The allowable deduction is only $3,000. To take a deduction for food allergy or celiac disease purchases, you must itemize on schedule a, but you don’t get to deduct the full amount.

To take a deduction for food allergy or celiac disease purchases, you must itemize on schedule a, but you don’t get to deduct the full amount.

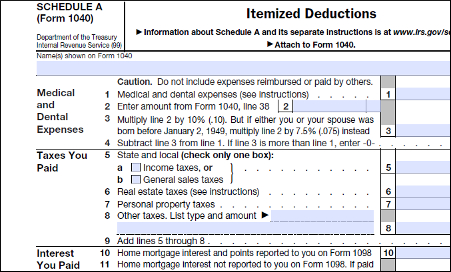

Tax deductions for allergies. Tax law says you can deduct qualified medical expenses that exceed 10% of your gross income (7.5% if you or your spouse are over 65). For example, if your annual income is $50,000, you can only deduct medical expenses that exceed $3,750. Tax deductions for autism if you’re like me, you dread tax day.

The amount of allowable medical expenses you must exceed before you can claim a deduction is 7.5 percent of your adjusted gross income (agi). Most people choose the standard deduction, especially after the tax cuts and jobs act, 2018 that effectively almost double the standard deduction. Tax deductions for allergies & chemical sensitivities doctors.

In addition, in 2021, you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (agi), found on line 11 of your 2021 form 1040. Those of us who have changed what we eat due to food allergies, food intolerance, or celiac disease pay a tremendous cost. There are no tax breaks for people who need alternative food for anything other than prescribed weight loss.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Recently, a local customer stopped by our showroom to purchase an austin air purifier to help with her asthma and allergies. Are eyeglasses a deductible expense?

Like many people coping with asthma and allergies, she was asked by her. Tax deductions for special dietary needs are more regulated. Other examples of improvements or equipment that readily pass irs muster are an elevator or a bathroom on a lower floor that makes things easier for a home owner with arthritis or a heart condition.

The irs states that you “cannot include the cost of diet food or beverages in deductible medical expenses because the diet food and beverages substitute for what is normally consumed to satisfy nutritional needs.” 3 If your doctor writes you a prescription for a legal drug, you have a. The temporary exception allows a 100% deduction for food or beverages from restaurants.

If it�s cash, you can deduct as much as your whole agi (up from 60 percent ) in 2020; Allergy and asthma home renovations might be tax deductible. This includes reading glasses purchased over the counter.

The costs add up to $15,000, and your home�s value increases by $12,000. If you spend a reasonable. To take a deduction for food allergy or celiac disease purchases, you must itemize on schedule a, but you don’t get to deduct the full amount.

Many people can opt for the standard deduction if they don’t want to itemize their personal deductions which is present on the irs schedule a. If you go with the standard deduction rather than itemize, there�s an exception in 2020 due to the pandemic and cares act. I also keep copies of all the.

Deductions can reduce the amount of your income before you calculate the tax you owe. The most frequently asked question i get (aside from recipes and things related to food allergies) is, “how do you make money?!” it makes me laugh, because some people seem to think that blogging isn’t a “real” job, or that it is merely a cute hobby. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

It can really add up! A credit reduces your tax bill dollar for dollar, but a deduction just decreases your taxable income. The allowable deduction is only $3,000.

Otherwise, the limit for other deductions is usually 50 percent of your agi at most. Beginning january 1, 2021, through december 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants as long as the business owner (or an employee of the business) is present when food or beverages are provided and the. For example, if your agi is $50,000, the first $3,750 of qualified.

You may have heard that if a food is medically necessary because of life threatening food allergies, it is tax deductible. The rules on tax deductions for special food necessary because of food allergies. How food bloggers make money and food blogger tax deductions work.

There are specific rules about which foods are allowed to be included in your. But before we know it, the decorations and gifts will be packed away, we’ll have rung in the new year, and the holiday season will turn into tax season. This is true, but there are steep thresholds before you will have any real tax savings.

Contact lenses and contact lens supplies, such as saline solution, are also deductible expenses. Yes, as long as they are corrective glasses. Gathering receipts and tracking deductions can be a real chore.

It can be partially deductible. For a physician with a marginal tax rate of 35%, a $1,000 deduction saves $350 in taxes where a $1,000 credit would save $1,000. Check your agi on line 37 of form 1040 schedule a.

Most of the deduction information is for those who live in the united states of america, and we cannot personally advise you about how to. Deductions are not nearly as useful as a tax credit, but there are a lot more of them. First, the food must be medically necessary and must cost more than the.

Limitations all medical expenses, including the air conditioner, must exceed 7.5 percent of your adjusted gross income to be deductible. While she was here, she mentioned that she recently replaced the flooring in her home. For example, if your agi is $25,000, your expenses must exceed $1,875 before they are allowed.

The irs does not permit you to take a deduction for food that is part of your regular nutritional needs.