Simple annual overview of deductions on a $80,000.00 salary. Federal tax paid ($10,368.00) $65,632.00:

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

This $80k salary example uses a generic salary calculation example for an individual earning $80k per year based on the 2022 personal income tax rates and thresholds as published by.

Tax deductions for 80000. Great, now you know how to do it,. This is the best video with detail about indiana property tax deductions and my clients $80000 mistake! Tax rate threshold tax due in band:

This calculator is intended for use by u.s. The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others. Tax rate threshold tax due in band:

Expert answer 1.) taxable income 80,000 tax on income upto $ 40,525 4,664.00 add: For example, if your income is $80,000, and you have $20,000 worth of tax deductions, your taxable income is. That’s a total of $20,000 in deductions — significantly more than your $12,550 standard deduction.

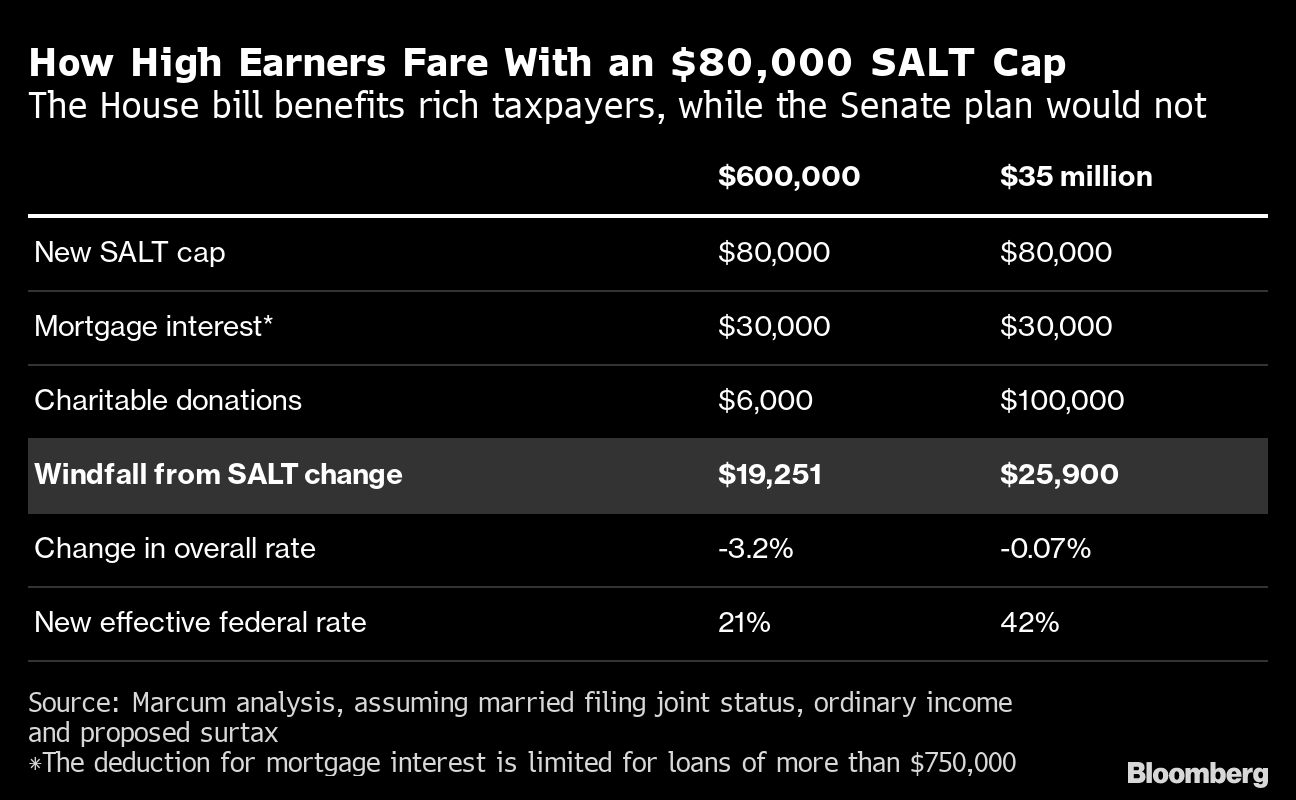

For a final figure, take your gross income before adjustments. House democrats on friday passed their $1.75 trillion spending package with an increase for the limit on the federal deduction for state and local taxes, known as salt. What is the standard deduction for senior citizens in 2020?

A tax deduction is money you can subtract from your taxable income or revenue but not from your actual income or revenue. Alabama state standard deduction (1 x $1,500.00 = $1,500.00) $76,000.00: House democrats late thursday altered their spending package by changing the deduction limit on state and local taxes to $80,000 through 2030.

If you are a home owner renters may have a little known tax deduction in indiana, at least ask your tax preparer if you qualify! New york state standard deduction (1 x $0.00 = $0.00) $72,300.00: Not only would itemizing reduce the amount of income on which you paid tax, but it would drop you into a lower tax bracket in this case:

Updated for the 2022/23 tax year, this illustration provides a tax return / tax refund calculation for a canadian resident, living in ontario earning $80,000.00 per annum based on the 2022 ontario tax tables. This differs from tax credits, which are applied to your final tax bill. Lets start our review of the $80,000.00 salary example with a simple overview of income tax deductions and other payroll deductions for 2022.

Federal tax paid ($10,368.00) $65,632.00: Federal standard deduction ($7,700.00) $72,300.00: Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.

California state tax tables ; However, if your modified adjusted gross income (magi) is less than $80,000 ($160,000 if filing a joint return), there is a special deduction allowed for paying interest on a student loan (also known as an education loan) used for higher education. New york state tax tables ;

Virginia state tax tables ; Indiana property tax deductions my client�s $80,000 mistake! Student loan interest is interest you paid during the year on a qualified student loan.

Applied to their fullest extent, instructional tax deductions can limit the quantity of earnings issue to tax by means of as lots as $4000 for every certified taxpayer. Federal standard deduction ($2,500.00) $77,500.00: Tax deductions lower the amount of your income that will be subject to taxation.

Assuming the single filer with $80,000 in taxable income opted for the standard deduction ($12,400), the amount of his agi that went to the irs was 13.28% — a far cry from 22%. His total deduction in 2021 are: House democrats’ spending package raises the salt deduction limit to $80,000 through 2030.

Simple annual overview of deductions on a $80,000.00 salary. Welcome to icalculator au (australia), this page provides a 2022/23 australia $80,000.00 income tax calculation with example of income tax and salary deductions. Federal standard deduction ($3,000.00) $77,000.00:

If you itemize your deductions, your taxable income would drop to $80,000. For your 2020 tax return, your modified adjusted gross income could not exceed $80,000 a year in order to claim the full credit and had to be between $80,000 and $90,000 for the partial credit. If you’re in a 25% tax bracket you will save $13,050 in taxes.

The standard deduction is a specific dollar amount that reduces your taxable income. This $80k salary example uses a generic salary calculation example for an individual earning $80k per year based on the 2022 personal income tax rates and thresholds as published by. Tax rate threshold tax due in band:

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Virginia state standard deduction (1 x $930.00 = $930.00) $76,070.00: This salary example for ontario was produced using standard tax return information for an employee earning $80,000.00 a year in ontario in 2022, this tax ans salary calculation.

The table below provides the total amounts that are due for income tax, social security and medicare. Federal standard deduction ($4,803.00) $75,197.00: For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for head of household.

Tax rate threshold tax due in band: So, if you made $100k but had $15k in deductions, you’d only be paying tax on $85k. Alabama state tax tables ;