Answer simple questions about your life and we do the rest. The big deduction on a mortgage is the interest.

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

But one of the biggest benefits of owning additional real.

Tax deductions for a second home. Ad turbotax® makes it easy to get your taxes done right. 5 tax benefits of owning a second home. Can you deduct interest on a second home on your taxes?

Answer simple questions about your life and we do the rest. Interest remains deductible on second homes, but subject to the limits. Beginning in 2018, state and local taxes, including property taxes, are limited to $10,000 per year.

A second home not used for income is treated very similarly to a first home for tax purposes, and that could make things easier at tax time. Ad turbotax® makes it easy to get your taxes done right. Owning a second home comes with all kinds of perks:

Ad see the top 10 ranked tax apps for seniors in 2022 & make an informed purchase. It must be rented for at least 14 days per year. Using the vessel as a second home deducting the interest you pay on your boat loan by declaring the boat your second home is the biggest tax deduction there is for.

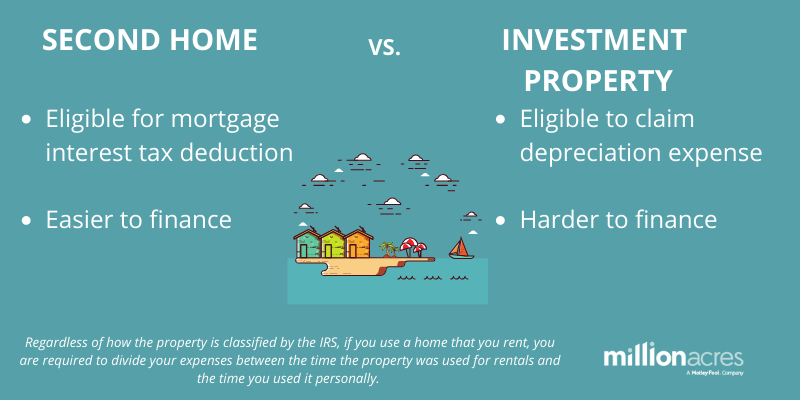

When it comes to owning a second home, the interest on your mortgage is deductible. You would be able to deduct the. This is where you can use the depreciation of the property to lower the amount of tax you pay on.

The period used for personal enjoyment cannot exceed the. The key to maximizing tax deductions for vacation homes is keeping annual personal use of your second home to fewer than 15 days or 10% of the total rental days, whichever is greater. The mortgage interest on your primary residence, as well as on a second.

The total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or sales taxes) is limited to $10,000; But one of the biggest benefits of owning additional real. Buying a second home—tax tips for homeowners.

Filing taxes after selling your second home if you’ve sold your vacation home within the last tax year, the irs states that you’re allowed to take up to a $750,000 profit if. You can deduct 100 percent of the interest on a mortgage on your. You might refinance or sell the home before you pay off the.

If you use the place as a second home—rather than renting it out—interest on the mortgage is deductible. If your second home is a rental, you could have used depreciation deductions. For single and married individuals filing taxes separately, the standard deduction is $12,550.

Property tax deductions when selling a house this is another tax structure that has recently changed. The big deduction on a mortgage is the interest. Expenses for making improvements to your second home prior to sale can be added to the cost basis of the home you are selling, which reduces your capital gain.

For married couples filing jointly, the standard deduction is $25,100. If you don’t rent the home for more than 14 days a year, you can also deduct your property taxes. You have always been allowed to deduct your property taxes.

If you itemize deductions, you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home. Answer simple questions about your life and we do the rest. Compare the top tax apps for seniors and find the one that�s best for you.