About the author see more Check with your 529 plan or your state to find out if you’re eligible.

If you don’t, this is a critical element.

Tax deductions for 529 contributions. After your business is up and running, put junior on the payroll. If you don’t, this is a critical element. Never are 529 contributions tax deductible on the federal level.

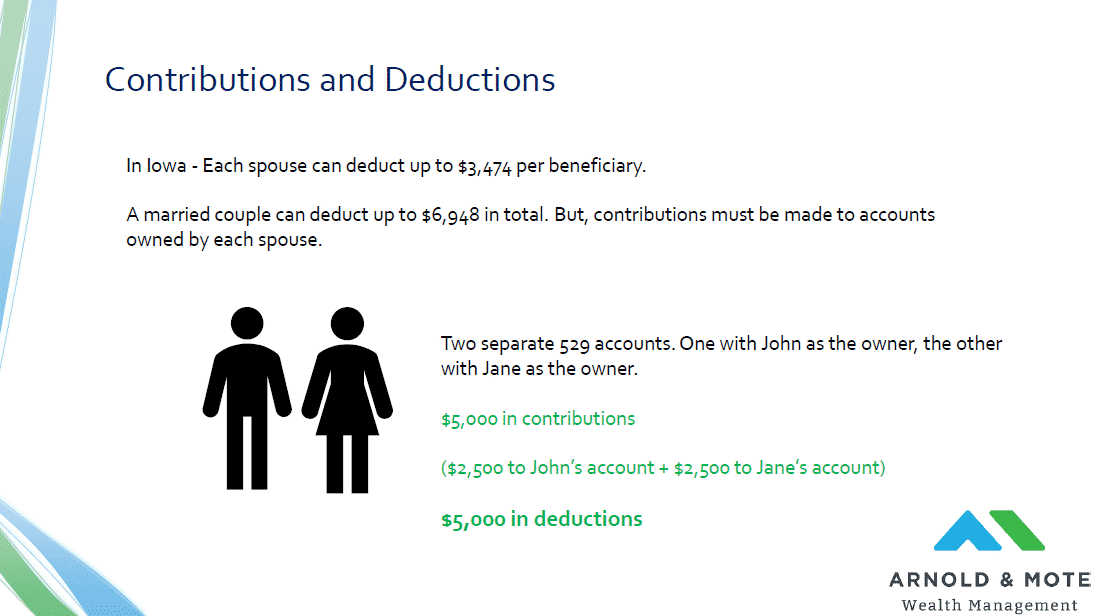

These states offer tax deductions or tax credits for your 529 plan contributions (more details below): Earnings from 529 plans are not subject to federal tax and generally not. Alabama arizona arkansas colorado connecticut washington, dc georgia idaho illinois indiana iowa kansas louisiana maryland massachusetts michigan minnesota mississippi missouri montana nebraska new.

529 plan tax deduction the proposal includes a provision to allow new jersey taxpayers to deduct 529 plan contributions of up to $10,000 per year from state taxable income. That’s a deduction of up to. Accordingly, that spouse is not entitled to a pa 529 plan deduction.

States with income tax deductions or credits for 529 plan contributions. Fees can vary greatly depending on the state and investment plan. $2,000 single or head of household / $4,000 joint (any state plan) beneficiary:

Now, new jersey taxpayers with gross income of $200,000 or less can qualify for a state income tax deduction of up to $10,000 per taxpayerfor contributions to the plan. 529 plans do offer state tax deductions on contributions. There are no federal tax deductions for 529 plans.

However, if you’re in one of the many states that offers a tax deduction or credit for 529 plan contributions, you might get an. You’ll enjoy a deduction of up to $10,000 per year ($20,000 if married and filing jointly) and you pay no state income tax on earnings and withdrawals that are used for qualified college expenses1. $5,000 single / $10,000 joint beneficiary:

The benefit would only be available to households with an annual income of $200,000 or less. Taxpayers in indiana who contribute to the state’s collegechoice 529 savings plans can get a tax credit of 20% back on their contribution, up to a threshold of $1,000. Note that there is no federal income tax deduction on 529 plan contributions.

$5,000 single / $10,000 joint beneficiary: When making 529 plan contributions to reduce pa taxable income, you need to understand pa’s tax rules to maximize your tax savings. The maximum amount to contribute to qualify for both the deduction and the credit is $24,325 for those filing jointly or $12,175 for individuals.

Montana legal deductions are capped at $3,000 per year for single filers and $6,000 per year for joint filers. Turbotax home & biz windows 0 2 388 reply 1 best answer annetteb6 employee tax expert Some states allow a deduction or credit for contributions to any 529 plan.

Massachusetts deduction for 529 contributions massachusetts allows a deduction for 529 contributions to massachusetts plans on state income taxes, but turbotax does not ask me about this nor do i see where i can enter it on the tax forms. College savings plans fall under internal revenue code section 529, qualified tuition programs. Only the account owner can deduct their contributions to this 529 account.

Ad easy to understand contribution guidelines to help you add to your savings for education. Learn more about maximum and minimum contribution levels in your state for 529 plans. If you already have your own business, you have this covered.

For contributions to irc section 529a pennsylvania able savings account programs, pennsylvania allows a maximum yearly deduction equal to the annual federal gift tax exclusion (found at irc § 2503 (b)) per contributor. How much can you write off for 529 contributions? When you pay her, the wages are a.

Refer to the pa able fact sheet on the department’s website for more information. However, some states may consider 529 contributions tax deductible. The deduction limit for 529 plans currently sits at $8,000 per year for single filers and $16,000 per year for married couples filing jointly.

While there are no limits on annual contributions to a 529 plan, most states limit tax credit and deduction contributions. But not every state offers the deduction. About the author see more

Contributions of up to $15,000 per beneficiary can be funded annually, and married couples can contribute up to $30,000 annually. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. Contributions to an individual’s taxable retirement plans, which comprise their 529 plan contributions, are credited to their state income tax benefits.

529 plans do not offer federal contribution tax deductions. Unlike many states, the irs does not provide a current tax deduction for contributions made to the plan. To do this, a taxpayer can contribute more than the annual deduction in 2019 ($4,865 for married taxpayers filing jointly or $2,435 for individual filers) and carry forward these additional contributions.

Check with your 529 plan or your state to find out if you’re eligible.