British columbia tax and credits. The following are the federal tax rates for 2021 according to the canada revenue agency (cra):

![Updated For 2022] Homeowner's Guide To Bc Taxes: Property Tax, Empty Homes Tax & More | Liv.rent Blog](https://liv.rent/blog/wp-content/uploads/2019/05/2021-12-10_Empty-Homes-Tax-01-805x1024.png)

8 rows income tax calculator british columbia 2021.

Tax deductions for bc residents. Bc provides a home renovations tax credit for individuals 65 and older and people with disabilities. This is any monetary amount you receive as salary, wages, commissions, bonuses, tips, gratuities, and honoraria (payments given for professional services). Table of amounts and thresholds 2021 for the provincial, british columbia

Use our income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Or the lowest return airfare between the airport nearest to you, and the nearest designated city (vancouver, for bc residents.) if you claim the benefit,. 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 (2022) or $222,420 (2021) and 16.8% on the remaining amount.

If you make $52,000 a year living in the region of british columbia, canada, you will be taxed $13,446.that means that your net pay will be $38,554 per year, or $3,213 per month. The value of the taxable travel benefit from your employer; You can claim these deductions on your return using the northern residents deduction (t2222) form.

Farmers’ food donation tax credit : The maximum residency deduction is equal to 20% of your net income from line 236 of your tax return. Deductible expenses include transport, travel, meals, vehicle costs, and temporary living costs for up to 15 days.

Your average tax rate is 25.9% and your marginal tax rate is 33.8%.this marginal tax rate means that your immediate additional income will be taxed at this rate. British columbia tax and credits. Current bc personal tax rates in british columbia and federal tax rates are listed below and check.

Rrsp deduction is the most common deduction available to all taxpayers under 71 years of age. This tax calculator is used for income tax estimation.please use intuit turbotax if you want to fill your tax return and get tax rebate for previous year. Updated for the 2022/23 tax year, this illustration provides a tax return / tax refund calculation for a canadian resident, living in british columbia earning $30,000.00 per annum based on the 2022 british columbia tax tables.

Under this tax credit, renovations or alterations made to improve accessibility and safety can be claimed up to a limit of $10,000. The new standard amount you can write off per year is $1200. This salary example for british columbia was produced using standard tax return information for an employee earning $30,000.00 a year in british columbia.

• a residency deduction (step 2) for having lived in a prescribed€zone • a deduction for travel benefits (step 3) you received from employment in a prescribed zone that were included in your income This credit was implemented to encourage farmers to donate certain foods they produce in british columbia to registered charities like school meal programs or food banks. 15% on the first $49,020 of taxable income, and.

To qualify, all renovations must have been made to the homeowner’s principle residence. Note that these expenses are only deductible against income earned at the new location. How many tax credits are there?

Federal tax bracket rates for 2021. Including the net tax (income after tax) and the percentage of tax. The period reference is from january 1st 2016 to december 31 2016.

If you move to a prescribed zone near the end of the year, say december 1st, then you will not be able to claim the northern residents deduction when you file your tax return by april 30th in the following year. Note that these expenses are only deductible against income earned at the new location. Calculate the total income taxes of the british columbia residents for 2016.

