If you are a police officer, here is a checklist of the tax deductions you may be able to claim on your personal tax return. An ordinary expense is one that is common and accepted in your.

There is a wide range of deductions you can claim as a police officer, such as:

Tax deductions for a police officer. Public safety officer tax deduction. The salt deduction helps support these vital investments at the state and local level. Barron noted that the uniform and equipment deductions are permitted if the dollar value is above the amount of the given allowance and/or expenditure of the items.

The expenses are itemized on schedule a and the total carried over to the 1040 federal income tax return. Reporting a police informant reimbursement; Kevin@policetax.com law enforcement deductions dues.

Proving you paid a police informant expense; A free checklist of tax deductions and expenses for police officers. Peace officer tax deductions worksheet professional fees & dues:

Answer yes to the question, if you were employed as a public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew). Fill out the required boxes which are colored in yellow. B) meets the deductibility tests;

Mostly this applies to those in law enforcement and emergency services, though the definition. Music streaming services, cds, audio books or podcasts; Answer yes, if the pension administrator paid for health insurance.

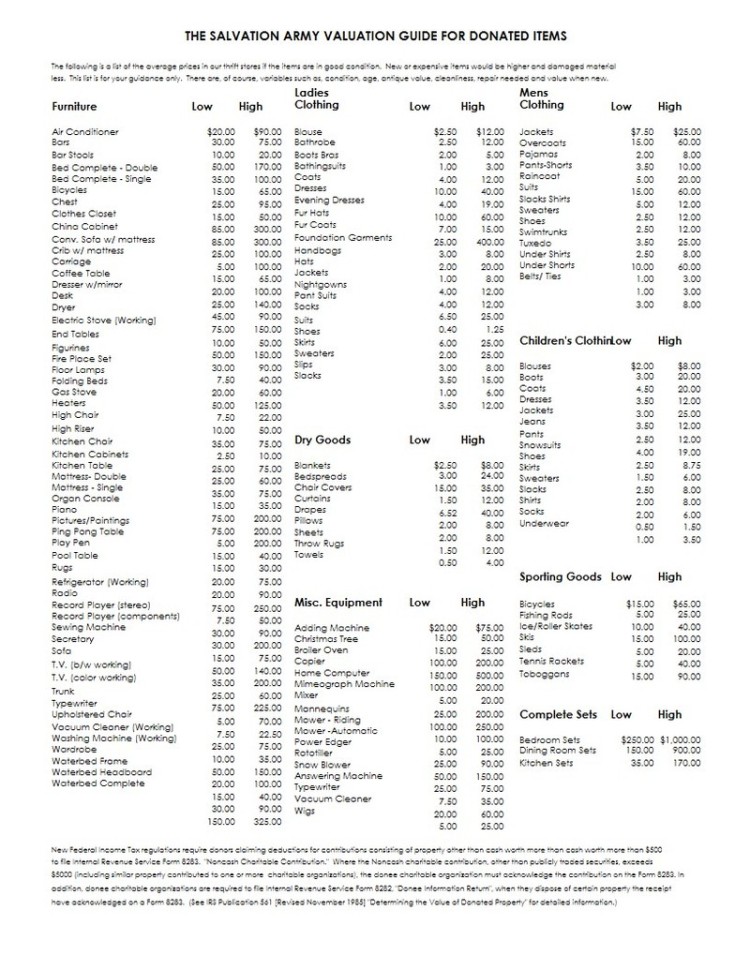

A police officer can take a full tax deduction for any necessary supplies purchased for use in his line of work, such as a passport, weapon or ammunition, if his department does not reimburse him for his expenses. Kevin chinnock, m.a.,ea, police tax returns, police tax deductions, Tax deduction worksheet for police officers legal (protection and production of taxable income) miscellaneous expenses errors & ommissions insurance job search costs.

C) satisfies the substantiation rules. However, the costs of initial admission fees paid for membership in certain organizations or social clubs are considered capital expenses. What we colloquially refer to as the “pso deduction” at molen & associates is a deduction for retired public safety officers.

Police tax is a full service tax, accounting and business consulting firm specializing in law enforcement located in long beach, san dimas, valencia, palmdale, corona, santa ana, irvine ca. You can’t claim a deduction if your study is only related in a general way or is designed to help get you a new job outside of the police force. A deduction is only allowable if an expense is:

San dimas, long beach, valencia, palmdale, irvine tel: Enter the total amount paid for the health insurance payment amount. Any work specific tools or equipment, such as bulletproof jackets and vests, gauntlets, holsters,.

The following tips will allow you to complete tax deduction worksheet for police officers easily and quickly: Newspapers and other news services, magazines and professional publications Dues paid to professional societies related to your occupation are deductible.

Claiming a deduction for police informant expenses; With it being national police week, we thought we would share a quick tip for police and any other public safety officers. Deductible expenses are defined by the irs as being “both ordinary and necessary”.

The cost of buying, repairing and cleaning any clothing itemsthat are part of your official uniform or feature a. If you are a police officer, here is a checklist of the tax deductions you may be able to claim on your personal tax return. To take the deduction, a law enforcement officer must keep track of her expenses.

Public safety budgets across the us are largely drawn from state and local property sales and income taxes. If needed, turbotax will reduce the deduction to. Property tax deduction capped congress has capped the state and local tax (salt) deduction at $10,000 from what has been unlimited.

An ordinary expense is one that is common and accepted in your. Download, copy of print the pdf for free. He can also take a deduction for work clothes and uniforms if the department requires these purchases and he does not wear the.

Law enforcement officers, like all taxpayers, are responsible for paying the correct amount of tax on all income they receive unless that income is specifically excluded by the internal revenue. A police officer can use schedule a for work related deductions such as uniforms and equipment. A single person is allowed $5,700 as a standard deduction.

Hit the green arrow with the inscription next to jump from field to field. There is a wide range of deductions you can claim as a police officer, such as: