The irs mileage rate for 2019 is 58 cents per mile. That’s a 2.5 cent increase from the 56 cents standard mileage deduction for 2021.

If you work as an independent contractor, you can deduct the cost of supplies, the cost of vehicles purchased for business use, and the cost of travel.

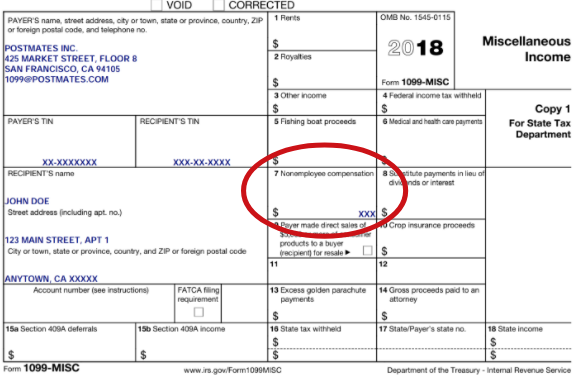

Tax deductions for a 1099. The phrase is something of a misnomer, as no deductions are actually filed on the form itself. Assume that at least 15% of the gross amount you make from your 1099 income may be deductible. 1099 deductions are personal income tax deductions available to certain u.s.

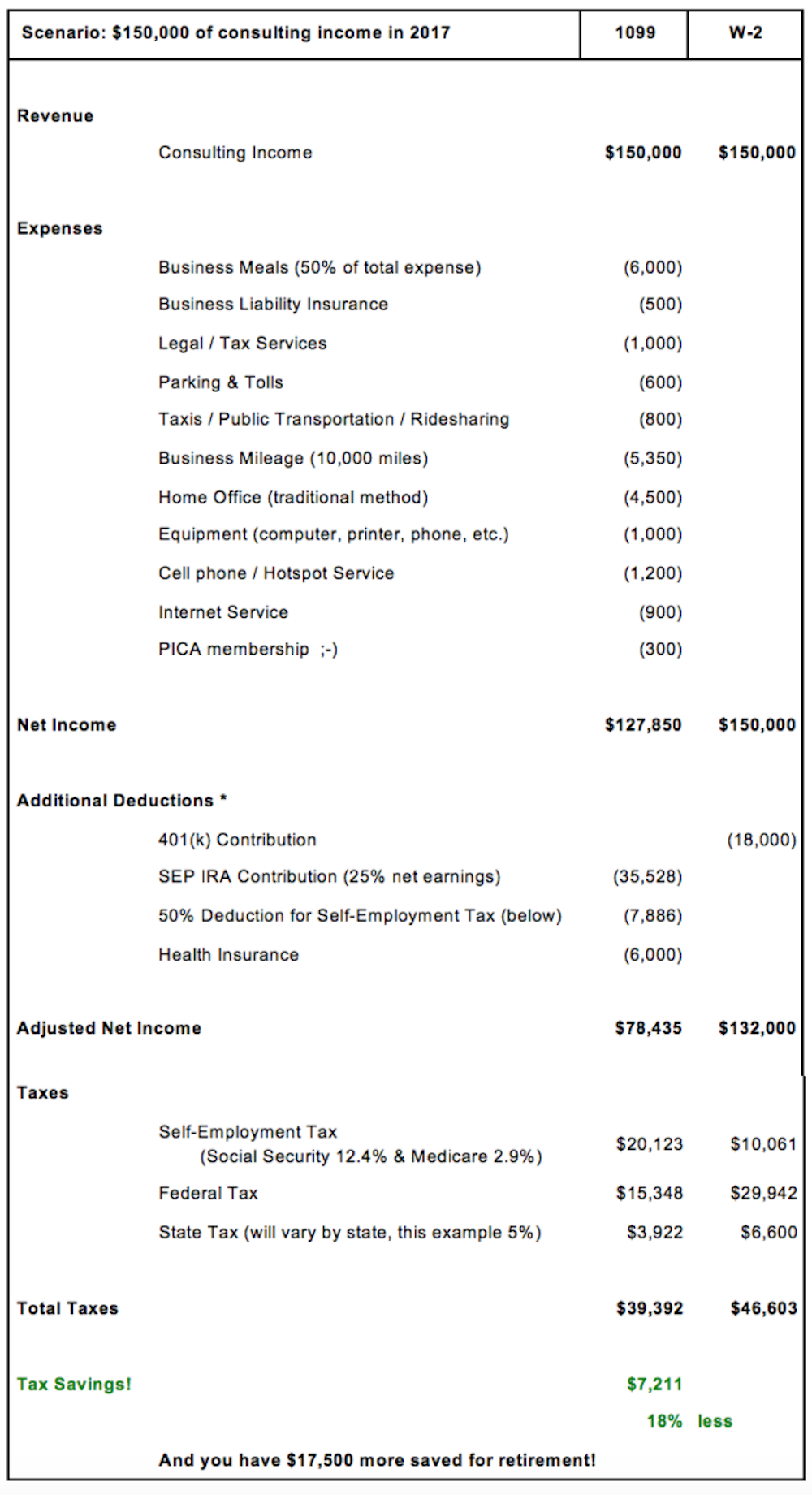

Beginning january 1, drivers can deduct 58.5 cents per mile driven from their taxes. The 21 best 1099 tax deductions for self employed contractors 1. By contrast, 1099 workers need to account for these taxes on their own.

You track your business mileage and then multiply the total number by the rate set by the irs for that tax year. You can reduce your taxable business income by the amount of your expenses. However, if you share plans for personal use, you should only deduct the amount that accounts for your business use.

You have two options when it comes to this. The irs mileage rate for 2019 is 58 cents per mile. That’s a 2.5 cent increase from the 56 cents standard mileage deduction for 2021.

Paying taxes as a 1099 worker. This is probably the most confusing and improperly calculated tax for 1099 workers. You can deduct these as a business expense, so your taxable income and tax brackets aren’t affected by the fees.

Advertising costs, professional licensing, equipment, travel, supplies, repairs and maintenance are all common deductions for 1099 income. Is 1099 a tax deduction for a company?. Top 25 1099 deductions for independent contractors 1.

Deducting a part of your home can be complex, but. 16 amazing tax deductions for independent contractors. Your small company must issue a 1099 for several types of payments you make.