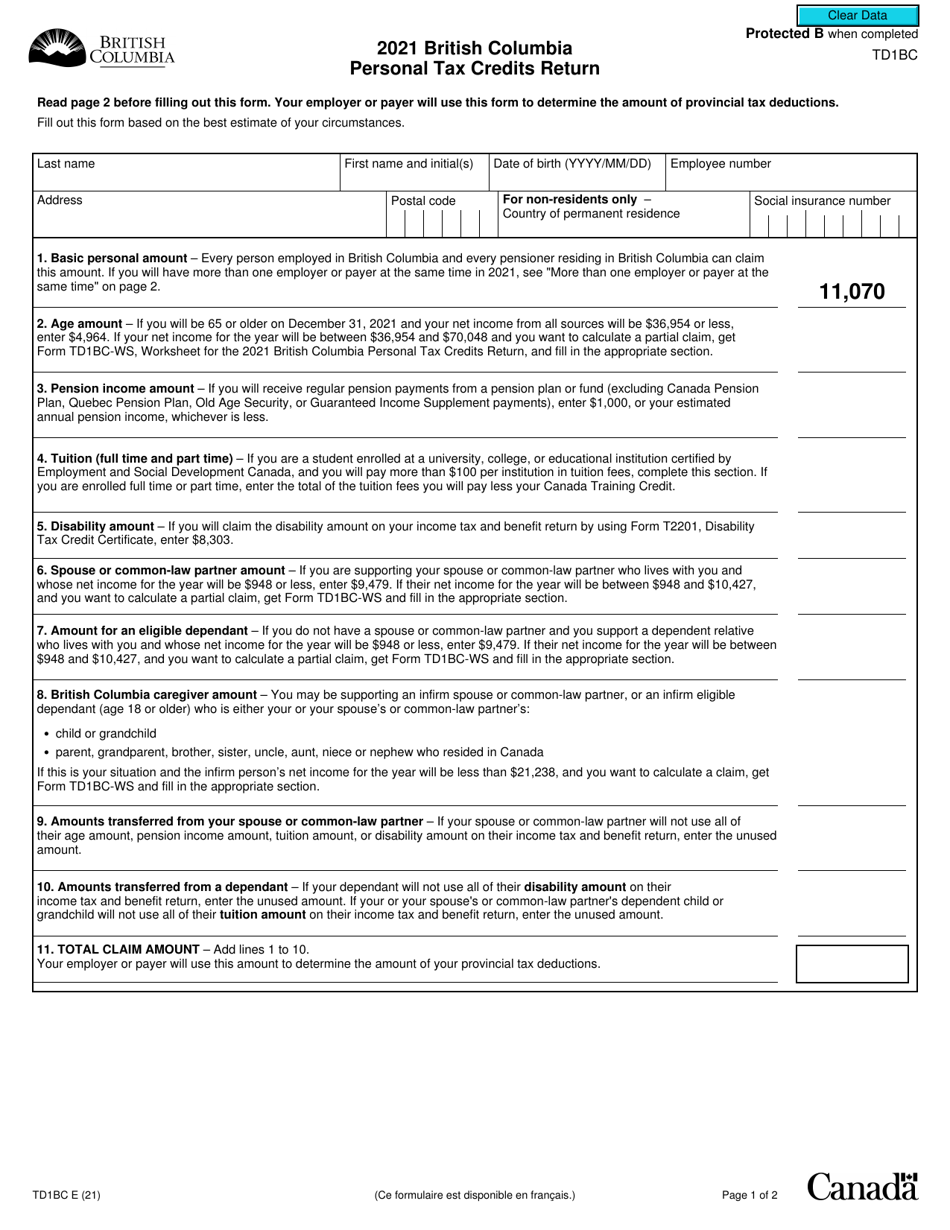

For more detailed information on the personal amounts, go to form td1bc, 2022 british columbia personal tax credits return. You (including temporary foreign workers) can contribute upto maximum of rrsp deduction limit as shown on your notice of assessment. These deductions are designed to help offset the additional costs of living in a remote area by lowering the amount of taxes you owe.

This therefore represents an additional declining amount of 1.457078%. 20.5% on the portion of taxable income over $49,020 up to $98,040 and. Cra tax information phone service.

This additional threshold is set at $ 13,229 for brackets ranging from 0 to $ 150,473. The following are the federal tax rates for 2021 according to the canada revenue agency (cra): 26% on the portion of taxable income over $98,040 up to $151,978 and.

8 rows income tax calculator british columbia 2021. There are 2 northern residents deductions: Do you like calcul conversion?

This includes moving after residency as well as for new placements within residency. A federal tax credit can be declared refundable, partially refundable or nonrefundable. This includes moving after residency as well as for new placements within residency.

For each trip, you can claim the lowest amount of; You can carry forward your contribution and. To take advantage of the laws regarding tax in british columbia, you should consult with a tax expert.

Deductible expenses include transport, travel, meals, vehicle costs, and temporary living costs for up to 15 days. Starting from this amount, the additional amount decreases to $ 12,298 at $ 214,368 in salary. The actual amount you spent on the trip;