Deduction limit of $15,000 per year for single filers and $30,000 per year for joint filers. The total subtraction for contributions made to both college savings plans may not exceed $10,000 for single filers and $20,000 for joint filers, even if you contributed more.

With a virginia 529 account, virginia taxpayers who own 529 accounts may contribute what they’d like to the 529 account and then deduct on their state tax return contributions up to $4,000 per account per year with an unlimited carryforward to future tax years.

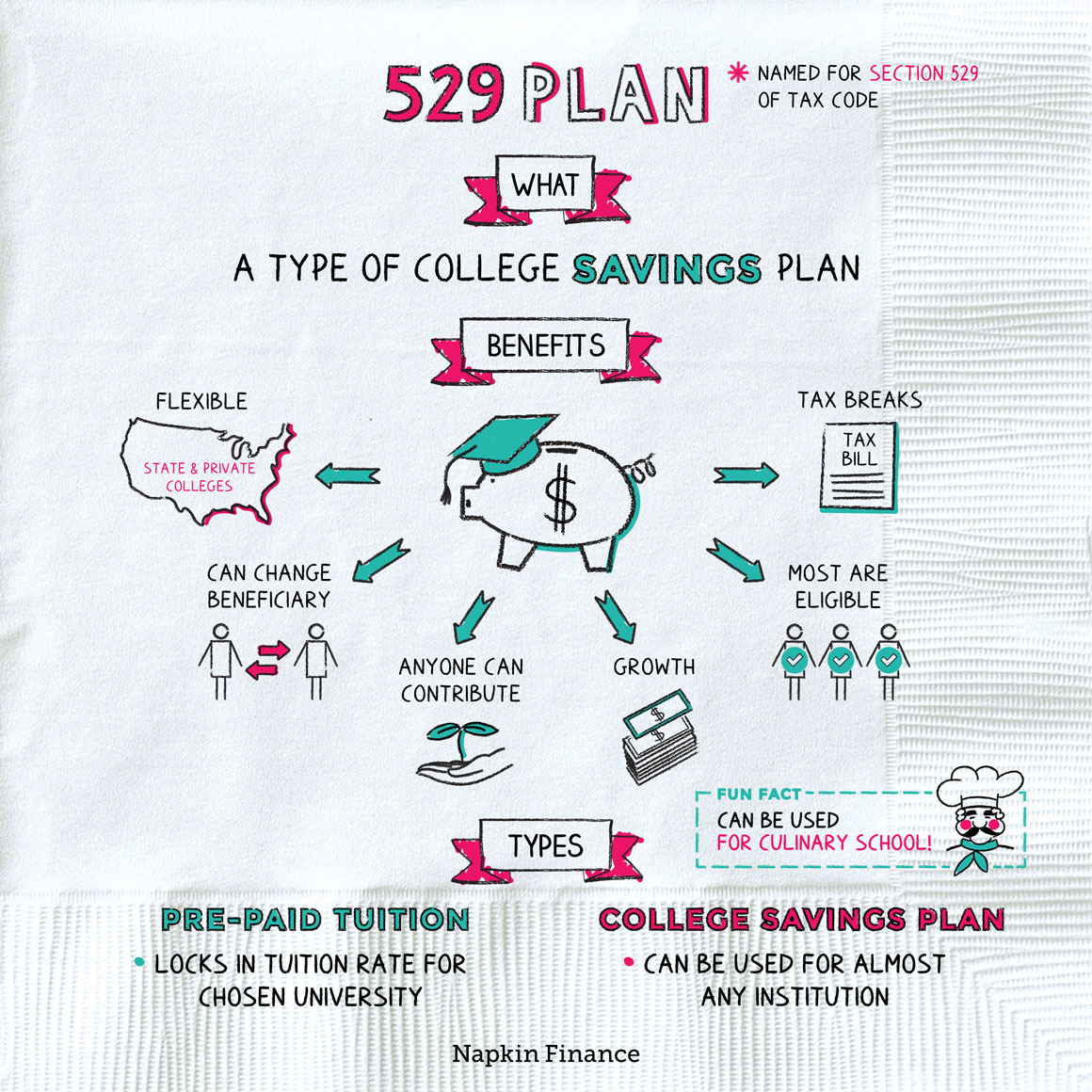

Tax deductions for 529 college savings plan. Note that there is no federal income tax deduction on 529 plan contributions. Federal tax deduction for 529 plans. Although 529 plans are often referred to as college savings plans, the contributions you make don’t just sit there until you.

Contributions to the rhode island 529 plan of up to $500 per year by an individual and up to $1,000 per year for married taxpayers filing jointly are deductible in computing rhode island taxable income, with an unlimited carryforward of excess contributions. However, indiana, utah and vermont offer a state income tax credit for 529 plan contributions and minnesota offers a state income tax deduction or tax credit, depending on the taxpayer’s adjusted gross income. There are no federal 529 tax deductions;

Ad highly rated by morningstar. New jersey may become the 35th state to offer an income tax benefit for residents who contribute to a 529 plan. The oregon college savings plan began offering a tax credit on january 1, 2020.

Single individuals or heads of household may subtract up to $2,000 per beneficiary. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Contributions to any other irc section 529 programs may not be deducted.

Although your contributions to a 529 college savings plan are not tax deductible, you still receive a benefit. Thus, families with multiple kids can claim higher deductions and save even more on state income tax. Some states require you to contribute to their state�s plan, while other states allow you to take the tax deduction for contributions to any state�s plan.

Also, some states offer a tax credit for contributions to a 529 plan. However, if you’re in one of the many states that offers a tax deduction or credit for 529 plan contributions, you might get an. Ad turbotax® makes it easy to get your taxes done right.

Even though every state has a plan, they are not all the same. These limits apply to each beneficiary of the ny 529 college savings program. For a short window of time, oregon taxpayers can qualify for both a deduction and a.

Limits on annual 529 state income tax. The total subtraction for contributions made to both college savings plans may not exceed $10,000 for single filers and $20,000 for joint filers, even if you contributed more. This is a major benefit of opening a collegeinvest 529 plan.

College savings plans fall under internal revenue code section 529, qualified tuition programs. You may carry forward the balance over the following four years for contributions made before the end of 2019. 25 rows while federal tax rules do not allow families to deduct 529 contributions, states have their own.

You can shop for 529 plans outside your state; Section 529 plans are offered by states under the federal tax code and may provide significant tax advantages to parents and others who save for future higher education expenses. Many states have 529 tax deductions for contributions;

Rowe price college savings plan. Contributions of up to $15,000 per beneficiary can be funded annually, and married couples can contribute up to $30,000 annually. Rowe price college savings plan today!

Unlike many states, the irs does not provide a current tax deduction for contributions made to the plan. The contribution may be made to an existing account you own, another wisconsin account, or to a new account. The 529 plan tax deduction is part of a comprehensive college affordability plan in the state’s fiscal year 2022 budget proposal.

Save for college, save on taxes. Married couples can subtract up to $4,000 per beneficiary when filing jointly. Minnesota offers a subtraction for contributions to any state’s section 529 plan.

You should plan for 529 contribution limits; For example, if a couple contributed $15,000 to their son’s oregon college savings plan account in 2019, they may subtract a maximum of $4,865 (because. The credit replaces the current tax deduction on january 1, 2020.

With a virginia 529 account, virginia taxpayers who own 529 accounts may contribute what they’d like to the 529 account and then deduct on their state tax return contributions up to $4,000 per account per year with an unlimited carryforward to future tax years. A taxpayer may subtract up to $1,500 ($3,000 for married joint filers) of contributions to any state’s section 529 college savings plan or prepaid tuition plan. 529 plan accounts are investment vehicles.

One of the big perks of using a 529 plan to save for college is that many states offer a tax deduction for contributions to the plan. Answers others found helpful does illinois allow a credit or deduction for college expenses? 12 for example, indiana taxpayers can get a state income tax credit equal to 20% of their contributions to a collegechoice 529.

But, like anything, there are rules that apply. There are no federal tax deductions for 529 plans. 36 rows the most common benefit offered is a state income tax deduction for 529 plan contributions.

For colorado taxpayers, contributions to any collegeinvest savings account are eligible for a deduction from your colorado state income tax return 1. Answer simple questions about your life and we do the rest. Deduction limit of $15,000 per year for single filers and $30,000 per year for joint filers.