5 other legitimate tax deductions for rv owners. Rv tax deductions can include:

However, that doesn’t mean there aren’t a few rv tax deductions available to those who rv.

Tax deductions for buying an rv. Rv tax deductions can include: Answer simple questions about your life and we do the rest. Background michele and dan harkins bought a weekend warrior toy hauler rv from the rv factory in june 2016.

Any potential tax benefits just are not going to be worth it. Taxpayers can claim both deductions on schedule a, itemized deductions. For others, things can get much more complex, especially if you, like so many rvers out there, run an online business.

You may also write off the cost of rv sales tax in lieu of deducting state income tax. Even if your rv is only utilized for a few days a year, you may still apply this advice if it is your permanent residence. So you can take more trips and more tailgates!

Apparently, the government doesn’t see the point in moving your second home to new locations. The benefit of treating a boat or rv as your primary residence, is to take allowable homeowner tax deductions that can decrease your overall tax bill. 5 other legitimate tax deductions for rv owners.

Although the rules have changed, state and local sales taxes paid on an rv may be deducted up to $10,000. Common deductions for campgrounds are updating electrical hookups, maintenance equipment, advertising costs, and many other expenses your campground accrues. You don’t get a tax deduction for buying an rv as a second home, any more than you would get a tax deduction for buying your main home.

The point of all these tax breaks isn’t to give people who can afford an rv special treatment. That�s a fairly large deduction that, despite the loss of the $4,000 personal exemption, minimizes the. You don�t get a tax deduction for buying an rv as a second home, any more than you would get a tax deduction for buying your main home.

If you financed your rv, you might be able to take the interest as a mortgage interest deduction. If you purchased your rv outright, you’ll have the opportunity to claim a deduction for the sales tax you paid on it. As long as the boat or rv is security for the loan used to buy it, you can deduct mortgage interest paid on that loan.

An rv or motorhome qualifies as a second home if it contains a kitchen, toilet and sleeping area. Can you deduct rv expenses? One of the ways your rv or motorhome may constitute a tax deduction is if you’re requesting a home mortgage interest deduction.

Tax season is upon us, and that means it’s time to pull out the paperwork and start crunching numbers. Rvs are almost always depreciating assets and expensive to maintain. Here are 5 more rv tax deductions that you can take as an rv owner:

However, that doesn’t mean there aren’t a few rv tax deductions available to those who rv. However, after you buy, do take advantage of all the tax deductions and benefits to make an rv more affordable. Dear craig, expenses incurred for the purpose of gaining or producing income can generally be deducted from that income in calculating the net income or loss for income tax purposes.

Local and state property tax deductions. Homeowner tax deductions if you claim your rv as your home. This deduction is the government’s way of helping you reduce your tax burden by giving you a break.

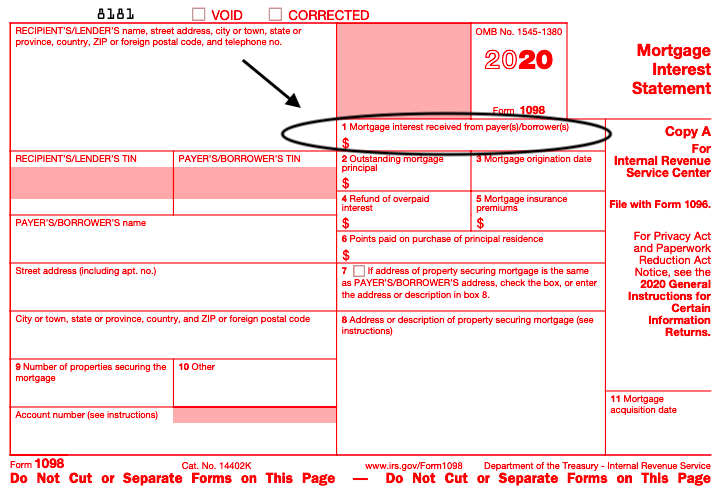

You do not have to have your rv in one location for it to be. These 2 areas of deduction are in the “your home” section on a 1098 form (for the interest) and in the “cars and other things you own” section (for property taxes). This would include certain expenses incurred to produce income if.

The primary tax deduction is the mortgage interest deduction. Ad turbotax® makes it easy to get your taxes done right. Don’t buy an rv for the tax deductions!

After tax reform was implemented for 2018, that standard deduction rose to $12,000 for singles and $24,000 for married couples filing jointly. First things first, don’t buy an rv for a tax deduction. For some, this is a simple matter of entering the info on a w2.

Rv tax benefits explained sales tax deduction. Rather, they exist to help everyone in similar situations. Instead, look at it as a lifestyle choice.

Rv tax information all full timers should have. What’s included in itemized deductions? The primary tax deduction is the mortgage interest deduction.

Rv tax deductions home mortgage interest deduction. If you live in a state that charges property tax for vehicles, you may qualify. Available deductions include any interest on an rv loan and property taxes.

This is available in most states for the tax year the rv was purchased. Deductions essentially reduce the amount of taxable income you make, therefore reducing your tax payable at the end of the year. The sales tax you paid on your rv purchase.

Business deductions for the use an rv taken on the returns of a corporate entity owned by the taxpayers were found to be evidence that the taxpayers had used the rv for commercial purposes, voiding a warranty on therv. When you own an rv primarily for private use, but rent it out sometimes 5 other legitimate tax deductions for rv owners. If your rv meets the internal revenue service qualifications for a first or second home, you may deduct any mortgage interest and points you purchased to finance the rv.