When you donate to a 501 (c) (3) public charity, including fidelity charitable, you are able to. This means that when you make a contribution to an organization that has been designated as a 501 (c) (3) by the irs and you have not received anything in return for your gift, you are eligible for a deduction when you file your taxes.

How much can you deduct?

Tax deductions for 501 c 3 donations. The cares act lifts these caps to 100% for individuals and joint filers, while corporations will see their cap lifted to 25% for 2020. So if you earn $100,000, you can claim up to $60,000 as a tax deduction for charitable gifts. Similar carryover rules as above apply for donations to private foundations exceeding the single year limit.

A 30% deduction ceiling is imposed for donations to certain veterans groups, cemeteries, fraternities, and private foundations. The donor may use this letter as proof of his or her contribution and claim a tax deduction. If you receive something in return for your donation, like event access, you can only deduct the leftover fair market value after subtracting the value of what was received.

You can�t always deduct the total amount of your donation to a 501 (c)3, due to the limits placed on charitable deductions by the federal government. Individuals giving to 501 (c) (3) organizations that are private foundations may generally deduct contributions representing up to 30% of their adjusted gross income. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor.

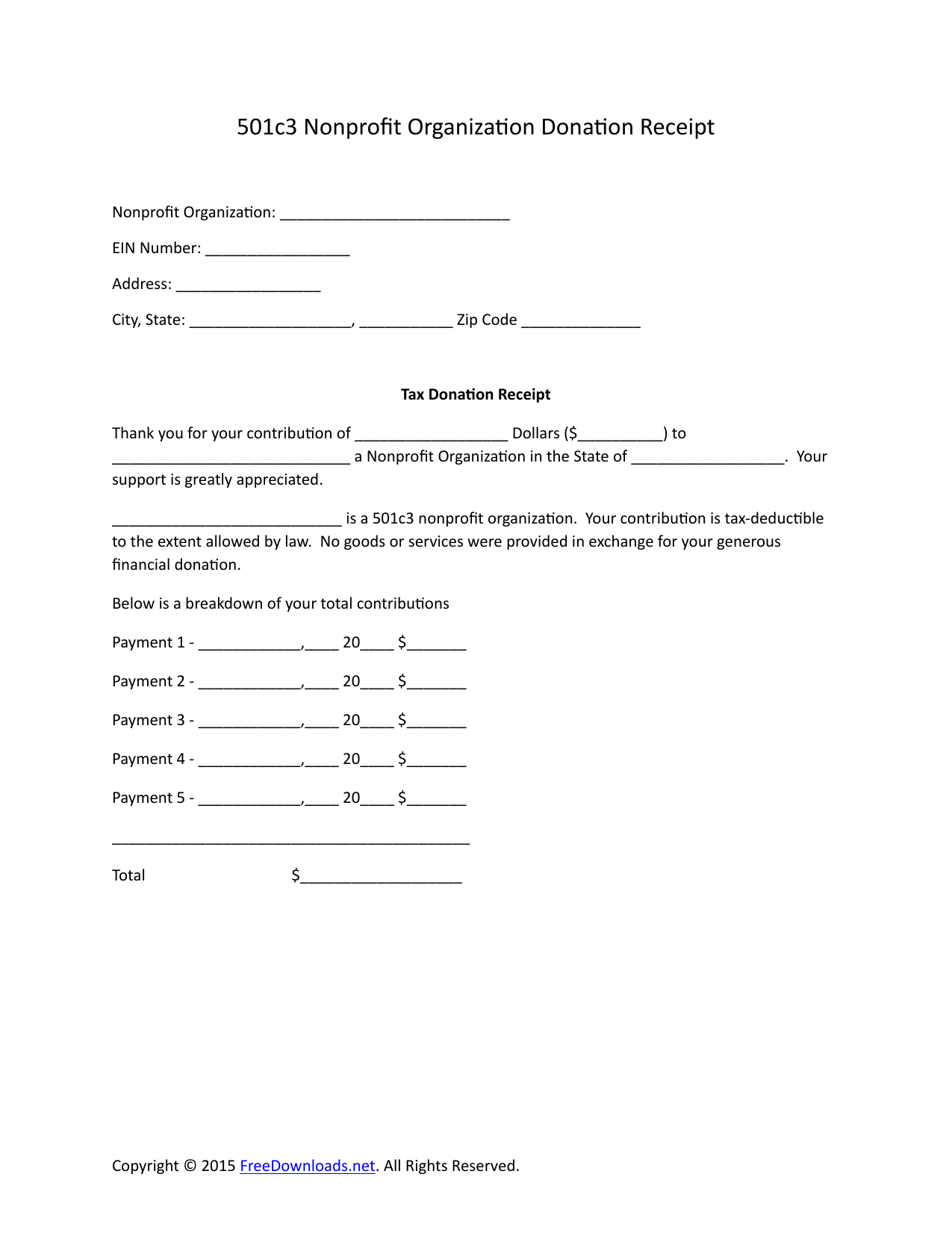

Itemizing deductions charitable contributions to qualified organizations are deductible by individuals and corporations. You can include all charitable cash donations up to 60% of your adjusted gross income (agi) for 501(c)(3) organizations like action against hunger. The irs requires public charities (also known as 501 (c) (3) organizations) to send a formal acknowledgment letter for any donation of more than $250.

For example, if you make a cash donation of $50,000 to a 501 (c) (3) but your adjusted gross income is only $70,000 during the year, you could only take $35,000 of the deduction this year. All 501(c)(3) organizations must be approved by the irs under a rigorous approval process. There�s financial incentive for americans to give generously to charity:

Cash donations to a private foundation 501 (c) (3) have lower tax deductibility limits, specifically 30% of agi. You may be able to claim a deduction on your federal taxes if you donated to a 501 (c)3 organization. How much can you deduct?

How the charitable contributions deduction works. A pledge or promise to pay does not count. But donations of services or use of leased property is not a tax deduction.

