Partnerships and corporations would report those amounts in a similar manner on their returns. Starting in 2021, the irs is making some changes to bring efficiency and increased accuracy to its reporting and compliance processes.

Your husband cannot claim you as a dependent.

Tax deductions for 1099 k. However, you can deduct only a portion of the expenses. Dont forget the total on 1099 is gross,it does not exclude returns,chargeback and theft,you have to deduct it yourself. Top 7 lawn care & landscaping business tax.

The options for a spouse are married filing jointly and married filing separately. We explain changes in your tax refund and provide tips to get your biggest refund. Personal trainer tax deductions from a to z.

However, there is no place to enter the cost of goods sold. Whether you receive the form(s) or not, you should report your independent contractor income to the irs on a schedule. You can either take mileage deduction,you can google how much for 2014,it could be 56 cents per mile or depreciation of your vehicle.

Advertising costs, professional licensing, equipment, travel, supplies, repairs and maintenance are all common deductions for 1099 income. That’s a 2.5 cent increase from the 56 cents standard mileage deduction for 2021. Deductible expenses include utilities, cable, internet and telephone.

Beginning january 1, drivers can deduct 58.5 cents per mile driven from their taxes. Here are the top 1099 tax deductions and some additional ones that you may have not known about! Your husband cannot claim you as a dependent.

Starting in 2021, the irs is making some changes to bring efficiency and increased accuracy to its reporting and compliance processes. If he filed a joint return, then you will need to amend your return to include your income on the return as well. Vehicles and other tangible property with a life expectancy of over a year can be depreciated.

You can also learn more about tax deductions for various professions with these articles: Partnerships and corporations would report those amounts in a similar manner on their returns. For illinois residents, the threshold is $1,000 usd with 3 or more transactions.

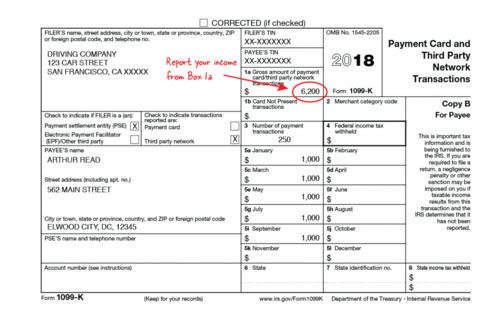

Enter the number of payment transactions (not including refund transactions) processed through. To determine the amount of your deduction, divide the area of your. For residents of massachusetts, maryland, vermont, and virginia, the threshold is $600 usd, irrespective of the number of transactions.

Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. The business will only send it if you earned $600 or more in income. Still, it�s important to consult with a tax professional to see if any exclusions apply.

Most costs associated with operating a business can be expensed on part ii of schedule c. By sarah craig november 22, 2021. The tax deductions listed above can generally be applied to all 1099 workers.