On december 20, president trump signed the consolidated appropriations act of 2019 ( h.r. It is called the domestic production activity deduction, or dpad, and it is not new, but has been around for many years.

Various ways to achieve deduction fully qualifying property partially qualifying property envelope hvac lighting interimlightingrule (permanent rule) interim lighting rule

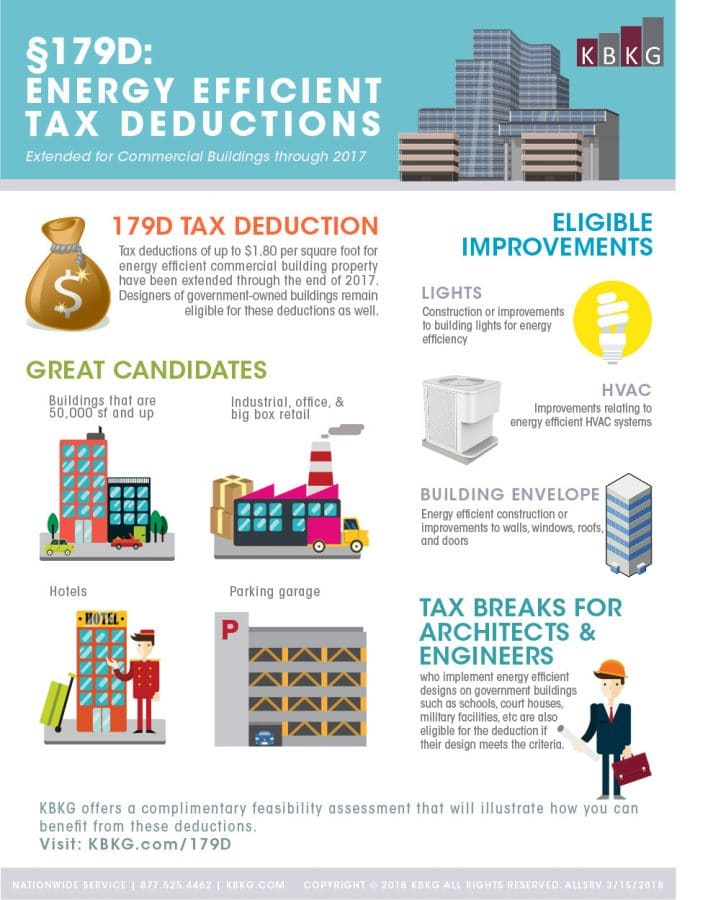

Tax deductions for architects. Aia partner engineered tax services explains how to secure your allocations. What industry are you in? Various ways to achieve deduction fully qualifying property partially qualifying property envelope hvac lighting interimlightingrule (permanent rule) interim lighting rule

At the end of construction, the architect requested and was granted an allocation of the full § 179d deduction by the government building owner. On december 20, president trump signed the consolidated appropriations act of 2019 ( h.r. If you work as an architect, some of the tax deductions you may be able to claim on your personal tax return are:

If your a&e firm has not looked into the 179d tax deduction, or previously did not qualify, you should evaluate design projects from 2021 through 2025 to determine eligibility. The original intent of the legislation was to benefit manufacturers who kept production in the u.s. We had a unit designed by an architect at a cost of around $15,000 which we built 2 years ago.

The deduction reduces the top effective rate on qbi income to 29.6% (which is 80% of the top 37% rate). Beginning january 2022, more a&e firms may qualify for the 179d energy efficient tax deduction with the expected passage of the reconciliation bill. Would you recommend architects take advantage of this reclassification?

Benefits originally awarded to architects through 179d epact have recently been extended through december 31, 2016. This deduction is designed to stimulate business activity and also promote productivity while on the job. But the truth is for architects, engineers and contractors there are significant tax breaks for being green.

Specialty tax for architects & engineers. The design, which was completed in 2020, included several energy efficiency measures in the school’s lighting, hvac systems, and the building envelope. Section 179d(a) allows a deduction to a taxpayer for part or all of the cost of energy efficient commercial building property that the taxpayer places in service after december 31, 2005, and before january 1, 2009.

Tax deductions checklist for architects in sydney. The good news is that if you are the owner or partner of an architectural or engineering firm, you may be eligible to take advantage of a beneficial 20% deduction in your. The phaseout of the qbi deduction is complete when the taxpayer’s taxable income exceeds $207,500 ($415,000).

It is called the domestic production activity deduction, or dpad, and it is not new, but has been around for many years. Through claiming a section 179d deduction, companies—taxpayers—can receive as much as $1.80 per square foot when making efficiency improvements above certain. For architects, engineers and contractors it provides a deduction of up to $1.80 per square foot for energy efficient design for government buildings—widely defined to.

The building qualified for the maximum § 179d deduction of $1.80 per square foot. (required) industry architecture engineering construction contracting other. To qualify for this tax deduction, the energy consumption of the building must be reduced by 50%.

Qualifying individuals can claim a deduction as much as $1.80 per square foot for the government buildings. The cost of buying mealswhen you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you have. What is the section 179d tax deduction?

This bill is notable for the architecture, construction, and engineering industries because it includes a long. Instead of sending it offshore. Some aec firms have leveraged the anticipated deduction to win public construction contracts.

For the first year we lived in it for the fhog, however we have now had it rented out for the past 8 months. Income exceeds $157,500 (or $315,000 if the taxpayer is married filing joint returns). The §179d deduction for architects and engineers created under the energy policy act (epact) of 2005 with the goal of incentivizing energy efficiency measures in commercial and public buildings, §179d of the federal tax code provides a deduction of up to $1.80 per square foot (indexed for inflation) for the installation of qualifying measures.

I just want to know whether we can claim the architect fees as a tax write off come tax time. In 2005, congress put in place section 179d. Complete the form below to estimate the deduction amount your company may be entitled to.

You must have spent the money yourself and weren’t reimbursed. 179d allows tax deductions of up to $1.80 per square foot on qualifying new or renovated commercial and multifamily projects for energy savings in interior lighting, building envelope, and hvac or hot water systems. Architects are able to take advantage of the 179d deduction for their work on the construction or renovation process of government buildings.