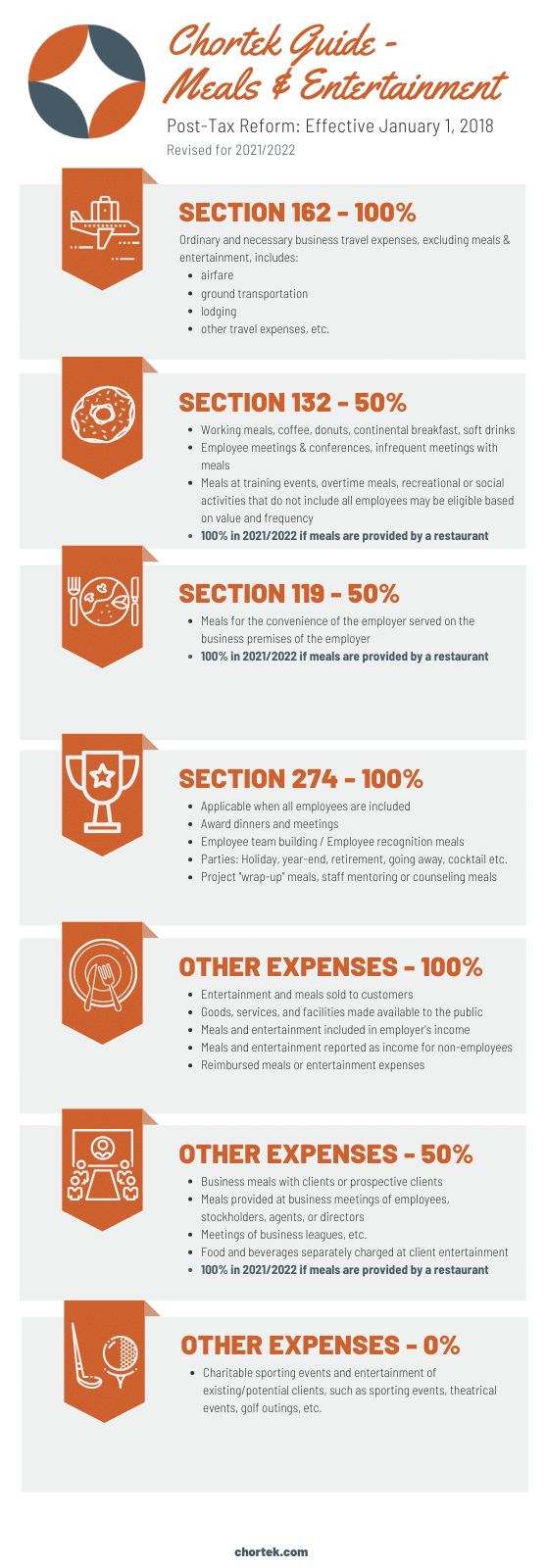

Throughout 2021 and 2022 they are a 100% deduction. Flagship, and all the ports of.

Call it marketing, call it a business meeting or whatever but really if it smells and feels like.

Tax deductions for business meetings. This little tax tip i’m about to share will let you write off an extra $14,000/year for your business while putting the money in your pocket tax free. Since 1909, business entertainment expenses have been at least partly tax deductible. At this time of year, you are.

You can rent your home to your business for business meetings! It’s tax deductible, in that case, and you may claim desks your. 50% deductible (100% if purchased from a restaurant) office snacks and meals.

The deduction for business meals is generally limited to 50% of the unreimbursed cost. It used to be that meals and entertainment were a 50% deduction on your taxes. Call it marketing, call it a business meeting or whatever but really if it smells and feels like.

Top 10 tax deductions for your small business 1. For example, you paid for lunch to. Throughout 2021 and 2022 they are a 100% deduction.

Ad participating companies are eligible to receive significant tax breaks & cash grants. The irs allows certain deductions for starting a new business. As for travel outside north america for a business convention or other meeting, it’s deductible if the convention is directly related to your business and there’s a good reason for it.

Discover the right location, the best talent, & all of the incentives available to you. Ad participating companies are eligible to receive significant tax breaks & cash grants. You cannot deduct startup costs.

This even goes beyond the standard home office deduction found in the irc 280a tax code. Keep in mind that the business must take off in order to write off its expenses. Furniture this past year, did you purchase furniture?

Starting with the carter administration, only 50% of business meals and. Per the irs audit manual, “board meetings between husband and wife are not ordinary and necessary business. On these facts, smith has spent a total of five days on business, including the three days in meetings and the two days traveling.

7 surprising tax deductions that can save your business thousands. Flagship, and all the ports of. 50% deductible (100% if purchased from a.

Discover the right location, the best talent, & all of the incentives available to you. Well, according to the irs audit manual, the answer is no. Generally there is no tax deduction for the provision of entertainment!

Business meals are deductible business expenses, and most meals are deductible at 50%, but entertainment expenses are not deductible as a business tax expense. In order for a taxpayer to deduct the cost of attending a convention related to his or her trade or business on a cruise ship, the ship must be a u.s. If you’re going to meals to discuss.

2021 tax deductions for business travel. The calculation is the number of square feet for your business space times $5 per square foot. 3 a business space of 100 square feet, for instance, would mean a deduction of.