Tax deductions for parents of college students the american opportunity credit. There are two education credits available:

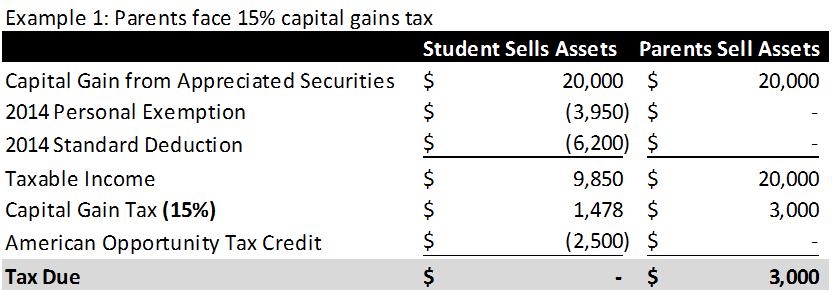

What this means is that you can claim up to a $2,500 credit for any qualified expenses per year (for the first 4 years) for every college student you are supporting.

Tax deductions for college students parent. Ad file with turbotax live and know where your taxes stand, from start to finish. Ad file with turbotax live and know where your taxes stand, from start to finish. They do this by reducing the amount of tax.

What�s more, student loan borrowers pay an average of $1,898 in interest each year. In this case, qualified means the loan was only for. The deduction is worth either$4,000.

With school back in session, parents and students should look into tax credits that can help with the cost of higher education. If you paid more than $600 in interest, your servicer will. Tax deductions for parents of college students the american opportunity credit.

The american opportunity credit is a credit available to parents of college students. However, to claim a college student as a dependent on your taxes, the internal. Don�t know how to start filing your taxes?

The credit pays 100 percent of your eligible expenses up to $2,000, and then adds another 25 percent for the next $2,000 in costs. There are two education credits available: The american opportunity tax credit and the lifetime learning credit.

12 hours agostudent loans have become a huge burden for many parents and young adults. The irs limits the tuition and fees college tax deduction to single taxpayers whose modified adjusted gross income (magi) is less than $80,000 or married (filing jointly only) taxpayers. This college expense deduction lets you reduce your taxable income by up to $2,500 for qualified student interest paid during the year.

Taxpayers who paid eligible tuition and fees in 2018, 2019, or 2020 might claim up to $4,000 in. Generally, a parent can claim your college student children as dependents on their tax returns. To qualify, your student must have been.

The american opportunity credit is a credit available to parents of college students who claim their student. What college expenses are tax deductible for parents?(solved) college tuition and fees are tax deductible on your 2019 tax return. Tax deductions for parents of college students.

The student loan interest deduction one useful tax break for college graduates and their parents is the student loan interest deduction. Tax credit options such as the american opportunity tax credit and lifetime learning credit allow you to deduct portions of tuition and fees, books, supplies, and. Don�t know how to start filing your taxes?

Who can claim an education credit? The tuition and fee deduction was set to expire on december 31, 2020. If you or your parents also paid student loans, you may be able to deduct student loan interest from your taxable income.

With college costs through the roof, and little hope of covering tuition without taking out some. For your 2021 taxes (which you file in. Of course, their income must.

Students who are in graduate school or who aren�t attending school at least half time may be eligible for the lifetime learning credit, which is worth up to 20% of eligible. Many parents, guardians, and students want a break from these expenses. Connect with an expert for unlimited advice

Connect with an expert for unlimited advice What this means is that you can claim up to a $2,500 credit for any qualified expenses per year (for the first 4 years) for every college student you are supporting.