The american jobs creation act of 2004 created additional reporting requirements for individual taxpayers making noncash charitable contributions. The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs.

The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return.

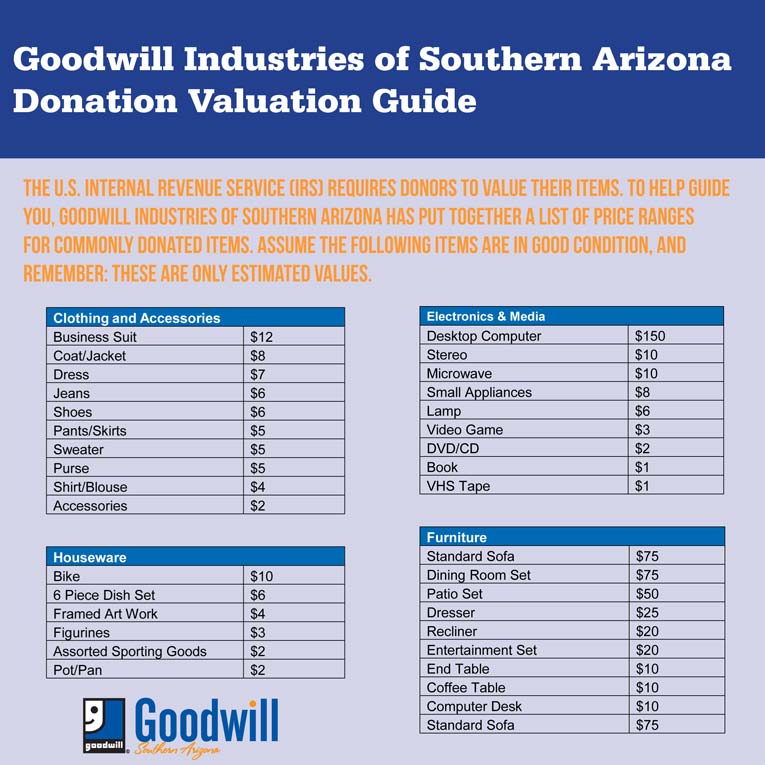

Tax deductions for clothing donations. How much can i deduct for clothing donations 2021. The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions. Only usable clothes should be donated. The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs.

The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. Donations to qualifying charity organizations are deductible on your tax return and may reduce your taxable income and overall tax bill, as long as you follow irs guidelines. As long as your items are in good, used condition (or better), you can deduct the fair market value of those items on your tax return.

The quality of the item when new and its age must be considered. According to the national philanthropic trust, americans gave $471.4 billion to charities in 2020, an increase of 5.1% over 2019 and proof that in good times and bad, the. Donate to a qualifying organization.

If you donate household items or clothing that are not in good used condition or better, you may still take a deduction if the value is estimated to be more than $500, and you include a qualified appraisal with your return. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Any donated household item must be new or used but in good condition and as mentioned above, there is no fixed method for determining the value of these donated items.

An item of clothing that is not in good used condition or better for which you take a deduction of more than $500 requires a qualified appraisal and form 8283, section b. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. The internal revenue service requires that.

Claim a tax deduction your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to federal law. How to claim charitable donations when you file your tax return. Clothing donations are deductible apr 15, 2021 if you choose to itemize deductions on your federal income taxes, remember that all of the extra stuff you donate to clothingdonations.org has a deductible value.

How much can you deduct for the gently used goods you donate to goodwill? Unfortunately, it’s not quite as easy as giving your old clothes to someone you know who’s in need. Things to remember about tax deductible donations.

You cannot take a deduction for clothing unless it is in good used condition or better. See deduction over $500 for certain clothing or household items, later. The american jobs creation act of 2004 created additional reporting requirements for individual taxpayers making noncash charitable contributions.

Ad donate your used clothing, furniture & appliances. The irs allows taxpayers to deduct the fmv of food, clothing or household items such as furniture, furnishings, linens, appliances and electronics. While it might be tempting to give away more ragged garments, charitable.

Once you assess the total value of all clothing donations you made, you may need to prepare form 8283 and attach it to your tax return if the total exceeds $500. During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. Gifts of donated property, clothing, and other noncash items have long been an important source of revenue for many charitable organizations and a popular deduction for taxpayers.

Get clothing donation tax deduction pdf signed right from your smartphone using these six tips: For any single piece of clothing you value at more than $500 you must list these separately on the form and note how much you originally purchased the item for. The irs requires an item to be in good condition or better to take a deduction.

Schedule a free pickup online According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.