(5) repeal the amt for. Ii 111th congress 2d session s.

The internal revenue service (irs) is responsible for publishing the latest tax tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year.

Tax deductions for 3018. 3018 is a bill in the united states congress. Moving deduction (not applicable for 2018 returns) personal property deduction For 2018, the maximum elective deferral by an employee is $18,500, and for the 2019 tax year this is increasing to $19,000.

How to cite this information. You will pay a premium of $60.00 per month automatically deducted from your paycheck but will not have deductions for dental. Claim for refund due a deceased taxpayer.

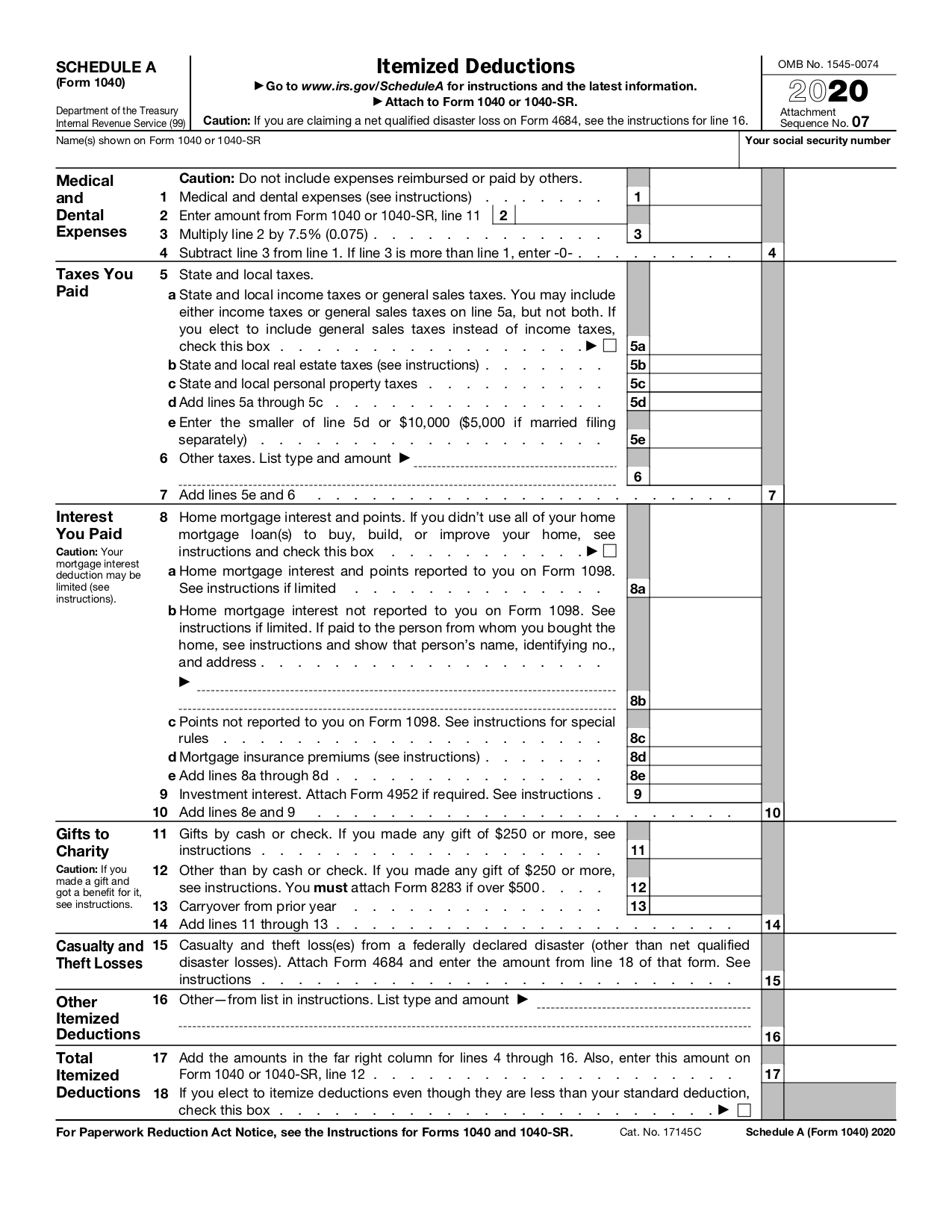

Prime minister’s drought relief fund; This is the one from the 117 th congress. You can deduct up to $10,000 ($5,000 if married filing separately) of combined property taxes and either state and local income taxes or state and local sales taxes.

(3) eliminate miscellaneous itemized tax deductions after 2010; Bills numbers restart every two years. Now, there are two deduction methods you can employ.

Tax rate threshold tax due in band: Plus, there are still some tax deductions and credits you can take. Why is there a dental insurance deduction?

The standard deduction amounts will increase to $12,000 for individuals, $18,000 for heads of household, and $24,000 for married couples filing jointly and surviving. (2) increase the standard tax deduction; Eligible donations with 100% deduction under section 80g subject to 10% of adjusted gross total income are:

The internal revenue service (irs) is responsible for publishing the latest tax tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year. You will pay a premium of $60.00 per month automatically deducted from your paycheck. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

(5) repeal the amt for. New hampshire state tax tables ; New hampshire state standard deduction (1 x $2,400.00 = $2,400.00) $869.00:

3018 to amend the internal revenue code of 1986 to make the federal income tax system simpler, fairer, and more fiscally responsible, and for other To understand more about how you can claim tax deductions when working from home, take a look at the following tax tips for employees. Eligible donations with 50% deduction under section 80g without qualifying limits are:

That means there are other bills with the number s. This page provides detail of the federal tax tables for 2018, has links to historic federal tax tables which are used within the 2018 federal tax calculator and has supporting links to each set of state. In turn, this will reduce your overall taxes, increase your refund, and decrease the taxes you owe.

Federal standard deduction ($0.00) $3,269.00: Total state income tax due for new hampshire: Ii 111th congress 2d session s.

Investment property in aurora, il located at 3018 savannah dr. (1) reduce the number of tax brackets for individual taxpayers from six to three (i.e., 15, 25, and 35%); The standard deduction amount is increased from $6,350 to $12,000 for single and married filing separately filers, $12,700 to $24,000 for married filing jointly and widow filers, and $9,350 to $18,000 for heads of household.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Job expense deduction (not applicable for 2018 returns) medical deduction; The standard deduction nearly doubled to $12,000 if you are single and $24,000 if married filing jointly.

For those unfamiliar, tax deductions are kind of important as they can reduce your adjusted gross income or agi. What is the $60.00 health insurance deduction? Common schedule 1 deductions for 2021 are:

State income tax total from all rates : This property was purchased by bank chicago 2861 for $178,000.as of 12/25/2021 the estimated market value is $281,073. Amends the internal revenue code to:

Underpayment of estimated income tax. What is the $60.00 health insurance deduction? Below is the personal tax deductions list:

Deductions can reduce the amount of your income before you calculate the tax you owe. State and local taxes (the salt deduction ). (4) exclude from gross income 35% of certain dividend income and gain on capital assets;

A bill must be passed by both the house and senate in identical form and then be signed by the president to become law. Only deduct home office expenses if you only. Additionally, you should anticipate some new deductions on your taxes for 2021.