The deductibility of gifts to 501 (c) (3) private foundations is capped at 30%, and was not included in this legislation. Partnership contributions are passed through to the partners under irc 703(a). When you donate to a 501 (c) (3) public charity, including fidelity charitable, you are able to.

That is, they are deductible as long as the nonprofit has applied for 501 (c) (3) status within three months of its second anniversary of incorporation in the state. Corporations may deduct all contributions to 501 (c) (3) organizations (regardless of foundation status) up to an amount normally equal to 10% of their taxable income. Monetary tax donation deductions in the form of recurring pledges;

With proper documentation, you can claim vehicle or cash donations. Important tax changes in 2020 This means that when you make a contribution to an organization that has been designated as a 501(c)(3) by the irs and you have not received anything in return for your gift, you are eligible for a.

If the irs approves the entity�s 501 (c) (3) status, donations made during the pendency of the application are deductible. Donations of cash or physical goods to your organization are tax deductible charitable donations. 3 in practice, most charities send an acknowledgment for all donations, even small ones.

You cannot deduct more than 50 percent of your total adjusted gross income. These are truly substantial changes to the tax treatment of donations. Intangible charitable donations related to time, resources, and skills

If your landlord gave your homeschool organization free or reduced rent, that is not a tax deductible donation for the landlord. The federal government wants to encourage donations to organizations that. This means that when you make a contribution to an organization that has been designated as a 501 (c) (3) by the irs and you have not received anything in return for your gift, you are eligible for a deduction when you file your taxes.

To deduct donations, you must file a schedule a with your tax form. If donors itemize deductions on their irs form 1040 tax return, and receive proper written acknowledgements from their donees, then donors can generally offset their u.s. Donations made to a qualified charity are deductible for taxpayers who itemize their deductions, within certain limitations.typically for cash contributions made between 2018 and 2025, the amount that can be deducted is limited to no more than 60% of the taxpayer’s adjusted gross income (agi).

Deductions of contributions to irc 501(c)(3) organizations and other exempt organizations 1.