So, with a rental property, or airbnb rental, might be available to write off all these expenses in the first. Talk to an accountant right now, or schedule a free consultation

You can claim tax deductions for all expenses which are incurred in deriving your rental income.

Tax deductions for airbnb. Talk to an accountant right now, or schedule a free consultation Ad meet with a live tax expert from the comfort of your home. You can write off (deduct) all ordinary and necessary expenses for your airbnb business as long as you in business to make a profit (not a hobby).

File w/ 100% confidence online. Keep in mind, the also applies to property you purchase and operate as an airbnb rental. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses.

If you’re hosting a stay, it�s possible that not all of your airbnb income is taxable. You can claim tax deductions for all expenses which are incurred in deriving your rental income. Before changes in the tax code, the.

The amount you can write. You can write off expenses related to preparing the space for your airbnb customers, such as: So, with a rental property, or airbnb rental, might be available to write off all these expenses in the first.

The irs has four simple requirements to determine if you’re eligible to take advantage of depreciation as a tax. Food and treats for your guests. Cleaning the rental space flowers towels, sheets, and other items for the space you must.

It’s the best way to get ahead of your taxes. Talk to an accountant right now, or schedule a free consultation If you’re renting your home and hosting it for airbnb, it can be one of the best tax deductions available to you.

Ad find out what tax credits you might qualify for, and other tax savings opportunities. For higher income taxpayers, the deduction is limited to 2.5% of. If you travel to attend an airbnb or rental agency conference in another city, or to a property further that 100 miles from home, that�s considered business travel and you can claim the.

Make sure to keep track of every expense. Airbnb hosts quick tax checklist calculate the number of days each month that you used your property for personal use and for rental use. This formula can help you calculate your deductible rent expense:.

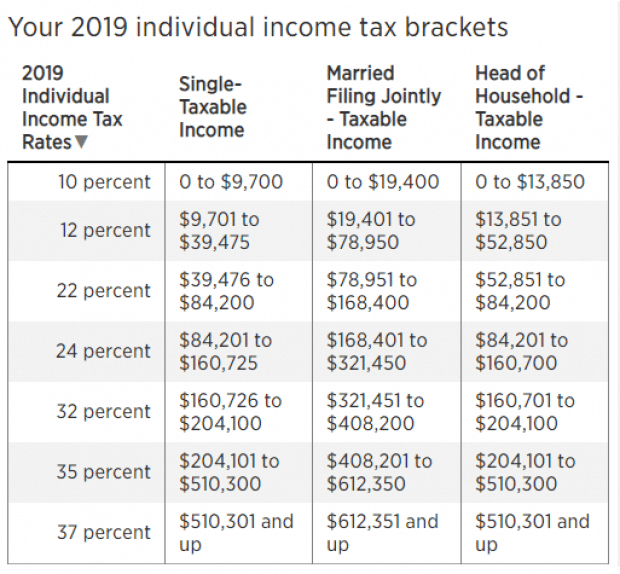

Guest or host service fees: How much you�ll be able to deduct, however, depends on your taxable income and how much you earn from your rental activity. This will determine the tax treatment of your rental.

So, if you’re an airbnb real estate investor and your property is considered a rental business, these airbnb tax deductions apply to you. Ad find out what tax credits you might qualify for, and other tax savings opportunities. In most cases, your effective.

You can deduct all of your ordinary and necessary business expenses from any taxes you pay on your airbnb rentals, including things like: 9 airbnb tax deductions to write off. Typically, where the entire property is rented out, all of the costs involved in running the.

Get all your questions answered and connect with a tax expert for unlimited advice You can deduct 100 percent of these guest / host.