1.22 subsection 63 (1) provides that an amount paid as, or on account of, child care expenses incurred for services rendered in a tax year for an eligible child may be deducted: If your child is under 13 years of age or a disabled dependent, you can claim a tax credit of up to 35% of your qualifying expenses.

The dependent care expense page is used to record information about dependent child care expenses.

Tax deductions for child care expenses. If you think you qualify for the child care tax credit or. For tax year 2020, the maximum amount of care expenses you�re allowed to claim is $3,000 for one person, or $6,000 for two or more people. Up to $8,000 for two or more children/dependents.

How are child care expenses entered as a deduction? The american rescue plan act of 2021, was enacted on march 11, 2021, making the child and dependent care credit substantially more generous and potentially refundable (up to $4,000 for one qualifying person and $8,000 for two or more qualifying persons) only for the tax year. The maximum limit you can claim is 35% of your expenses up to $3,000 for one child.

Answer simple questions about your life and we do the rest. The credit is available for expenses paid for the care of a qualifying child or dependent. You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn�t able to care for himself or herself.

The percentage of your qualified expenses that you can claim ranges from 20% to 35%. In fact, it is easy to assume that you can write off your child care deductions for the entire year. It’s a job which often requires further upskilling and training to ensure you meet all necessary industry requirements.

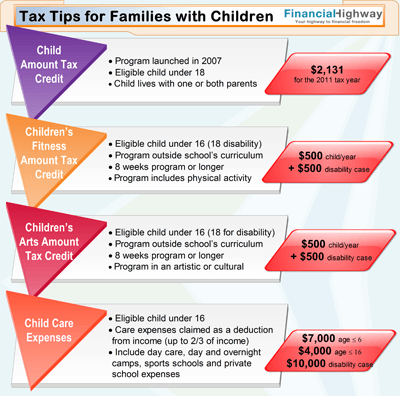

If your child is under 13 years of age or a disabled dependent, you can claim a tax credit of up to 35% of your qualifying expenses. As a result of the american rescue plan act or arpa, the child tax credit for tax year 2021 can be worth from $3,000 to $3,600 per qualified child, depending on the age of the child (ren) and your total income. Training is a common tax deduction for child care workers.

If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age, you may qualify for a tax credit of up to 35 percent of qualifying expenses of $3,000 ($1,050) for one child or dependent, or up to $6,000 ($2,100) for two or more children or dependents for tax year 2020,. Information about medical or hospital care, educational expenses, reimbursements, and more. What payments can you not claim?

If your income at least $15,000 for the year, you can deduct 35 percent of your child care or babysitting expenses from your taxes. Table of contents [ show] Find out how to calculate your allowable child care expenses deduction.

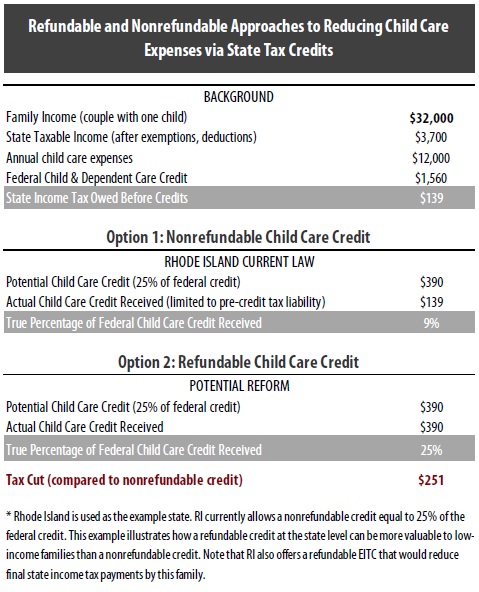

The child and dependent care credit is a tax credit that can be used to reduce your federal income tax. No, there are no tax deductions available for child care for individuals—just a credit. To qualify, you must pay.

To enter a child care expense on the dependent care expense page, complete the following fields: Subtract any portion of that amount that will be a reimbursement. Child and dependent care tax credit if you were eligible for a child and dependent care credit on your federal income tax return, form 1040 or 1040a for the tax year, you may be entitled to a credit on your maryland state income tax return.

50% of all qualifying expenses up to a maximum of $4,000 for one child/dependent. To determine the childcare deduction: 1.22 subsection 63 (1) provides that an amount paid as, or on account of, child care expenses incurred for services rendered in a tax year for an eligible child may be deducted:

However, if your income is $43,000 or above for the year, you can only deduct 20 percent of your child care costs when you file your income tax return. To learn more, read about the top five common tax credits. If you paid for a babysitter, a summer camp, or any care provider for a disabled child of any age or a child under the age of 13, you could claim a tax credit of either:

A qualifying expense is a care provider like a daycare center, summer camp, or babysitter. If you pay for daycare so that you can work (or look for work), you may be able to take advantage of the child and dependent care credit; The credit can be up to 35% of your expenses.

While this tax credit is designed to help you recoup some of what you have paid in toward daycare or babysitting services throughout the year, there is a limit to how much you can claim on your tax return. As long as the course relates directly to your current job, the fees and related expenses are usually tax deductible. However, you might qualify for other credits or deductions.

Child care expense deduction limits. Ad turbotax® makes it easy to get your taxes done right. Information about child care services, receipts, and more.

The dependent care expense page is used to record information about dependent child care expenses. If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age, you may qualify for a tax credit of up to 35 percent of qualifying expenses of $3,000 ($1,050) for one child or dependent, or up to $6,000 ($2,100) for two or. However, this only applies if the organization or agency who placed the child with you can receive charitable donations.if they cannot accept the donations, any.

Qualified expenses for the child and dependent care credit. Only by the taxpayer, when there is no supporting person (for example, where a taxpayer lives alone with the eligible child throughout the year); Identify the anticipated, reasonable childcare costs for children under age 13 (including foster children) that will allow a household member to work or pursue an education.

Questions and answers about child care expenses. To qualify, the child or dependent must have been under the age of 13 when the care was provided.