Limits limit based on credit rate. With a first home, the points can be deducted in the year you buy the home.

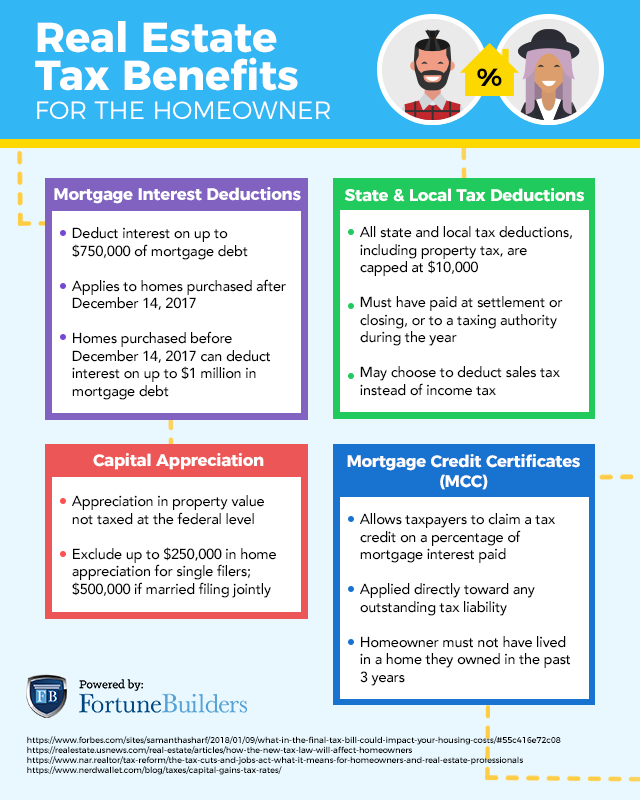

For tax year prior to 2018, you can deduct interest on up to $1 million of debt used to acquire or improve your home.

Tax deductions for buying a home. For tax year prior to 2018, you can deduct interest on up to $1 million of debt used to acquire or improve your home. But, depending on your unique situation, itemizing may be the best choice for you. Other than deductions for homeowners, some of the most common itemized tax deductions include:

These are taxes the seller had already paid before you took ownership. $12,550 for single filers and. Another home buying tax deduction is apportioned mortgage interest.

You won�t get a 1098 report listing these taxes. For most people, the biggest tax break from owning a home comes from deducting mortgage interest. Building entrance and exit ramps.

If the amount you borrow to buy your home exceeds $750,000 (or $1 million for mortgages originated before december 15, 2017), the number of deductible points is typically limited. With a first home, the points can be deducted in the year you buy the home. Here are the most common deductions:

Limit on deduction form 1098. Typically, the irs allows homeowners to deduct the full amount of their mortgage points in the same year that homeowners pay them. If you paid $3,000 for points, you could deduct the entire amount in the tax year you bought the home.

The following can be eligible for a tax deduction: Limits limit based on credit rate. For many taxpayers, the new standard deductions are greater than itemized deductions.

Medical care home improvements with a tax deduction: Answer simple questions about your life and we do the rest. You can lower your taxable.

Figuring the credit mortgage not more than certified indebtedness. 8 tax breaks for homeowners. In 2021, single heads of households will be able to deduct $18,880, while married couples filing jointly will be able to deduct $25,100.

(startup stock photos / pexels) mortgage interest deduction. For tax years after 2017, the limit is reduced to $750,000 of debt for binding contracts or loans originated after december 16, 2017. This rule applies if you’re a sole proprietor and use your car for business and personal reasons.

If you finance a car or buy one, you are not eligible to deduct your monthly expenses on your federal taxes. Reducing your home mortgage interest deduction. Mortgage interest credit who qualifies.

If you have a mortgage on your home, you can take advantage of the mortgage interest deduction. You do not need to itemize to claim the tuition and fees deduction. State or local income taxes and sales taxes charitable donations medical and dental costs that aren’t reimbursed

There are several tax benefits of buying a home you should know about. Two major incentives are the mortgage interest and property tax deductions. Tax deductions for homeowners most of the favorable tax treatment that comes from owning a home is in the form of deductions.

For additional tax information for homeowners, please see irs publication 530. Under the proposed bill, eligible homebuyers could receive a tax credit of up to 10% of their home’s purchase price, up to $15,000. This amount of prorated mortgage interest can be written off.

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are mortgage interest and certain real estate (property) taxes. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. Don’t forget to include any taxes you may have reimbursed the seller for.

These can be deducted in the year you buy your home if you itemize your deductions. $25,100 for married couples filing jointly, up $300 from the 2020 tax year. How to claim the credit.

What home improvements are tax deductible 2021? Schedule 1 and form 8917, tuition and fees deduction. To claim the deduction, you need to complete two tax forms:

Ad turbotax® makes it easy to get your taxes done right. 8 tax benefits of buying a home in 2021 | lendingtree there are several tax benefits of buying a home you should know about. If you buy at the.

The first tax benefit you receive when you buy a home is the mortgage interest deduction, meaning you can deduct the interest you pay on your mortgage every year from the taxes you owe on loans up to $750,000 as a married couple filing jointly or $350,000 as a single person. The standard deduction for the 2021 tax year is: Although eligibility requirements could change before the bill is signed into law, the current requirements are:

Two major incentives are the mortgage interest and property tax deductions. Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before dec. Mortgage more than certified indebtedness.

Instead, that amount will be shown on the settlement sheet. For a second home, the points payment may still be deducted, but irs rules state that the deduction must be spread out over the life of the loan.