Investment fees and expenses investment fees, custodial fees, trust administration fees, and other expenses you paid for managing your investments that produce taxable income are miscellaneous itemized deductions and are no longer deductible. In addition to health insurance premiums, you can write off expenses such as glasses, nonprescription medications, and visits to the chiropractor.

The capital gains rates apply to the difference in your purchase and selling price.

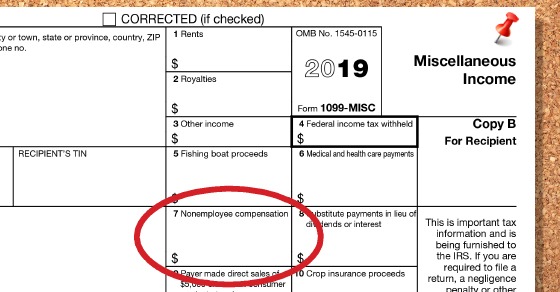

Tax deductions for 1099 misc. The irs allows taxpayers to deduct 50 cents for every business mile driven during 2010, the standard mileage rate cannot be taken in addition to actual vehicle expenses like gas, repairs, depreciation, and insurance. If you file taxes with a 1099, you must pay that additional 7.65% in taxes. If the size of the commission exceeds $600, you.

The internal revenue service says you can deduct food costs that are directly related to doing. Advertising costs, professional licensing, equipment, travel, supplies, repairs and maintenance are all common deductions for 1099 income. The combined tax rate is 15.3%.

Make sure you’re in the driver’s seat by tracking all of your expenses and keeping reliable documentation throughout the year. It is important to exercise caution when claiming 1099 deductions, as the internal revenue service ( irs) may request receipts and documentation of any deductions taken. This can include payments to individual sales reps, or marketing channels and platforms like amazon, ebay or uber.

Formerly, that would have been a miscellaneous itemized deduction subject to the 2% rule, but that deduction was eliminated in 2018. Vehicles and other tangible property with a life expectancy of over a year can be depreciated. The tax form you need to use is capital gains and losses, schedule d.

Medical and health care payments. In addition to health insurance premiums, you can write off expenses such as glasses, nonprescription medications, and visits to the chiropractor. If you sell items, such as collectibles, at a profit, you will typically need to pay capital gains taxes.

One of the largest expenses available to independent contractors to deduct is mileage. That’s a 2.5 cent increase from the 56 cents standard mileage deduction for 2021. 1099 tax calculator | how much will i owe in taxes?

Paying taxes as a 1099 worker. Of that total payroll tax, the irs allows you to deduct between 50% and. Turbotax (tt) will complete schedule c for you and allow you to deduct any expenses associated with this income.

You have two options when it comes to this. What is the maximum deduction i can claim on a 1099 misc. The capital gains rates apply to the difference in your purchase and selling price.

Most costs associated with operating a business can be expensed on part ii of schedule c. 100% of your health insurance is one of the many deductible business expenses for independent contractors to include on your 1099. This comes to a total of 15.3% in payroll taxes.

12.4% for social security tax and 2.9% for medicare. In most cases, you can only deduct 50 percent of what you spend on each meal expense. Independent contractors must decide whether or not they want to use actual expenses, or the standard mileage rate.

Investment fees and expenses investment fees, custodial fees, trust administration fees, and other expenses you paid for managing your investments that produce taxable income are miscellaneous itemized deductions and are no longer deductible. There are several different types of 1099 deductions, including business expenses, home office expenses, and costs for transportation. You can deduct medical, dental and vision premiums.

Beginning january 1, drivers can deduct 58.5 cents per mile driven from their taxes.