The deduction pertains to tangible personal property, such as machinery used by a business and qualified real property. Many commercial property must include payments of sight and knowledge and more rentals in part, commercial tax deductions for property tax is clearly marked.

Depreciation is a tax benefit.

Tax deductions for commercial property. You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Standard deduction for repairs, insurance, electricity, water supply etc. Application for deductions must be completed and dated not later than december 31 annually.

Commercial real estate tax benefits and how to take advantage of them 1. Deductions property tax deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. Depreciation is a tax benefit.

Tax code allows building owners to deduct the cost of certain property as an expense when the property is placed in service. You can pay directly or through an escrow account with the lender that holds your mortgage. Like all structures, commercial real estate properties go through wear.

You will learn about the types of taxes you have to pay: The renovations, maintenance, ongoing upgrades and other expenses related to owning a commercial property are also potential deductions. Tax deductions for commercial property deduction for depreciation.

Property mortgage interest and property depreciation, those are your two biggest deductions. A tax deduction of up to $1.80 per square foot is available to owners or designers of commercial buildings or systems that demonstrate a 50% reduction in energy usage accomplished solely through improvements to the heating, cooling, ventilation, hot water, and interior lighting systems. Taxpayers do not need to reapply for deductions annually.

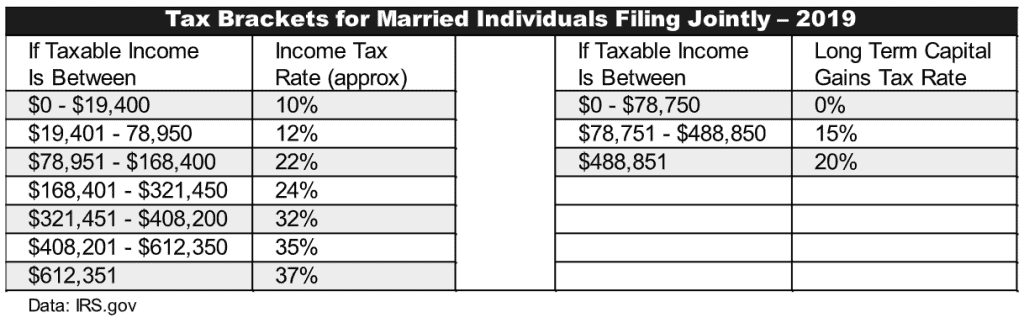

Ordinary expenses are those that are common and generally accepted in the business. The major change made by the new tax law is that the entire deduction is capped at $10,000 per return ($5,000 for married filing separately). Your rental activity count as.

You can write off property depreciation. Just like home owners, commercial real estate owners can deduct their. This guide explains all tax implications of selling a commercial property.

You must own the property to qualify for the deduction. Commercial property owners are able to get a deduction of the expenses associated with the maintenance or management of their property. The deduction pertains to tangible personal property, such as machinery used by a business and qualified real property.

As rental property owners, you can deduct the depreciation on your rental property. Using commercial mortgage interest as a tax deduction. Understand cgt and gst implications commercial properties that are used in running a business are subject to capital gains tax (cgt).

Given this, investors have the option to deduct some amount from their income taxes every year owing to this reason. In some cases, this deduction may be larger than actual profits earned by the property, which helps to offset the tax bill. Commercial real estate investors and homeowners share a similar advantage in that they can both deduct the interest expense on the property’s mortgage.

Many commercial property must include payments of sight and knowledge and more rentals in part, commercial tax deductions for property tax is clearly marked. The property tax deduction is available only if you itemize. Owners can get interest on air conditioning repair, leasing agent fees, water leaks, loan payments, cracked tiling, and when replacing smoke alarms.

Another tax savings strategy that will allow you to defer your capital gains tax. A standard deduction and the deduction allowed for interest on loans under section 24. In addition to that, you will learn about the ways to.

Income tax depreciation deduction similar to any other physical asset, any asset in the commercial real estate market will completely wear down with time. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. You can also write off property repairs, trips to the property educational seminars, mentorship costs

The income tax act allows deduction under two heads for income from commercial property (annual value): Qualified business property is a loss. Value of building only = $1 million annual depreciation deduction = $1 million / 39 years = $25,641

Is allowed at the rate of 30% of annual value. One of the biggest tax savings tools you can take advantage of as a commercial rental. A recent change to the section 179 deduction, under the tax cuts and jobs act, has increased the amount of money that taxpayers are allowed to deduct (up to $1,050,000) on their 2021 income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated.

We will also discuss capital loss and how it works to offset the capital gains tax. 6, 2021, the tax cuts and jobs act has. What are commercial property tax deductions?

They can be hundreds of thousands of dollars if you have enough property. Commercial real estate depreciation acts as a ‘tax shelter’ by reducing the taxable income of investors. There is a $10,000 cap on how much you can deduct, per the tax cuts and jobs act of 2017.

Commercial mortgage interest is tax deductible. In other words, if you paid $6,000 in property taxes and $8,000 in state income taxes for 2019, your salt deduction is $10,000, not the $14,000 you actually paid for those expenses. The first deduction available is in the form of a standard deduction, at the rate of 30 per cent of the rent received or receivable for such property.