Wages to spouse (subject to ss/med tax) The percentage you write off depends on how much you use your car for business travel vs.

Both wages and benefits you provide employees are tax deductible, this includes:

Tax deductions for auto repair business. A person or business can immediately deduct repair and maintenance expenses if the cost is $2,500 or less per item or per invoice. Keep in mind that the section 179 deduction cannot exceed net taxable business income. You may deduct the cost of parts and depreciate the cost of tools if you fix the car yourself.

(do not include auto or truck) cell phone (business portion of use only) supplies: Vehicle expenses include insurance, gas, repairs, oil changes, and car washes. So if you are going to enter your vehicle repairs, you also.

Let’s say you spend $6,000 on your car. If a taxpayer uses the car for both business and personal purposes, the expenses must be split. Exact expenses range vary slightly based on the business but common expenses for auto mechanics include:

The deduction is based on the portion of mileage used for business. Wages to spouse (subject to ss/med tax) Commonly incurred deductions related to operating an auto racing business may include expenditures for supplies (gas, oil, tires and other spare parts), travel (airfare, lodging and meals), entrance fees, licensing, repairs, uniforms, research and development, merchandising production, advertising, administrative overhead and employee salaries,.

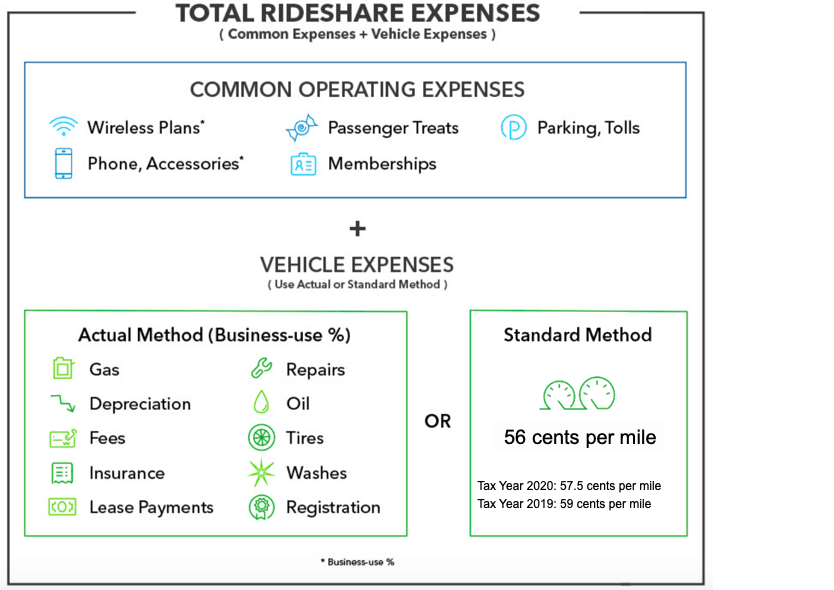

There are two methods for figuring car expenses: Maintaining a budget is a major foundation of businesses. In other words, all section 179 deductions for all business property for a year can�t be greater than $1 million.

The percentage you write off depends on how much you use your car for business travel vs. However, only certain individuals are eligible to claim a tax deduction related to car expenses. However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use.

To calculate the taxable portion of the deductible, use this formula: Taking legitimate auto repair shop tax deductions is one way to reduce the amount of income tax you must pay. (charges for parts ÷ total charges) × deductible = taxable portion of deductible.

If you do claim actual expenses, you should keep receipts to document what you spend on various costs. Note that you have an option to see whether the standard mileage deduction (which takes into account gas, repairs, maintenance, depreciation) for your vehicle is more than the actual expenses deduction on your return. The dollar amount is adjusted each year for inflation.

Certain deductions, such as charitable donations and unreimbursed medical expenses,. You can enter repairs for your business vehicle in turbotax following the steps below. In 2014, businesses can elect to expense (deduct immediately) the entire cost of most new equipment up to a maximum of $25,000 for the first $200,000 of property placed in service by dec.

Below are the reasons for getting an extended car warranty for your business vehicle. For more information and calculation examples, see publication 25, auto repair garages and service stations. Have been filed safety equip, masks, goggles, earplugs, etc.

The total amount you can take as section 179 deductions for most property (including vehicles) placed in service in a specific year can�t be more than $1 million. If you use your car only for business purposes, you may deduct its entire cost of ownership and operation (subject to limits discussed later). Business owners can take a tax deduction for the business use of their personal car.

Cleaning supplies, mops, towels, tarps, etc. You can deduct 30% of your expenses. 15,000 x $0.575 = $8,400.

An extended warranty helps with car repair payments. You can generally deduct actual auto expenses, including any necessary repairs and regular maintenance, or take a deduction based on the irs standard mileage rate. The irs automatically factors in car repair expenses when calculating the business mileage rate.

More simply, you can take a. You can generally figure the amount of your deductible car expense by using one of two methods: Supplies and incidentals tools and equipment repair advertising costs business bad debt employee compensation such as commission and bonuses rental expenses for property excise taxes legal fees

After gathering up all of his receipts, dave calculates that he spent $8,000 on his car, including gas and maintenance. A business with an applicable financial statement, however, has a safe harbor amount of $5,000. For tax year 2021, he can deduct $0.56/mile.

These deductions could be useful for businesses that rely on the heavy use of a vehicle every day, such as a tractor truck that hauls. A sudden car repair expense can be devastating to your business if you don’t have a reliable way to pay for it. You drive a total of 10,000 miles and 3,000 miles are for business.

Caring for it is a priority. Luckily, the cost associated with these licenses and permits is considered an expense and is eligible for auto repair shop tax deductions. Since 75% of the miles he drove were for work, he’ll be able to deduct 75% of those costs.

If you drive your car 50% of the time for business, you can deduct 50% of the cost if you drive your car 50 percent of the time for business, you can deduct 50 percent of the repair costs. Hsa and flexible spending accounts; This is up from $500, which was the threshold through december 31, 2015.

Both wages and benefits you provide employees are tax deductible, this includes: Follow the twists and turns of the car tax deduction with these five steps. Mileage expense to visit clients membership dues and professional subscriptions business licenses