Charitable remainder trust income tax deduction. Computing the charitable tax deduction for a charitable remainder trust charitable deduction for a crat.

Looking at the last example, you’re contributing stock valued at $100,000 into a crat.

Tax deductions for charitable remainder trust. The income tax deduction is usually limited to 30 percent of adjusted gross income, but it can vary from 20 percent to 60 percent, depending on how the irs defines the charity and the type of asset. Looking at the last example, you’re contributing stock valued at $100,000 into a crat. Basic rules all crts share the following characteristics:

A trust can deduct up to 100% of its net income for the year. The rules for calculating the present value of the remainder interest in a crat are. The value of the remainder interest for income tax deduction purposes is based on two factors.

(4) the person funding the trust (the settlor) is entitled to claim an income tax deduction in the tax year that the crt is funded. Charitable remainder unitrusts (cruts) can be beneficial in certain instances. A charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the crt’s assets that will pass to charitable beneficiaries.

A charitable trust is treated as a private. Description & operation the use of a crt is generally appropriate when a donor has the desire to: Crts can be structured to defer the payment stream and provide an effective.

Total contribution to the charitable remainder trust account: So how do you get a tax deduction for transferring assets to a crt? Computing the charitable tax deduction for a charitable remainder trust charitable deduction for a crat.

Charitable remainder trust income tax deduction. If the charitable remainder trust (crt) is funded with cash, the donor can use a charitable deduction of up to 60% of adjusted gross income (agi); To summarize the example above:

If you cannot use the full deduction the first year, you can carry it forward for up to five additional years. Charitable deductions from a trust must be traceable to trust income. The rules for calculating the value of.

At the end of the specified term, the remaining trust assets pass to a designated charity. Donate cash or appreciated property to the trust. This amount is locked in and is not based on a percentage of assets.

A charitable trust described in internal revenue code section 4947 (a) (1) is a trust that is not tax exempt, all of the unexpired interests of which are devoted to one or more charitable purposes, and for which a charitable contribution deduction was allowed under a specific section of the internal revenue code. Charitable deduction for a crut. As noted above, estates and some older trusts may be eligible for an expanded charitable deduction for amounts permanently set aside for charity.

The trustee(s) calculate the payment amount by multiplying the designated You can take an income tax deduction, spread over five years, for the value of your gift to the charity. The amount will be recalculated each year and the lead beneficiaries receive larger payments that year if the crut’s rate of return exceeds the fixed percentage payout, and smaller payments that year if the crut’s rate of return is less than the fixed percentage payout.

Because you are ultimately donating the remaining assets to charity, you can take a charitable deduction (assuming you itemize) in the year that you fund the trust based on what is expected to remain at the end of the trust’s term. 9, 1969, unless they are from an estate that meets the exceptions stated in. Charitable unitrust remainder trust & tax incentives.

However, if appreciated assets are used to fund the trust, up to 30% of their agi may be deducted in the current tax year. Because a charitable remainder unitrust is exempt from federal income tax (the income and gains of the trust are only taxed when they are distributed to the noncharitable beneficiaries as part of the fixed percentage of trust assets distributed each year), they are frequently used to defer income tax on gains about to be realized. Another gift that generates annual income is the charitable remainder trust.

If a donor decides to. A charitable remainder unitrust (crut) pays out a fixed percentage of the trust value each year. Amount going to granddaughter = $500,000 (before income taxes paid by daughter) amount going to tiger university = around $500,000 depending on investment returns inside the charitable remainder.

8 rows trust withdrawal rate. This is the amount of value that you plan on withdrawing from the trust. The income tax deduction equals the value of the trust’s remainder interest at the time the crt is funded.

This is due to the 10 percent remainder requirement which requires the charity or charities must be projected to receive, on an actuarial basis, at least 10 percent of the value of the initial gift to the crt. Where things get tricky is. What is a charitable remainder annuity trust (crat) unlike cruts, charitable remainder annuity trusts will pay out a fixed dollar amount every year.

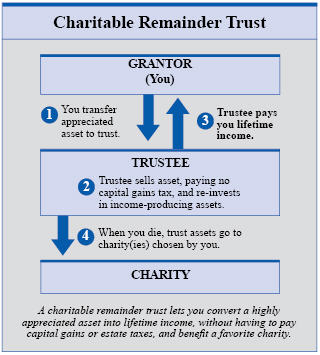

A charitable unitrust remainder trust (“crut” or “trust”) is an irrevocable agreement that will provide an income stream to the donor or a named beneficiary for life or a term of years. Convert appreciated assets into income with a charitable remainder trust (crt) convert appreciated assets into a lifetime or retirement income stream.