Fortunately, there are many tax deductions for social media influencers to take advantage of. This category includes all your ordinary and necessary business.

Learn the most recent changes to the tax laws to ensure you get the best tax breaks.

Tax deductions for advertising professionals. Whether it’s sales and open. Pay less to the irs. It�s tax time for sales and marketing.

A tax deduction guide just for professionals. If you own fixed property that is legally under your name or your businesses name, you may be. As long as the expenses are considered.

Office worker and business professional tax deductions is a pretty broad topic. Professional services deductions real estate tax deduction. Advertising costs tax deductions real estate agent sue, a real estate agent, deducts as advertising expenses all of her sell side marketing expenses including staging, brochures, ad.

A software system like the bonsai accounting and taxes tool. Most real estate agent marketing expenses will fall under the category of a tax deduction. Expenses for advertising that promotes your products or services may qualify for a deduction.

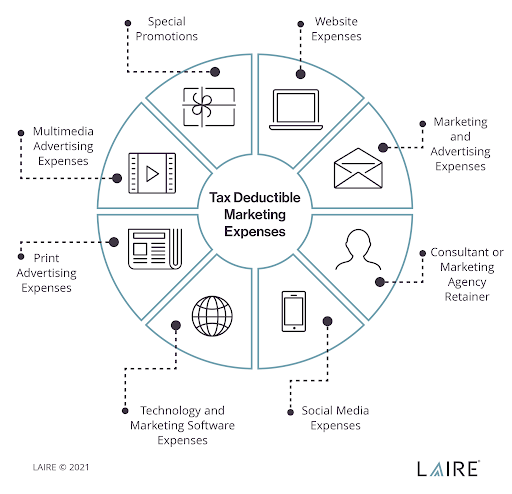

This category includes all your ordinary and necessary business. If you pay for advertising or marketing to promote your small business, those costs are fully tax deductible. Thinkstock advertising and promotional expenses are usually deductable along with other ordinary and necessary expenses in horse and livestock activities.

Learn the most recent changes to the tax laws to ensure you get the best tax breaks. Fortunately, there are many tax deductions for social media influencers to take advantage of. Now that you know about tax deductions for advertising professionals, here’s how you can take advantage:

You may deduct up to $5000 of startup costs, including advertising, in your first year of business. Here are the top tax deductions that every professional business owner should know about. Contract labor is a tax deduction expense, and has other special requirements.

Medical professionals tax deductions in order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” an ordinary expense is one that. Print, tv, radio ads, promotional materials, advertising collateral, and promotional events are all. I’ve highlighted the items that should be top of mind for every b2b.

The business expenses deduction allow for business. The rest must be depreciated over time. Marketing tax deductions for real estate agents.

Learn about the unique deductions you qualify for as a licensed professional. As a marketing professional, you will incur lots of expenses. The term business professional covers a wide range of roles, including managers, designers, supervisors, it staff,.

Those include software and subscriptions, ad spend, as well as your people spend, that is, your own. The only know how guide for professionals who want to reduce their tax burden. What follows are the top ten tax deductions for professionals you should be aware of:

5 what you may not deduct.