Find information about the amounts you may be able to claim as a deduction or a credit related to education. If you’re married to someone who is also an educator, you may deduct up to $500 in educator expenses from your income taxes.

Continuing education and training courses are often in locations that are also popular vacation spots.

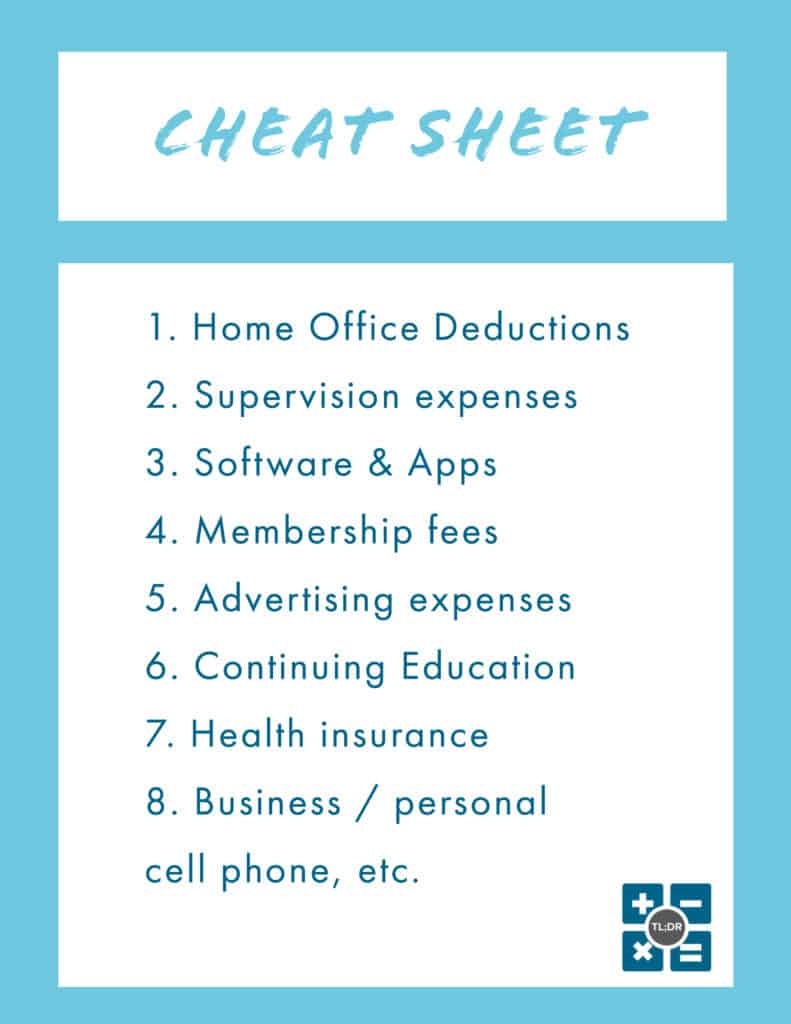

Tax deductions for continuing education. Ad turbotax® makes it easy to get your taxes done right. Continuing education and training courses are often in locations that are also popular vacation spots. However, costs for a course taken at a distant location or at a location outside the territorial limits of the professional organization would be considered unreasonable by the cra if that same course was offered locally at a smaller cost.

Qualifying elementary and secondary school teachers and other eligible educators (such as counselors and principals) can deduct up to $250 of qualified expenses. From simple to complex taxes, filing with turbotax® is easy. If attending a class or conference benefits your business or contributes to your continuing education, then you can write off your travel expenses.

Tax advantaged 529 plans and coverdell education savings accounts. Select i�ll choose what i work on; Is required to meet the minimum educational requirements in effect when you first got the job to deduct these, itemize deductions on schedule a.

This includes, tuition, education, and textbook amounts, interest paid on student loans, and moving expenses. To be deductible, you must be able to show that this education maintains or improves skills required in your present work. it is required by law or regulations for maintaining a license to practice, status, or job. Deduct your educational expenses and bank fees as other miscellaneous expenses

First, a special educator deduction allows kindergarten through grade 12 teachers to deduct up. 🏘️ real estate license renewal. Find information about the amounts you may be able to claim as a deduction or a credit related to education.

The tuition and fee education tax deduction was repealed for 2021 and 2022 (and beyond) with the taxpayer certainty and disaster tax relief act of 2020. Select visit all beside education Teachers often take continuing education courses or other courses to improve their skills even.

Some industries — like real estate — require licenses or certifications to be. Once licensed, you can deduct the cost of any continuing education classes needed to improve your skills. For example, professionals can deduct costs for continuing education 4 education expenses are not deductible if

Your deductions must be more than the 2% of adjusted gross income (agi) threshold for miscellaneous deductions. Expenses that you can deduct include: Tuition, books, supplies, lab fees, and similar items certain transportation and travel costs other educational expenses, such as the cost of research and typing

Coverdell education savings accounts and 529 plans are tax advantaged savings accounts for. To enter for this deduction use the following steps: That said, neither party may deduct more than $250 each.

If you’re an employee, you write the expenses off by itemizing on schedule a. To be deductible, your expenses must be for education that either maintains or improves your job skills, or is required by your employer or by law to keep your salary, status or job. If the cost of the continuing education maintains or improves skills you use on the job or that is required to maintain your job, it is deductible.

For example, you might be a freelance consultant going to college on the side. Where do i deduct continuing education? However, deductions don’t count if you are attending for.

Classes you take for a new field aren�t deductible. If you�re an employee, you write the. Maintain your irs afsp record of completion with one of our online ce classes.

However, it must be directly related to your current job. Once licensed, you can deduct the cost of any continuing education classes needed to improve your skills. Tuition and fees education tax deduction.

Cost of the class or conference cost of the hotel 50% of the cost of meals on your trip buses, taxis, subway rides, airplane flights, and tips If you’re married to someone who is also an educator, you may deduct up to $500 in educator expenses from your income taxes. Ad credentialed afsp continuing education online | we report your ptin to the irs for you.

Here are the basics : Expenses to learn a new trade or job or to qualify for a new career aren�t deductible. Tax deductions for teachers and educators $250 educator deduction.