You or your business can deduct any of the following: The amount that can be deducted in a year is subject to limits that depend on the type of donation and how you file your taxes.

It can donate supplies, money, or property to a recognized charity, but pay attention to the rules before you go crazy giving stuff away.

Tax deductions for business donations. Youth organizations are always looking for businesses to sponsor their teams. Then multiply $4,050 plus the withholding allowances. The contribution can be cash or property.

Let�s say you�re an attorney, and you provide legal services to a charity, he says. 21 hours agoif you made cash donations to eligible charities in 2021, you might qualify for a tax deduction. For the 2021 tax year, you can deduct up to $300 of cash.

You or your business can deduct any of the following: Donations of your time don’t count, and you can’t wipe out your business income with donations. Keep documents to prove donation legitimacy.

A breakdown is needed for charitable deductions or to claim a church deduction on federal taxes. Even if you donated in previous years, you could still be. All expenses related to business travel can be written off at tax time, including.

Referring to irs guidelines, donate to a local or national charity. Their cost is depreciated over time. Businesses can make tax deductible donations to bona fide nonprofit organizations.

The internal revenue service allows a person or business to claim federal tax deductions made from a church or other qualified charity. The section 179 deduction allows business owners to deduct up to $1,080,000 of property placed in service during the tax year. How to claim a charitable donation deduction.

Did your business donate to a charitable organization this year? During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. As a small business, you can deduct 50 percent of food and drink purchases that qualify.

Eligible individuals can deduct up to $300, and eligible couples can deduct up. Ad uncover business expenses you may not know about and keep more of the money you earn. It applies to cash donations of up to $300, or $600 if you’re married and filing jointly.

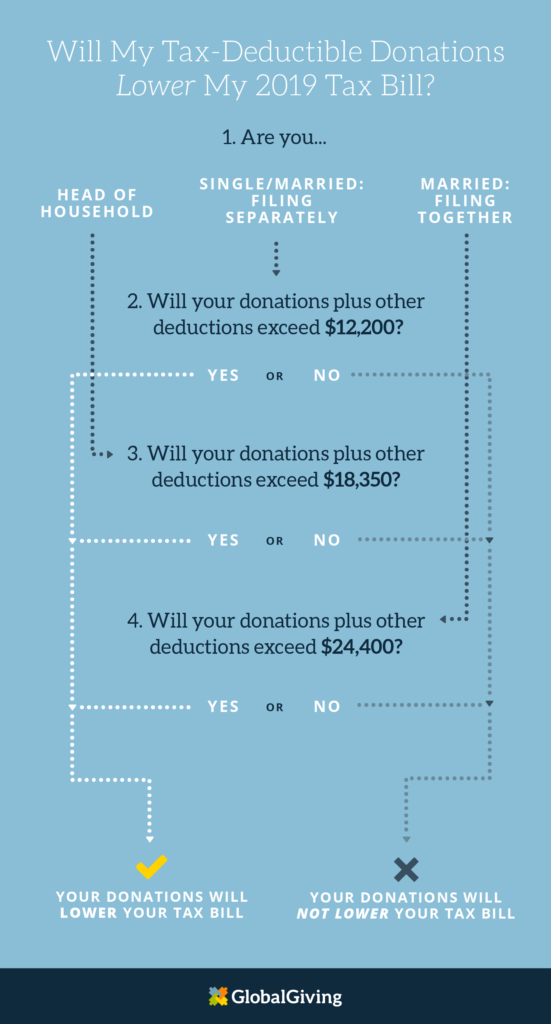

The answer depends on several factors such as how you are filing, other deductions, and what kinds of donations are being reported. Top 25 tax deductions for small business 1. The irs classifies business startup expenses as capital expenses because they are used for an extended.

For example, if you have $25,000 in taxable income this year and donate 60% of that, or $15,000, to charity, you will receive the deduction. Ways to donate to charity. Marketing costs travel costs training costs marketing costs travel costs training costs special considerations:

Volunteer as a company at a soup kitchen, charity run or. 2 hours agohelping business owners for over 15 years. However, the value of your or an employee�s time is not tax deductible, clarifies allec.

It can donate supplies, money, or property to a recognized charity, but pay attention to the rules before you go crazy giving stuff away. Yes, your small business can donate to charity and take a deduction for it. So now we will talk about tax deductions for church donations.

By multiplying the taxable gross wages based on your pay periods per year, you will calculate how much money you earn on each pay period. In fact, the only entity able to deduct a. Instead of a monetary donation, companies can donate their time to a great cause.

The section 179 deduction is limited to the business’s taxable income, so claiming it cannot create a net loss on your return. Unlike inventory, the basis for most items is $0, because the business already deducted the cost at the time of purchase. But you may be surprised to learn how it is deducted on your tax return.

The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. If so, you may be able to claim deductions if you donated to a qualifying organization. Therefore, the charitable deduction is limited to $0.

Office supplies and most small equipment fit this description. The amount that can be deducted in a year is subject to limits that depend on the type of donation and how you file your taxes. When you receive taxable income of less than $45,142, there is an.

The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable organizations. Normally, the maximum allowable deduction is limited to 10% of a corporation�s taxable income.