If you’re not sure where something goes don’t worry, every expense on here, Depreciation of property and equipment. If you have an office in your home that you use exclusively for business, you can take a deduction for the.

Individuals who work as independent contractors and receive 1099 forms from their employers. Here are some key items you can deduct as a 1099 provider: As a 1099 worker, you cannot deduct many expenses related to owning a business, such as advertising or supplies.

The standard mileage rate lumps ordinary expenses together and allows you to deduct a single price per mile. For example, maybe you use your home as an office, a yoga. These can include the following:

Here are 6 common deductions for a 1099 contractor: Most costs associated with operating a business can be expensed on part ii of schedule c. If the size of the commission exceeds $600, you.

How do i deduct mileage from a 1099? For tax year 2019, the normal mileage deduction for business usage is 58 cents per mile, up from 54.5 cents in 2018. This is by far the simplest method.

What deductions are allowed when you receive a 1099? The combined tax rate is 15.3%. People need to understand you don’t necessarily have to spend money on your business in order to have business expenses.

One of the largest expenses available to independent contractors to deduct is mileage. If you work as a company employee, your employer typically withholds this from your paycheck as part of payroll taxes. Depending on your profession, you may have significant home office expenses.

This can include payments to individual sales reps, or marketing channels and platforms like amazon, ebay or uber. If you have a separate line or internet plan for work, you can deduct 100% off the cost. Health insurance premiums hsa contributions retirement contributions (see more below) deductible business expenses heavy vehicle purchase qualified business income (qbi) 2) take advantage of high retirement contribution maximums

If you work as an independent contractor, you can deduct the cost of supplies, the cost of vehicles purchased for business use, and the cost of travel. Try your best to fill this out.