The contribution limits for traditional and cash balance defined benefit plans are the same, so the figures above also provide a cash balance plan calculation. It allows a business owner to contribute significantly higher amounts to their own retirement and get tax deductions for the plan year.

Like all qualified retirement plans, assets are protected from creditors.

Tax deductions for cash balance plans. A cash balance plan can help business owners to accelerate their retirement savings and realize significant annual tax deductions, primarily because the annual contribution limits for a cash balance plan are higher than a 401 (k) profit sharing plan. 21 rows cash balance plan maximizes tax deductions for law firm partners. As long as the company contribution to the dc plan remains at or below 6% of pay, robert smith, inc.

It allows a business owner to contribute significantly higher amounts to their own retirement and get tax deductions for the plan year. Based on the owner’s age and compensation, the annual deductible contribution for an owner can be as high as $245,000 a year. Shopping for 401k plans for your business how to hack a 6 figure tax deduction using a cash balance plan exposed:

A cash balance plan is a type of defined benefit plan that allows an owner to determine the business�s deduction and his or her own ability to defer income. The employer decides the amount or percent of contribution for the owners. Like all qualified retirement plans, assets are protected from creditors.

Instead, if the total company contributions to both plans exceed 31% of eligible plan compensation, the portion going to the dc plan is capped at 6% of eligible plan compensation. On september 3, 1993, the u.s. This could be $20,000 to the db and $10,000 to the dc, or $5,000 to the db and $25,000 to the dc, whatever, so long as the total deduction is $30,000 or less and neither of the individual plan limits is violated.

Cash balance plan combines the characteristics of a traditionally defined benefit pension plan and a defined contribution plan. How do cash balance plans work? The age of a business owner has a high impact on the contribution limit you can make into your.

Accelerate savings, maximize tax deductions cash balance plans are a great design for employers seeking to fund much larger contributions than permitted under a 401k and profit sharing plan. Cash balance plans are structured differently from traditional defined benefit plans, and which design you use depends on your objectives. Department of the treasury issued final.

It allows a business owner to contribute significantly higher amounts to their own retirement and get tax deductions for the plan year. The contribution limits for traditional and cash balance defined benefit plans are the same, so the figures above also provide a cash balance plan calculation. 42 rows for business owners, cash balance plan contributions allow you to have the highest savings and tax deductions in a year.

The nation’s first cash balance plan was introduced of bank of america in 1985 and the pension protection act (ppa) of 2006 affirmed the legality of cash balance plans and made the plans. A cash balance plan is the most popular type of defined benefit plan. This law firm wanted to.

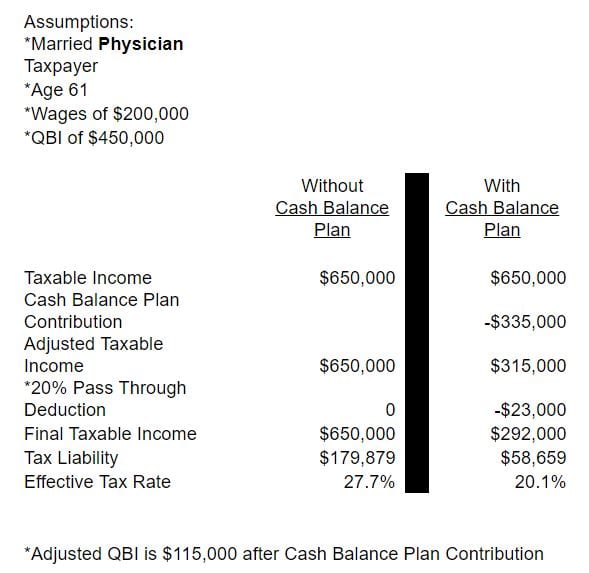

The cash balance plan allows for a greater contribution limit than 401(k) / profit sharing plans (up to $336,000, depending on age, instead of $63,500 for those age 50 and older in 2020 for a 401(k) plan), and hence, providing a greater tax deduction to the business owner. Like all qualified retirement plans, assets are protected from creditors. Using a plan under section 199 for a 20% deduction however, the tax effect of a cash balance plan is on general business income and not at.

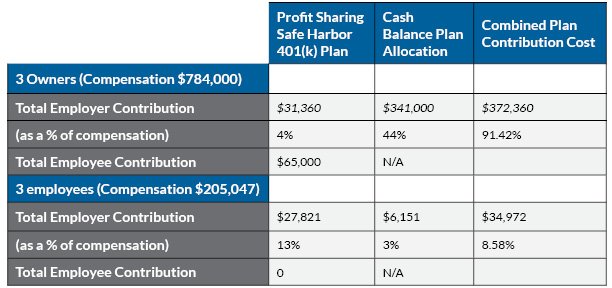

Cash balance plan illustration (provides the highest contributions and tax deductions for companies with employees) the contributions for cash balance plans are calculated based on the employees’ ages, compensation, and employee classes as established by the employer. Like all qualified retirement plans, assets are protected from creditors. Payroll company�s excessive costs as a 401k provider

These plans offer much greater flexibility than traditional defined benefit plans, which have more rigid requirements. Any amount paid under the plans in any taxable year in excess of the limitation of subparagraph (a) shall be deductible in the succeeding taxable years in order of time, but the amount so deductible under this subparagraph in any 1 such succeeding taxable year together with the amount allowable under subparagraph (a) shall not exceed 25 percent. After cash balance plan* qbi:

Can deduct the full maximum db contribution regardless of what percentage. A cash balance plan may be a good if: