Federal income tax brackets and rates for 2022 If both you and your spouse are 65 or older, your standard deduction increases by $2,600.

What are the 2022 tax brackets?

Tax deductions for 65 and older. What is the standard deduction for age 65 and older? Therefore, you can take a higher standard deduction for 2021 if you were born before january 2, 1957. For 2021, she gets the normal standard deduction of $12,550, plus one additional.

The owner cannot receive both exemptions. The internal revenue service (irs) gives seniors a more significant standard deduction when they turn 65. Ad turbotax® makes it easy to get your taxes done right.

If you are age 65 or older, your standard deduction increases by $1,750 if you file as single or head of household. You can get an even higher standard deduction amount if either you or your spouse is blind. You are considered age 65 on the day before your 65th birthday.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If one of you is legally blind, it increases by $1,300 and if both are it increases by $2,600.

If you’re both 65 or older, your deduction could be $27,800. If you are age 65 or older,your standard deduction increases by$1,700 if you file as single or head of household. The amount of the additional standard deduction is based on your filing status.

When you’re over 65, the standard deduction increases. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. Any taxing unit, including a city, county, school or special district, may offer an exemption of up to.

2021 major tax breaks for taxpayers over age 65 increased standard deduction: What are the 2022 tax brackets? 7 rows single or head of household over 65 age:

If you don�t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. If you owe $4,000 in taxes before the credit and you get a $3,750 credit, your tax bill will be just $250. If both you and your spouse are 65 or older, your standard deduction increases by $2,600.

Taking the standard deduction is often the best option and can eliminate the need to itemize. Higher standard deduction for age (65 or older). You�re considered to be 65 on the day before your 65th birthday.

If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,400. Ellen is single, over the age of 65, and not blind. If you fit the requirements, the credit for the elderly or the disabled could really brighten your tax day.

Answer simple questions about your life and we do the rest. If you are legally blind, your standard deduction increases by $1,700 as well. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

Individual income tax return, line 12, page 30, will indicate if there are additional amounts to include in the standard deduction. Federal income tax brackets and rates for 2022 If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

There is a larger standard deduction if the taxpayer and/or spouse is age 65 or older, or blind. If you are legally blind, your standard deduction increases by $1,700 as well. A single tax payer can have gross income of up to $14,250 before required to file a tax.

For the 2021 tax year, seniors get a tax deduction of $14,250 (this increases in 2022 to $14,700). (see form 1040 and form 1040a instructions.) If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

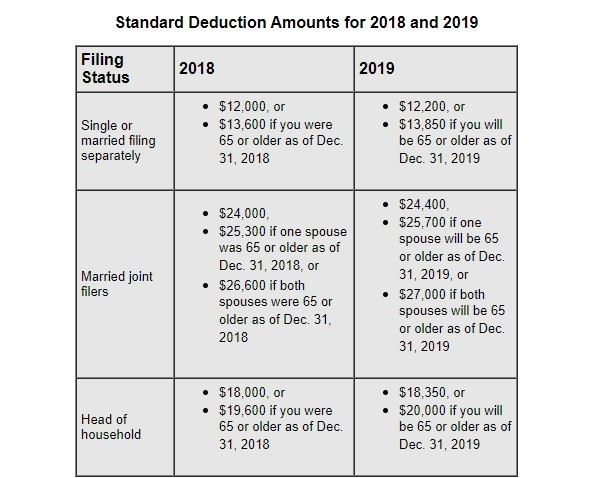

If you are married filing jointly and you or your spouse is 65 or older,your standard deduction increases by$1,350. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,300. The tax cuts and jobs act, the massive tax reform law that took effect in 2018, roughly doubled the standard deduction.

If you are legally blind, your standard deduction increases by $1,700 as well. If both you and your spouse are 65 or older, your standard deduction increases by $2,600. The standard deduction is $1,300 higher for those who are over 65 or blind;

What is the irs deduction for people over 65? 5 taxable social security income your social security benefits might or might not be taxable income. As a result, about 90% of all taxpayers, including older americans, take the standard deduction.

If the owner qualifies for both the $10,000 exemption for age 65 or older homeowners and the $10,000 exemption for disabled homeowners, the owner must choose one or the other for school district taxes. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. What is the standard deduction for over 65?

This tax credit ranges from $3,750 to $7,500, depending on your income and filing status. What is the extra standard deduction for seniors over 65? If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

A standard tax reduction is a part of your income that is not taxed, thus reducing your overall tax bill. Anyone 65 and older by december 31 of the tax year is entitled to a higher standard deduction than younger folks. You qualify for a larger standard deduction if you or your spouse is age 65 or older.

It depends on your overall earnings. The specific amount depends on your filing status and changes each year. You�re allowed an additional deduction for blindness if.

As qualifying widow (er) it increases by$1,350 if you are 65 or older. If you are legally blind, your standard deduction increases by $1,750 as well. It’s $1,650 higher if also unmarried and not a surviving spouse (in 2021, that part rises to $1,700).

If you are legally blind, your standard deduction increases by $1,700 as well.