Here are some examples of work attire that can be deducted: Giving back to your community is one of the more fulfilling things you can do in your life.

If you are running a business that requires protective clothing, you can deduct the cost of these items.

Tax deductions for clothing. Cost or selling price of the donated property. Taxpayers can claim a deduction on donated clothes as long as the items are in good condition or better. Fair market value is the price a willing buyer would pay for them.

How to use work clothes as a tax deduction step 1: Tax deductions for boutique owners. Determine which work clothes are necessary for your.

If you are running a business that requires protective clothing, you can deduct the cost of these items. It includes low and high estimates. If that wasn’t enough, there are other reasons to donate your old items as well.

Tax deductions for clothing qualifying organizations. 2 donate items in good condition only. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their state and/or federal taxes.

If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions. Please choose a value within this range that reflects your item�s relative age and quality. Any donated household item must be new or used but in good condition and as mentioned above, there is no fixed method for determining the value of these donated items.

How to itemize clothing donations for taxes. For example, a pilot was able to. Here are some examples of work attire that can be deducted:

In order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” an ordinary expense is one which is customary in your particular line of work. The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs. Get clothing donation tax deduction pdf signed right from your smartphone using these six tips:

Open the doc and select the page that needs to be signed. Donating food, clothing, and household items the irs allows taxpayers to deduct the fmv of food, clothing or household items such as furniture, furnishings, linens, appliances and electronics. Simply giving used clothing directly to a needy person does not qualify.

Type signnow.com in your phone’s browser and log in to your account. Nevertheless, every once in a while a taxpayer is adamant that the cost of his or her clothing should qualify for a tax writeoff and takes the matter all the way to court. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

Comments off on how to itemize clothing donations for taxes; The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return. Standard guidelines, such as a fixed percentage of.

If you don’t have an account yet, register. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing’s values. To receive a deduction, your donated items must be in good used condition or better.

Giving back to your community is one of the more fulfilling things you can do in your life. For example, if you own. You may be able to claim the below tax deductions for some common clothing items you donated in 2021 on the tax return you�ll file in 2022.

Which work clothes are necessary and usable only for work? How much can i deduct for clothing donations 2021. For any single piece of clothing you value at more than $500 you must list these separately on the form and note how much you originally purchased the item for.

The salvation army does not set a valuation on your. Did you know that the irs estimates that overall, small business owners pay an estimated 30% more in taxes by missing out on deductions? October 02, 2020 by tony mers;

For the 2021 tax year, you can deduct up to $300 of cash donations per person without having to itemize, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. Search for the document you need to esign on your device and upload it. Here are some tax deduction for boutique owners.

