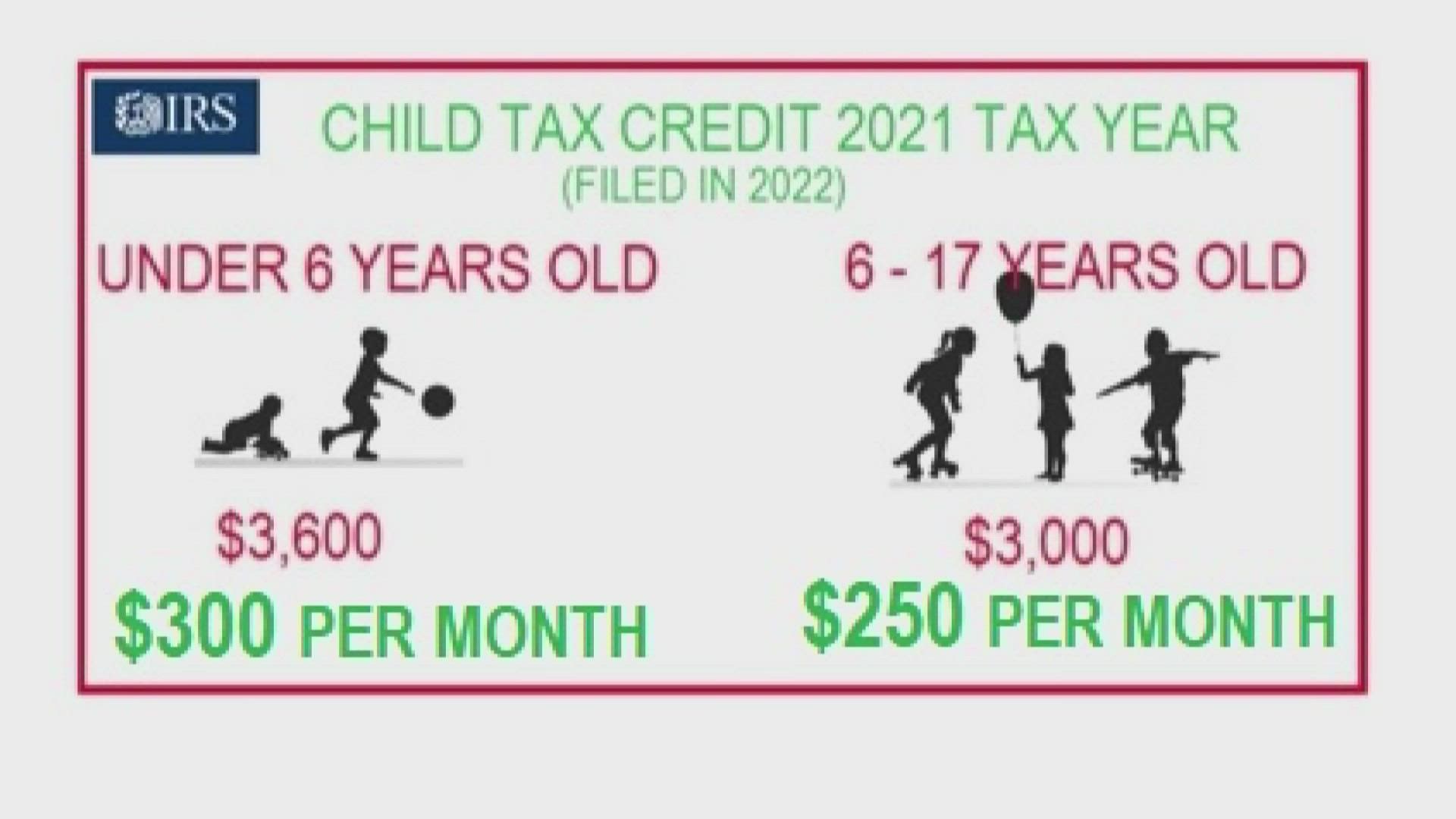

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Ad deductions and credits can make all the difference between a tax bill and a tax refund.

For tax year 2021 this.

Tax deductions for 17 year old. If you don�t itemize your deductions on schedule a form (1040), you may qualify to take a deduction for contributions of up to $300. What at 17 year old exempt from taxes? What at 17 year old exempt from taxes?

Should my 17 year old file taxes? Ad slay your state & federal taxes filing with taxslayer® join millions slaying their taxes. If he earned less than $6350 he will get a refund of withheld taxes.

From simple to complex taxes, filing with turbotax® is easy. Everything you need to file your taxes Who can i claim as a.

Your move is closely related to the start of work. Ad answer simple questions about your life and we do the rest. Students are not exempt from paying taxes.

Ad free tax support and direct deposit. Ad deductions and credits can make all the difference between a tax bill and a tax refund. Though you cannot claim both education tax credits for one student, you can claim one of the credits for one student and the.

$3,600 for children ages 5 and under at the end of 2021; From simple to complex taxes, filing with turbotax® is easy. In addition, claiming this credit gives up to $3,600 for children under 17.

Wants a refund at the end of the year, on line #5,. For federal income tax purposes, if you are claiming him or your child: The child tax credit 2017 for 2017, the child tax credit is worth up to $1,000 per child.

For tax year 2021 this. Dependent children who earn more than $12,550 in 2021 or $12,950 in 2022 must file a personal income tax return. The child tax credit is better than the deductions because your taxes are reduced dollar for dollar.

6 often overlooked tax breaks you don�t want to miss. In any case, if you meet all other requirements, you will receive the credit. Taxslayer® has the right tools at the right price.

For tax year 2022, the child tax credit will return to its previous level of $2,000 for children under 17 who live with a taxpayer more than half the year. The child tax credit phase out begins at an adjusted gross income of $75,000 for single. The per year (not per child) total should be no more than $2,000.

According to the irs, you can deduct your moving expenses if you meet all three of the following requirements: For tax years prior to 2018, the threshold is is when the minor works and earns more than the standard personal exemption for the year, according to irs publication 929. Beginning in 2018, a minor who may be claimed as a dependent has to file a return once their income exceeds their standard deduction.

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Ad answer simple questions about your life and we do the rest.