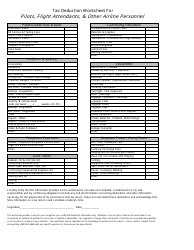

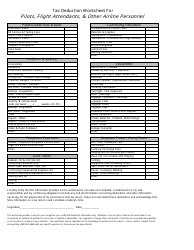

Rather, pilots deduct their meals and incidental expenses while on work related trips using the per diem rates established by the gsa (conus) and department of defense (oconus). Flight crew expense report and per diem information there are two types of deductions for pilots and flight attendants.

In order to deduct expenses in your trade or business, you must show that the expenses are ordinary and necessary. an ordinary expense is one, which is customary in your particular line of work.

Tax deductions for airline pilots. Although they are a huge asset to our jobs, the airline does not require that we have a personal computer or laptop as a condition of employment. Records you need to keep. Miscellaneous deductions will remain at zero.

If you live in al, ar, ca, hi, ny, mn or pa your state will allow flight deductions. If you earn your income as an employee pilot, this information will help you to work out what: Prior to 2018, pilots who itemized their deductions could deduct ordinary and necessary business expenses from their federal taxes.

Ordinary and necessary business expenses for pilots include unreimbursed travel costs, union dues, pilot uniforms, and. Tax relief on two thirds of professional subscriptions to balpa and one half of subscriptions to ipa may also be claimed. First is out of pocket expenses such as uniforms, cell phone, union dues, etc.

However, if the pilot stays overnight in a remote city (the other end of his route) that is travel, and the pilot is allowed to deduct meal and lodging expenses as well as transportation to and from the airport. We need both to prepare your tax returns. Flight crew expense report and per diem information there are two types of deductions for pilots and flight attendants.

The second is the per diem allowance and deduction. The second is the per diem allowance and deduction. The key reliefs and deductions include:

Of course, this only applies to 2017 and earlier, the deduction for unreimbursed business expenses was eliminated for 2018 and forward. The tcja eliminates itemized deductions for ordinary and necessary business expenses paid or incurred by a taxpayer as of jan. If you stay away from home long enough you need a night�s sleep, whatever you pay for your lodging is a.

We need both to prepare your tax returns. As a result, pilots who itemize their deductions are no longer able to deduct these expenses when filing their federal taxes. Tax deductions for pilots employee expenses.

Also fixed rate expenses for pilots and cabin crew agreed with hmrc can be claimed to cover the cleaning of uniforms etc. The per diem rates are based on the locations that the pilot stays as well as the time the pilot stayed there. Also included in miscellaneous deductions are home office expenses, tax preparation fees, and investment fees.

Completing cockpit preparations and external inspections to determine that an aircraft is acceptable for flight. If you are claiming a dependent or you are head of household and claiming a dependent, you must complete this form and list each dependent. In order to deduct expenses in your trade or business, you must show that the expenses are ordinary and necessary. an ordinary expense is one, which is customary in your particular line of work.

Ezperdiem.com is probably best known for helping airline pilots and flight attendants with their taxes via the per diem calculator, but ezperdiem.com helps pilots and flight attendants with many other tax issues that pertain to their airline employment. Most of this information can be found withing irs publication 463 or irs publication 529. There are two types of deductions for pilots and flight attendants.

Rather, pilots deduct their meals and incidental expenses while on work related trips using the per diem rates established by the gsa (conus) and department of defense (oconus). Premiums paid for salary guarantee and loss of licence insurance. Business related expenses for flight crew.

Flight personnel can achieve tax savings by maintaining proper records and claiming deductions in two key areas: Pilots don�t deduct per diem per se. The irs says airline flight crews are entitled to certain employee business expenses, and they provide certain tests that must be passed in order to determine if an expense is deductible.

The amount of any donations to registered charities (as long as you haven’t received anything in return for your donation, such as raffle tickets or novelty items) the cost of bank fees charged on any investment accounts Tax deductions for airline pilots are numerous. There are some tax deductions that all employees can claim on their personal tax returns:

First is out of pocket expenses such as uniforms, cell phone, union dues, etc. A flat rate fixed expense allowance (frea) of £1,022 per annum for all uniformed commercial pilots and other unformed flight deck crew. The allowance was negotiated with hmrc by balpa and represents an annual tax saving of £408 for higher rate taxpayers;

Income and allowances to report.