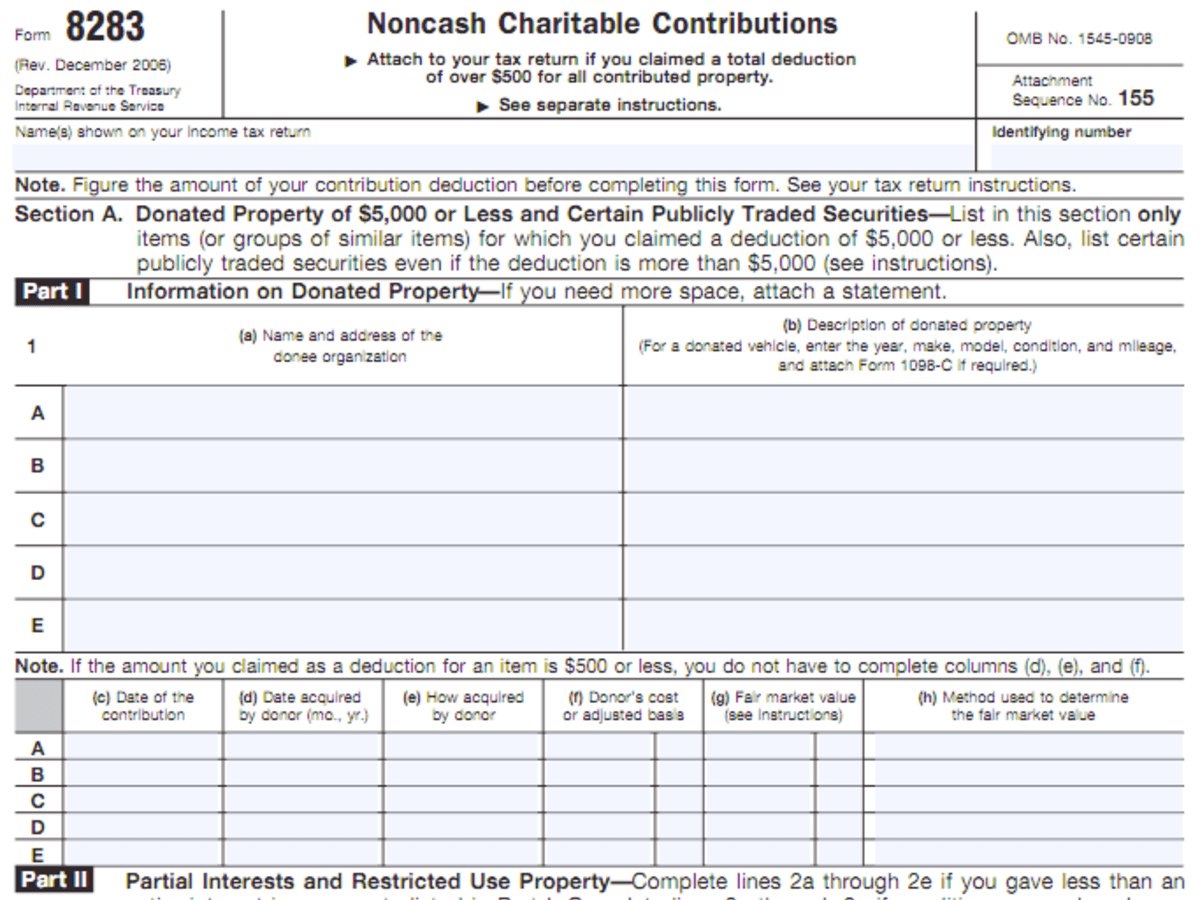

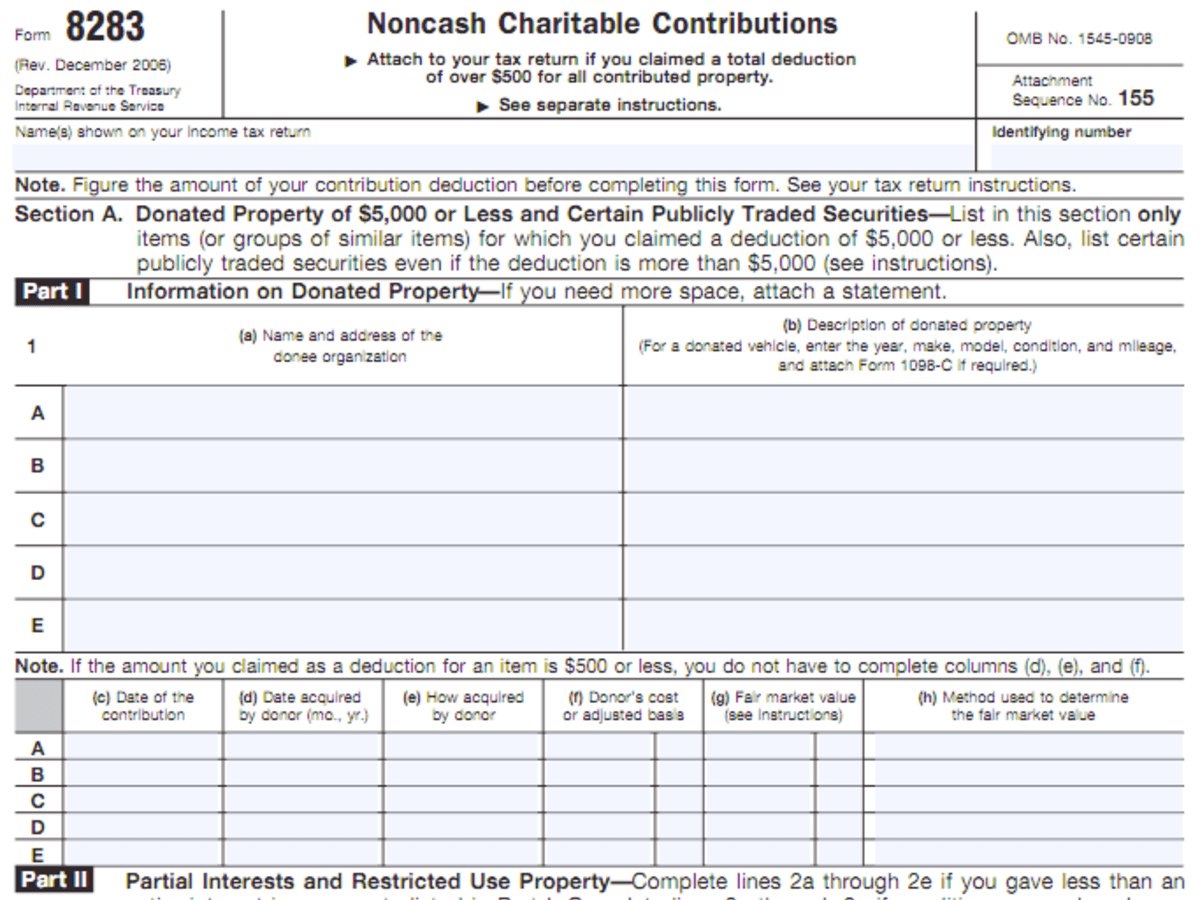

Once you assess the total value of all clothing donations you made, you may need to prepare form 8283 and attach it to your tax return if the total exceeds $500. Document your employer’s policies keep a copy of your employer�s policy. Value usually depends on the condition of the item.

Story continues below this advertisement has not loaded yet, but your article continues below. These values are according to the salvation army and goodwill.