The federal government has seven income tax brackets, ranging from the 10% marginal rate to 37%. Deductible employee expenses for special categories.

For tax year 2018 and on, unreimbursed employee expenses and home office.

Tax deductions for an employee. Deductible employee expenses for special categories. Appraisal fees for a casualty loss or charitable contribution casualty and theft losses from. The federal government has seven income tax brackets, ranging from the 10% marginal rate to 37%.

Here’s how you would deduct some of those payments: However, if the expenses meet the requirements under either: For tax year 2018 and on, unreimbursed employee expenses and home office.

The facts and circumstances test. 25,000 for payment of health insurance premium for self, spouse and dependent children. This included any home business.

The safe harbor test, or. You have at least one regular work location (other than your home) for the same trade or business. Ordinarily, if an employer pays for an employee’s local lodging expenses, the cost must be included in the employee’s compensation and the employee must pay tax on it.

More › 353 people used more info ›› Then the expenses qualify as a working condition. Claiming a tax deduction for workers� salaries, wages and super contributions as a business owner, you can generally claim a tax deduction for:

The salaries and wages you pay to employees super contributions you make on time to a complying super fund or retirement savings account (rsa) for your employees and for certain contractors. Fica taxes support social security and medicare. You can deduct amounts paid to employees for sickness and injury, but only amounts not covered by insurance or.

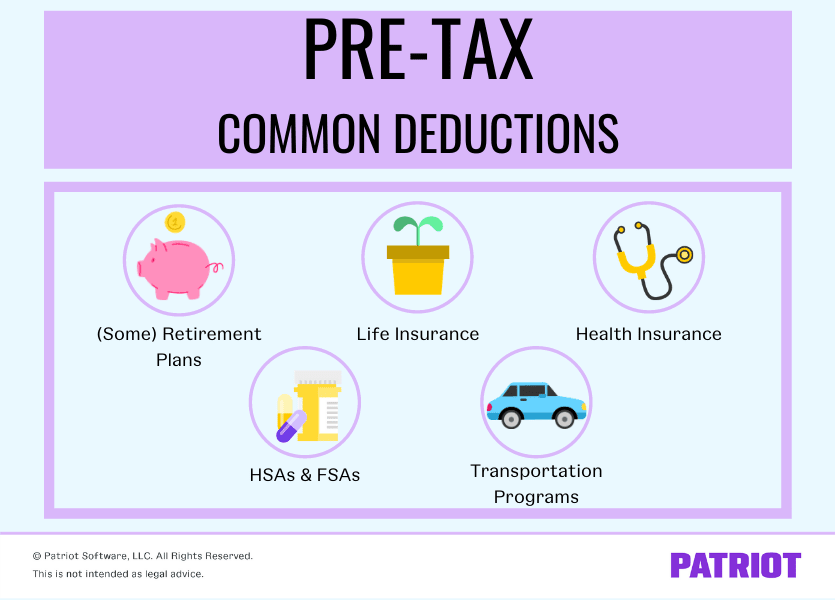

You can get deductions of up to rs. The $1,500 maximum for the simplified deduction. Pretax deductions may lower federal insurance contributions act.

To deduct workplace expenses, your total itemized deductions must exceed the standard deduction. The work location is outside the metropolitan area where you live and normally work. Section 80d is a popular option of an income tax deduction for salaried employees allowing deductions for health insurance premiums and other medical expenses.

Pretax deductions behoove employees and employers because they have the potential to reduce taxable income. Employers and employees can both reap substantial tax benefits when the employer provides or pays for employee meals. Employees pay social security tax at a rate of 6.2% with a.

Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. These withholdings constitute the difference between gross pay and net pay and may include: Payroll deductions are wages withheld from an employee�s total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance.

However, there are detailed rules about what meal expenses qualify for this favored tax treatment. You can deduct the cost of paying bonuses to employees if the bonus is for services rendered, and not a gift. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions, unless they are a qualified employee or an eligible educator.

You must also meet what’s called the 2% floor. that is, the total of the expenses you deduct must be greater than 2% of your adjusted gross income, and you can deduct only the expenses over that amount.