The tax reform act of 1976 engrafted a second concept onto the marital deduction: The basic purpose of the deduction was to provide equalization in estate and gift tax treatment between spouses residing in com munity property states and those residing in common law property states.

Try it for free and have your custom legal documents ready in only a few minutes.

Tax deductions for common law. This refers to a variety of credits, including for tuition, interest on. Using this method, you will deduct part of the cost of the asset from your taxes each year over the “useful life” of the asset. Child care expenses (line 21400):

Regardless of your trade in the construction industry, allowable tax deductions can lower your tax liability and possibly lead to getting a tax refund. Try it for free and have your custom legal documents ready in only a few minutes. The plan of this article is to analyze the marital deduction against the experience of eight years to determine whether or not

Spouse or common law partner amount: Due to the tax cuts and jobs act, many common law enforcement tax deductions aren�t available through 2025 if you�re an employee. Whether an individual uses a personal vehicle for his or her own business or company owns a vehicle, the depreciation of value and costs associated with that vehicle may be deducted from the company’s income at year�s end.

Disability amount, disability tax credit & caregiver credit. To receive the full deduction you must have earned less than $65,000 as a single filer or $135, 000 if you are married filing jointly. Common tax deductions for small businesses automobile deductions:

(how it works.) deduction for state and local taxes you. For decedents dying after december 31,1976, a marital deduction was allowed up to $250,000, even if this amount exceeded Common tax deductions below are some of the common federal tax deductions your clients might claim or be able to claim, when you are supporting someone to file a tax return at your community tax clinic.

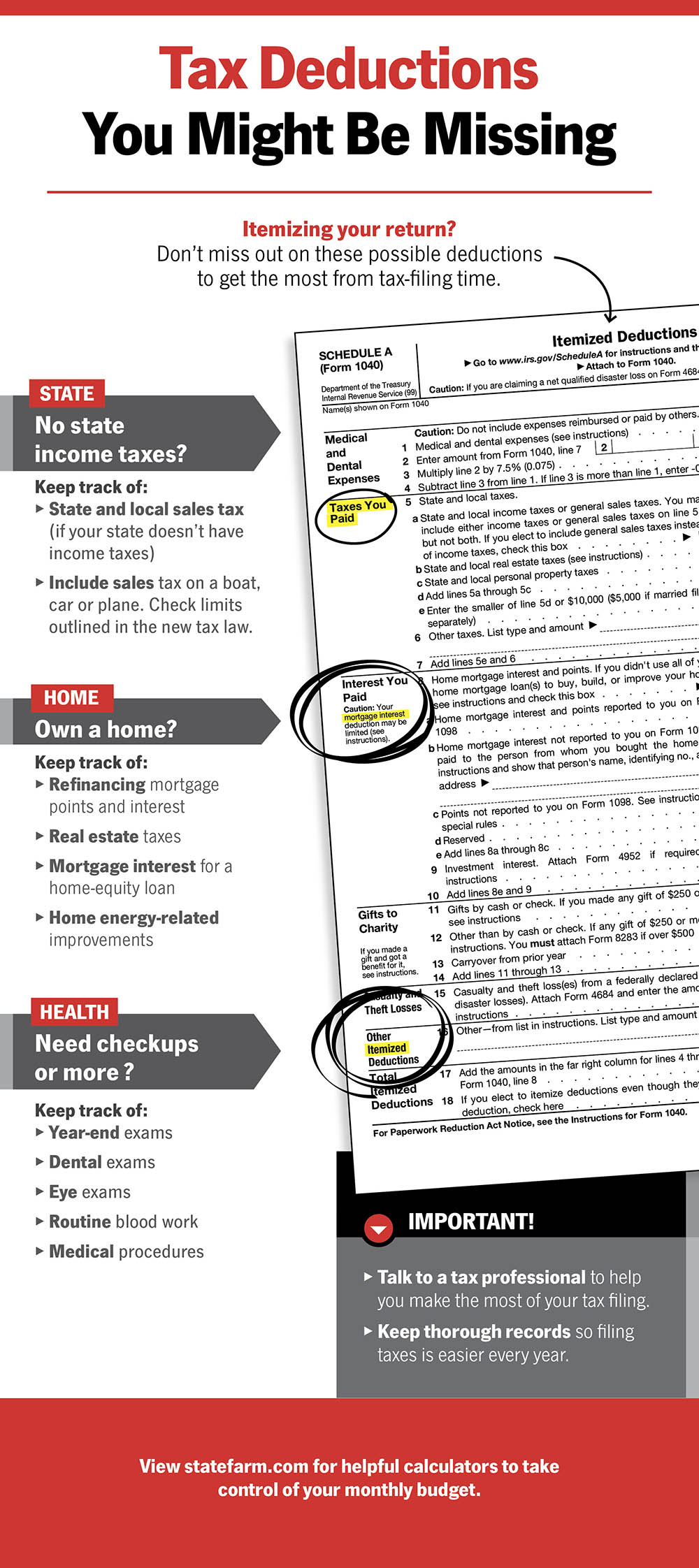

You can still deduct costs related to a 1099 law enforcement job and take advantage of the general tax deductions available. Let’s not get ahead of ourselves though. In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income for the tax year.

Education deductions and credits include amounts you may be able to claim as a deduction or a credit related to education. You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job. Here are the top tax deductions that every professional business owner should know about.

If you earned more than than the income limits for the full deduction, you may qualify for a reduced deduction if you don’t earn more than $80,000 as a single filer or $165,000 filing jointly. If you don�t maintain an inventory or buy expensive equipment, these day. You can claim childcare expenses if you hire a babysitter or send your child to daycare so you can go to.

The tax reform act of 1976 engrafted a second concept onto the marital deduction: Itemized deductions include, but are not limited to, things like: Expenses was the common law doctrine that no deduction is allowable if it would frustrate public policy.1 the court�s denial of a deduction was not grounded on the construction of a code provision, such as the requirement that an expenditure be an ordinary and necessary business expense to be deductible.

Since it’s a miscellaneous deduction, it’s subject to the 2 percent limit, which means that you have to have combined miscellaneous deductions greater than 2 percent of your adjusted gross income to begin writing them off. First is the depreciation method. The basic purpose of the deduction was to provide equalization in estate and gift tax treatment between spouses residing in com munity property states and those residing in common law property states.

You can claim a tax credit if at any time in the year you “supported” a spouse or common law partner and their net income was less than $12,069. You�ll need to itemize for most. Common tax deductions for small business owners updated on december 19, 2021 december 18, 2021 8 comments on common tax deductions for small business owners preparing for income tax season is one of the least favorable jobs a small business owner does.

Claim the charitable tax deductions you have contributed to by filling out schedule 9 as well as line 349 of schedule 1 of your income tax return. But if you qualify, it could pay off. Charitable donations (charitable tax credits) child care expenses.

Common law and community property states, no marital deduction was allowed for an estate consisting solely of community property. Medical expenses charitable contributions mortgage interest and home mortgage points local and state taxes education expenses casualty and theft loss certain miscellaneous expenses Try it for free and have your custom legal documents ready in only a few minutes.