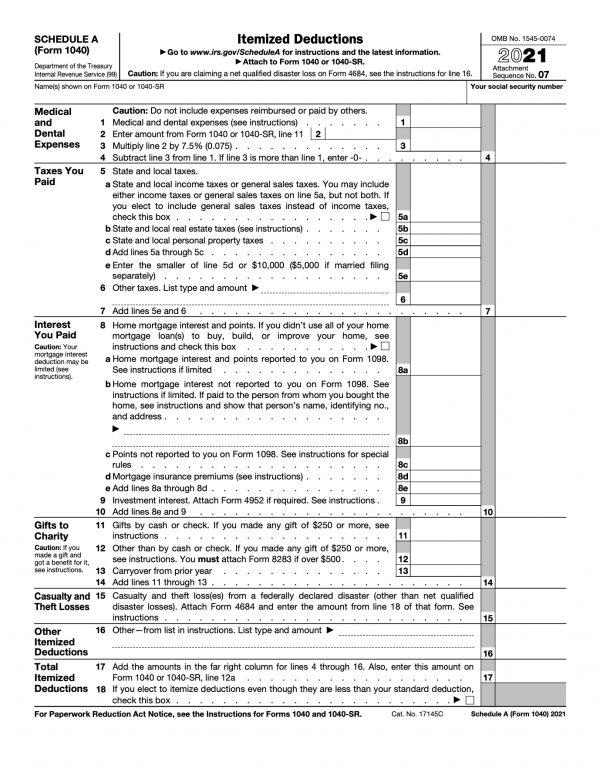

“the mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build, purchase, or make improvements upon their residence, from taxable income,” explains julia kagan for investopedia. Evidence of any tax credits, tax deductions, or tax exemption;

If you file form 1040, you can only deduct the amount of your medical and dental expenses that are more than 7.5% of your agi.

Tax deductions for 1040. The most recent numbers show that more than 45 million of us itemized deductions on our 1040s—claiming $1.2 trillion dollars’ worth of tax deductions. I take the standard deduction.i use schedule c, but i don�t even use the expenses section, because i really don�t have any.however, i did have to buy a new laptop last year, which i use for both personal and business reasons. Hi barbara, i am a freelancer, and i don�t itemize or anything.

State and local income taxes or state and local sales taxes I�m wondering if there is an easy way to deduct the cost of the laptop or part of it. A standard deduction is an amount that the irs predetermines based on your filing status.

There are, of course, other rules and limits, but don’t worry—we’ll calculate if you qualify in the background when you file with 1040.com. “the mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build, purchase, or make improvements upon their residence, from taxable income,” explains julia kagan for investopedia. Tax deductions for contract workers.

You will need receipts and records to validate the expenses, but you won’t have to calculate how much of the expenses to deduct — generally you can take 100%. The aggregate deduction for state, foreign income, local income (or sales taxes in lieu of income taxes), and property taxes is limited to $10,000 ($5,000 if married filing separately) per return. You choose between the two based on whether your standard deduction is higher or lower than your itemized deduction list.

Up to $1,000 of that is refundable. Itemized deductions allow you to convert otherwise taxable income into nontaxable income if you. Traditional ira deduction hsa/fsa deduction dependent care fsa contributions student loan interest.

You can use the 2021 standard deduction tables near the end of this publication to figure your standard deduction. Your checking account number and routing number (for direct deposit) keep in mind that irs tax form 1040, with the payment amount, is owed by april 15. The expenses must have been paid in 2021, unless they were charged to.

An itemized deduction is exactly what it sounds like: An itemized list of the deductions that qualify for tax breaks. Below the line, or after agi, is where you either add up your itemized deductions and apply that total, or you.

However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private. Child tax credit and additional child tax credit are the real bonuses for people with children as their dependents. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

On a federal level, the irs allows the taxpayer to deduct $12,550 from this, meaning only $7,450 of the total income is subject to income taxes. Report it as a deduction on your schedule a for your 1040 form. Having separate bank and credit accounts for your business.

“the mortgage interest deduction can also be taken on loans for second homes and vacation. The standard deduction for an individual who can be claimed as a dependent on someone else’s return is limited. The american opportunity credit is good for four years of undergraduate higher education, and it will pay up to $2,500 for qualifying expenses for each qualifying student.

Evidence of any tax credits, tax deductions, or tax exemption; Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately). 21 hours agoif you itemize, you can deduct up to 60% of your adjusted gross income.

Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Deductible taxes are reported on form 1040, schedule a in the taxes you paid section. As a rule of thumb, it’s easiest to deduct business expenses that were used exclusively for your business or project.

If you file form 1040, you can only deduct the amount of your medical and dental expenses that are more than 7.5% of your agi. The amount depends on your filing status. Alternatively, you can claim a.

Get your share of more than $1 trillion in tax deductions. That same year, taxpayers who claimed the standard deduction accounted for $747 billion. You will need to list this on form 8812.

About schedule a (form 1040), itemized deductions. For 2021, this deduction is generally limited to the greater of (1) $1,100 or (2) the individual’s earned income, plus $350, not to exceed the regular standard deduction amount. For each eligible child, you may receive credit of up to $2,000 to offset your tax owing ($1,400 is refundable).