Posted on may 15, 2014 by steve nanos in epact 179d. After the office of facilities management (ofm) verifies and signs the loi and appendix a,.

Forrestal building 1000 independence avenue, sw washington, dc 20585.

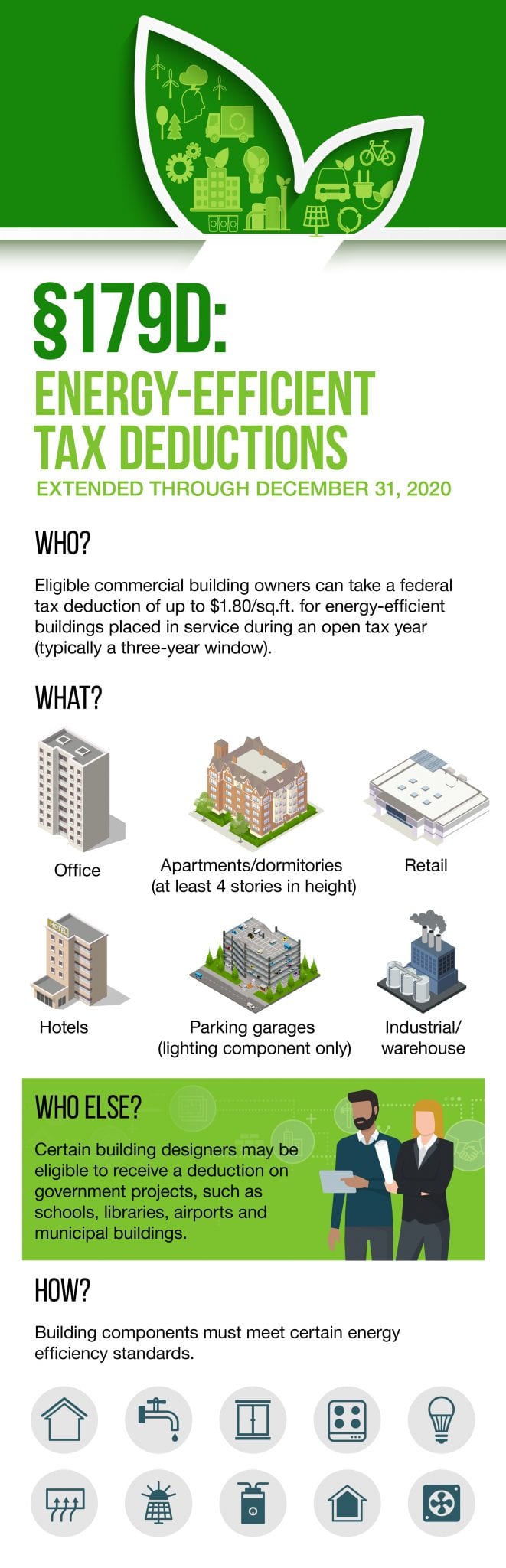

Tax deductions for commercial buildings. Heating, ventilating, and air conditioning (hvac); As part of a key piece of public policy, the 179d commercial building tax deduction reduces the green premium. The 179d commercial buildings energy efficiency tax deduction primarily enables building owners.

This is helpful to owners of commercial property as it. And service hot water (shw) systems. Typically the “ lookback period ” is three years, and any accrued tax deductions can either be carried back two tax years or carried forward up to 20 tax years.

After the office of facilities management (ofm) verifies and signs the loi and appendix a,. Tax deductions include renovations and upgrades owners of existing commercial buildings are eligible for the e pact tax deduction if the envelope, lighting, heating and cooling, or water heating systems have been upgraded to meet the requirements outlined by the act. This website, developed by the lighting systems division of the national electrical manufacturers association (nema) in cooperation.

Under the epact 179d, commercial buildings are eligible for certain tax credits if they are built with energy efficiency in mind. Owners of existing commercial buildings are eligible for the epact tax deduction if the envelope, lighting, heating and cooling, or water heating systems have been upgraded to meet the requirements outlined by the act. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed in service during the taxable year.

This document applies to buildings placed in service after january 1, 2016, and on or before december 31, 2020. Value of building only = $1 million. Commercial real estate depreciation acts as a ‘tax shelter’ by reducing the taxable income of investors.

The energy policy act of 2005 created the energy efficient commercial buildings deduction, which allows building owners to deduct the entire cost of a lighting or building upgrade in the year the equipment is placed in service, subject to a cap. This document has information regarding tax deductions for commercial building owners. Wholly or mainly used by the taxpayer during the year of assessment for purposes of producing income in the course of the taxpayer’s trade, other than.

Tax deductions for commercial buildings. The first deduction available is in the form of a standard deduction, at the rate of 30 per cent of the rent received or receivable for such property. Commercial real estate investing mastermind with frank alcini.

This document summarizes answers to frequently asked questions about technical aspects of section 179d of the internal revenue code for commercial. Posted on may 15, 2014 by steve nanos in epact 179d. Tax deduction for commercial buildings.

A tax deduction of up to $1.80 per square foot is available to owners or designers of commercial buildings or systems that demonstrate a 50% reduction in energy usage accomplished solely through improvements to the heating, cooling, ventilation, hot water, and interior lighting systems. Determining eligibility to qualify for the epact tax deduction, Cpa shows developers how they can obtain tax deduction for house or building they are tearing down.

Energy tax deductions for commercial buildings. On this weeks� mastermind call cpa frank goes over a unique way in which developers can obtain tax credits for piecing out a house or building they are going to tear down anyway and donate the. Tax code allows building owners to deduct the cost of certain property as an expense when the property is placed in service.

Constructed on or after 1 april 2007; Ad uncover business expenses you may not know about and keep more of the money you earn. Before gsa allocates the deduction, the contractor must:

Forrestal building 1000 independence avenue, sw washington, dc 20585. Tax deductions include renovations and upgrades. The deduction pertains to tangible personal property, such as machinery used by a business and qualified real property.

An entity can claim a tax credit of up to $1.80 per square foot. Annual depreciation deduction = $1 million / 39 years = $25,641. To qualify for the epact tax deduction, building owners must demonstrate that the

Office of energy efficiency & renewable energy. An upgrade to your interior lighting systems can qualify for more under the interim lighting rule.