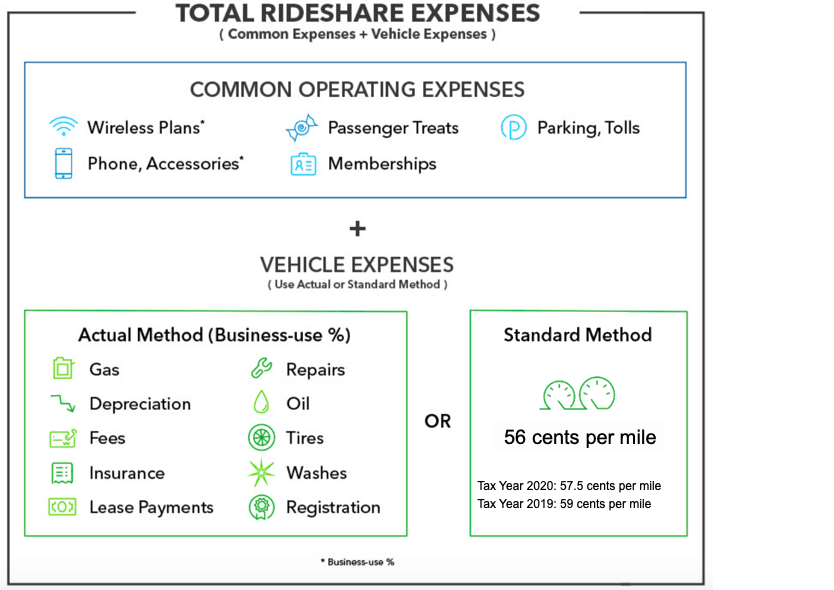

For miles driven in 2021, the standard mileage deduction is $0.56 per mile. When it comes to deducting general car expenses, the business owner has two options to choose from:

Make sure the car’s title.

Tax deductions for business car. 1 depreciation licenses gas oil tolls lease payments insurance garage. For tax year 2021, that. It has to be used for business at least 50% of the time.

For example, a pool cleaning business can deduct the purchase price of a new pickup truck that is used to get to and from customers� homes. You or your business leases or owns the car you can’t deduct a car you don’t own or lease. In 2021 and under irc § 168 (k), your business may have qualified for a federal income tax deduction up to 100% of the purchase price of a new nissan truck or van purchased and placed in service in 2021.

How to qualify for business car tax deductions 1. If your car use is mixed between business and personal reasons, you can only deduct costs that are related to the business usage of the vehicle. This includes a nissan titan and nv cargo van.

To calculate how much you can deduct for your personal car being driven for business purposes, multiply that amount times the number. So if you use your car for work 70% of the time, you can deduct 70% of the cost. With normal depreciation, you would take about a $10,000 deduction each year over 5 years.

To compute the deduction for business use of your car using the standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs. For tax year 2021, that amount is 56 cents per mile. Make sure the car’s title.

So, if adam drove 4,860 business miles in 2021, his deduction would be $2,721.60 (4,860 x $0.56). In the example above, the deduction turns out to be $2,800 (5,000 miles x $.56 = $2,800). Standard mileage rate more simply, you can.

For example, if you use a company car 60% of the time for your business, you can deduct 60% of your driving expenses for the year. Oil and gas tires licenses tolls and parking fees lease or rental payments registration fees and taxes vehicle loan interest insurance garage rent. Taxpayers looking to write off business use of car expenses will need meticulously kept records to provide to the irs.

Accelerated depreciation is extremely powerful because you could wipe out your taxable income and buy a car without paying any taxes on your income. Current irs mileage rates here is a list of the irs published mileage rates for 2020 and 2021: To qualify as a “heavy” vehicle, an suv, pickup or van must have a manufacturer’s gross vehicle weight rating (gvwr) above 6,000 pounds.

You can�t deduct more than the cost of the vehicle. For 2022, the rate is $.585 per mile driven for business use. The irs allows you to deduct the following actual car expenses:

To compute the deduction for business use of your car using standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs. As discussed earlier, you can deduct 50% of the cost of business meals. Qualifying vehicles must have had a gross vehicle weight rating of over 6,000 lbs.

If your business owns the vehicle, you can also deduct depreciation expenses, but only if you use the vehicle more than 50% of the time for business purposes. Registration fees and taxes gas and oil costs maintenance and repairs licenses vehicle insurance rental. In 2022, it is $0.585 per mile.

Multiply the miles driven for business during the year by a standard mileage rate. The majority of employees who use their car for work can’t claim an employee business expense deduction on schedule a of their tax return, as. Well with accelerated depreciation, you can take the $50,000 and accelerate the loss in the first year.

Multiply the number of business miles you drove by the current irs mileage rate (i.e. The vehicle must be new or new to you, meaning that you can buy a used vehicle if it is used first during the year you take the deduction. You can claim the mileage you use for business driving, either by deducting the actual miles traveled for business, or by using the standard mileage deduction of $0.56 per mile driven.

Employees who use their car for work can no longer take an employee business expense deduction as. The vehicle may not be used for transporting people or property for hire. When it comes to deducting general car expenses, the business owner has two options to choose from:

For amounts incurred or paid after 2017, no business deduction is allowed for any item generally considered to be entertainment, amusement, or recreation. Before the tax cuts and jobs. For miles driven in 2021, the standard mileage deduction is $0.56 per mile.

There are two methods for deducting vehicle expenses, and you can choose whichever one gives you a greater tax benefit.