Simply select the types of clothing, household and/or electronics items donated, and instantly see how that translates into hours of programs and services provided to people in the community. Keep in mind that you must itemize your deductions in order to gain a tax benefit.

To determine the fair market value of an item not on this list below, use this.

Tax deductions for charitable donations calculator. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. The organization must give you a written acknowledgement. Donation value guide for 2021.

We got the data from lists at websites of charities. You may be surprised to learn that you can afford to be even more generous than you thought. Charitable donation tax credit calculator use this tool to calculate your charitable donation tax credit.

Keep in mind that you must itemize your deductions in order to gain a tax benefit. One should prepare a list for each separate entity and date donations are made. If you’re calculating if a deduction.

21 hours agodon�t miss this charitable donation tax deduction worth up to $300 per individual. How to claim charitable donations when you file your tax return. Simply select the types of clothing, household and/or electronics items donated, and instantly see how that translates into hours of programs and services provided to people in the community.

Turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. When you donate cash to a public charity, you can generally deduct.

Key points if you made cash donations to eligible charities in. How the charitable contributions deduction works. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

Charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual�s income. $2.00 $7.00 2.00 $12.00 $0.00 $5.00 $10.00 2.00 $15.00 $0. Donations made to a qualified charity are deductible for taxpayers who itemize their deductions, within certain limitations.typically for cash contributions made between 2018 and 2025, the amount that can be deducted is limited to no more than 60% of the taxpayer’s adjusted gross income (agi).

Lance leads a team responsible for creating educational content that guides people through the pivotal. 14 rows discover the impact a charitable donation can have on your taxes. The charitable tax deduction is a powerful tool for saving on your taxes, but it may require some additional strategy to maximize your savings.

Your vehicle donation will be used to help rehabilitate men and women in our adult rehabilitation centers and will result in a tax deduction in accordance with irs rules. In allowing this, the united states incentivizes charitable giving by letting the donor to write charity off on their taxes. Specifically, look below to see a list of charity sites we used for values as well as a link to the source website.

The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. Donation calculator & tax guide donation calculator the donation impact calculator is a great way to see how your donations support your goodwill’s programs and services. With the reduction of many federal tax deductions, charitable giving is one of the only levers you can easily adjust to surpass the standard deduction and increase your tax savings.

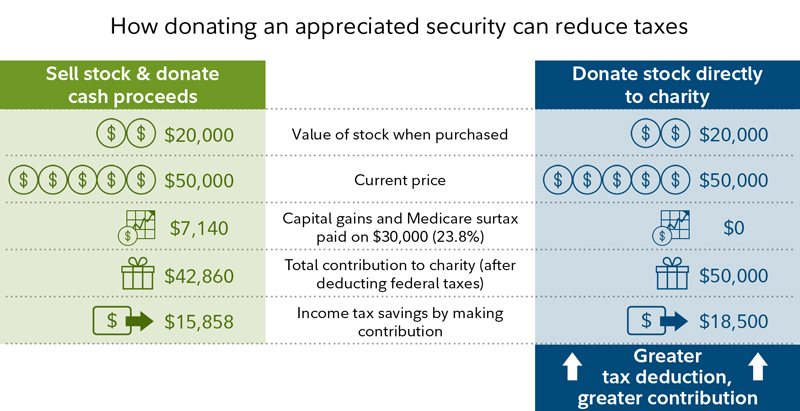

During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. Make sure that when itemized, your total deductions are greater than your standard deduction. Donate securities, eliminate the capital gains tax and get a larger tax credit

Get the most from your charitable contributions anytime. Lance davis is the senior editorial director for bankrate. Calculate how much you can claim with our charitable tax credit calculator below.

Then we placed a short code in the source column for each donation item. For example, we coded salvation army as “sa”. This will reduce taxes in the tax year the donation was made.

All charitable contribution calculators & tools. Estimate the potential federal income tax deduction of donating to charity appreciated securities held longer than one year. In the first section, calculate your federal and provincial or territorial tax credit.

To determine the fair market value of an item not on this list below, use this. Charitable contributions to qualified organizations may be deductible if you itemize deductions on form 1040, schedule a, itemized deductions pdf.to see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. The calculator will display the net cost of the donation and the tax savings.

What�s the maximum amount i can claim as a charitable tax deduction on my taxes? Use this interactive tool to see how charitable giving can help you save on taxes—and how accelerating your giving with the bunching strategy may help save even more.