If someone can claim you as a dependent, you get a smaller standard deduction. 4 rows what is the extra standard deduction for seniors over 65?

If you don�t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

Tax deductions for 65 and over. If you fit the requirements, the credit for the elderly or the disabled could really brighten your tax day. (see form 1040 and form 1040a instructions.) The standard deduction for seniors over 65 is even larger next year, growing to.

When you’re over 65, the standard deduction increases. What was the adjusted gross income of the applicant, spouse, and any individuals sharing ownership in the property for the prior year? As a result, about 90% of all taxpayers, including the elderly, will take the standard deduction.

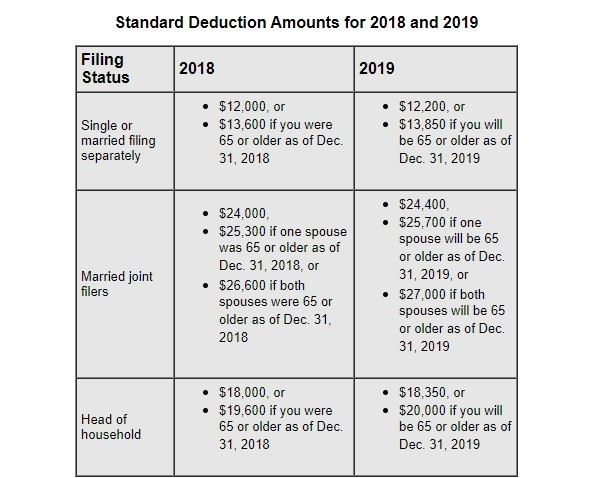

The current irs deduction for individuals over the age of 65 is an additional $1,300 on top of the standard individual deduction. This tax credit ranges from $3,750 to $7,500, depending on your income and filing status. Once you turn 65, the irs increases your standard deduction (if you file single) from $12,200 to $13,850, a $1,650 bump taking a potentially huge chunk out of your 2019 tax burden.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. Individuals who are both aged and blind may receive both standard deductions increases. The tax cuts and jobs act, the massive tax reform law that took effect in 2018, roughly doubled the standard deduction.

If you are age 65 or older, your. Ad answer simple questions about your life and we do the rest. Higher standard deduction for age (65 or older).

For 2020, the additional standard deduction for married taxpayers 65 or over or blind will be $1,300 (same as for 2019). You can get an even higher standard deduction amount if either you or your spouse is blind. If both you and your spouse are over 65 and file.

For the 2021 tax year, seniors get a tax deduction of $14,250 (this increases in 2022 to $14,700). A standard tax reduction is a part of your income that is not taxed, thus reducing your overall tax bill. If you are legally blind, your standard deduction increases by $1,700 as well.

The standard deduction is $1,300 higher for those who are over 65 or blind; 2022 standard tax deduction for seniors over 65 years of age with the standard deduction increase*: It’s $1,650 higher if also unmarried and not a surviving spouse (in 2021, that part rises to $1,700).

You qualify for a larger standard deduction if you or your spouse is age 65 or older. You are considered age 65 on the day before your 65th birthday. If you don�t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

Were you 65 years of age or older on december 31 of last year? For a single taxpayer or head of household who is 65 or over or blind, the additional standard deduction for 2020 will be $1,650 (same as for 2019). If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

5 taxable social security income your social security benefits might or might not be taxable income. Increased standard deduction when you’re over 65, the standard. If you owe $4,000 in taxes before the credit and you get a $3,750 credit, your tax bill will be just $250.

A single tax payer can have gross income of up to $14,250 before required to file a tax. 7 rows single or head of household over 65 age: If you are age 65 or over, blind or disabled, you can tack on $1,300 to your standard deduction ($1,600 for unmarried taxpayers).

Taking the standard deduction is often the best option and can eliminate the need to itemize. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. Therefore, you can take a higher standard deduction for 2021 if you were born before january 2, 1957.

The internal revenue service (irs) gives seniors a more significant standard deduction when they turn 65. Exploring the standard deduction the internal revenue service standard deduction for married couples filing joint tax returns is $24,000. From simple to complex taxes, filing with turbotax® is easy.

For a single taxpayer or head of household who is 65 or over or blind, the additional standard deduction for 2020 will be $1,650 (same as for 2019). The additional standard deduction for those age 65 and over or the blind is $1,350 for 2021 or $1,700 if the taxpayer is also unmarried and not a surviving spouse. Anyone 65 and older by december 31 of the tax year is entitled to a higher standard deduction than younger folks.

If you are legally blind, your standard deduction increases by $1,700 as well. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. Do senior citizens get a higher standard deduction?

For 2020, the additional standard deduction for married taxpayers 65 or over or blind will be $1,300 (same as for 2019). For the 2019 tax year, seniors over 65 may increase their standard deduction by $1,300. If you’re both 65 or older, your deduction could be $27,800.

The specific amount depends on your filing status and changes each year. As written, the standard deduction amounts will increase to $12,000 for individuals, $18,000 for heads of household, and $24,000 for married couples filing jointly and surviving spouses. 4 rows what is the extra standard deduction for seniors over 65?

It depends on your overall earnings. For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,750 for single filers or head of household, and $1,400 for married filing jointly, married filing separately, and surviving spouses. If someone can claim you as a dependent, you get a smaller standard deduction.

When you�re over 65, the standard deduction increases. 2021 major tax breaks for taxpayers over age 65 increased standard deduction: