Yearly % 1 salary/tax component $85,000.00: On a £85,000 salary, your take home pay will be £57,989 after tax and national insurance.

State income tax total from all rates :.

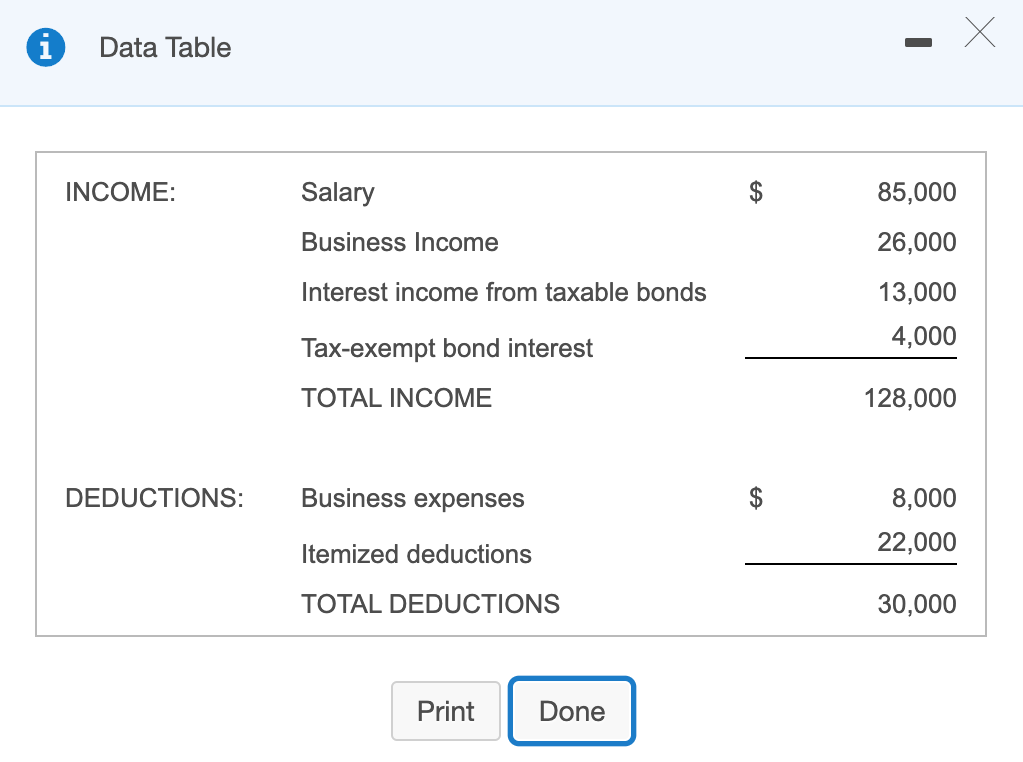

Tax deductions for 85000. This figure is for guidance only, and does not in any way constitute financial advice. Connecticut state standard deduction (1 x $14,000.00 = $14,000.00) $71,000.00: Itemized deduction opportunities and changes itemized deductions could help your family claim more money in deductions than the standard deduction offers.

If you work 5 days per week, this is £223 per day, or £28 per hour at 40 hours per week. Welcome to icalculator au (australia), this page provides a 2022/23 australia $85,000.00 income tax calculation with example of income tax and salary deductions. Filing $85,000.00 of earnings will result in $6,502.50 being taxed for fica purposes.

Income tax breakdown [ 2022 tax tables] tax rate threshold tax due in band: New jersey state tax tables ; State income tax total from all rates :.

The standard deduction for married taxpayers filing jointly has been increased to $25,100. 10% of the income tax, where the total income exceeds inr 1 cr. For heads of households, the standard deduction will be $18,800, up $150.

Tax rate threshold tax due in band: An individual who receives $62,927.19 net salary after taxes is paid $85,000.00 salary per year after deducting state tax, federal tax, medicare and social security. If you found this payroll example for a ₹8,50,000.00 salary in india useful, we kindly request that you tax a second to rate your experience and/or share to your favourite social network.

When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. Deduction is limited to whole of the amount paid or deposited subject to a maximum of rs. New jersey state standard deduction (1 x $1,000.00 = $1,000.00) $84,000.00:

Your average tax rate is 28.6% and your marginal tax rate is 41.1%. Connecticut state tax tables ; $85,000.00 + interest $ + capital gains (50% of value) $ + eligible dividends (taxation value) $ + ineligible dividends (taxation value) $ =

The standard deduction is available to almost all taxpayers who aren’t dependents and, for tax year 2022, is set at $12,950 for single taxpayers and $25,900 for. Adjusted gross income = $85,000: You can view a breakdown of each income tax calculation, tax credits, expenses and payroll deduction for this ₹8,50,000.00 salary example in india below.

3% on the sum of total income tax and surcharge. The deduction is available to borrowers who have a magi under $85,000 (single filers) or $170,000 (joint filers), though deduction amounts are phased out for magis over $70,000 (single filers) or. On a £85,000 salary, your take home pay will be £57,989 after tax and national insurance.

1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd. Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. What does it mean to be in the 12% tax bracket?

For example, here are the standard deductions for 2020 taxes to be filed in 2021, per the irs: This equates to £4,832 per month and £1,115 per week. Tax rate threshold tax due in band:

For senior citizens of 60 years or older, the 0. Estimated tax liability = $6,790 Federal standard deduction ($0.00) $85,000.00:

Filing $85,000.00 of earnings will result in $11,687.50 of that amount being taxed as federal tax. Federal standard deduction ($0.00) $85,000.00: Your taxable income would lower to $85,000.

Section 80c includes investment in national savings certificate(nsc), investment in equity linked savings scheme (elss mutual fund), children tuition expenses, etc If your modified adjusted gross income exceeds $85,000 for single filers or $170,000 for married filing jointly filers, the deduction isn�t allowed at all. Single filers with adjusted gross incomes between $70,000 and $85,000 married couples filing jointly with incomes between $140,000 and.

That means that your net pay will be $60,724 per year, or $5,060 per month. This $85k salary example uses a generic salary calculation example for an individual earning $85k per year based on the 2022 personal income tax rates and thresholds as published by the ato. 1,50,000 12.this maximum limit of rs.

The deduction amounts are reduced for the following filers: Deductions can reduce the amount of your income before you calculate the tax you owe. The personal tax exemption hasn’t changed from 2018.

$85,000.00 income tax calculations for 2018; This deduction could even drop you into a lower tax bracket, saving you even more money. Tax deductions make a portion of your income nontaxable.

Section 80c deduction against public provident fund (ppf), employees’ provident fund(epf), the premium paid towards life insurance policies, principal repayment of a home loan. This is a $300 increase from the previous year. $12,550 for single taxpayers $12,550 for.

Yearly % 1 salary/tax component $85,000.00: Let�s look at how to calculate the payroll deductions in the us. How much federal tax do i owe on 85000?

If you make $85,000 a year living in the region of california, usa, you will be taxed $24,276.