For example, the cra can decide that salaries paid to related persons are not needed to earn business income. Tax write off on equipment year 1 year 2 year 3 year 4 old rules $2,000 $1,600 $1,280 $1,024 accelerated rules $3,000 $1,400 $1,120 $896 3.

100% deductible meals include company picnics and parties, staff meetings, office snacks and other meals that are for “the convenience of the employer”.

Tax deductions for dentists. This reduction applies to paychecks for the calendar year 2011. Tax deductions a to z for dentists (tax deductions a to z series): Finally, employees at dental practices are entitled to a minimum 2% reduction in payroll taxes, although the employer portion of the tax does not qualify for this.

Under section 179, you can write off these expenses and claim a maximum deduction of $500,000. Some deductions that may be available to dentists include: Teeth cleanings, sealants, and fluoride treatments are examples of common preventive treatments.

Payments you made for inpatient hospital or nursing home care, though with exceptions for. Ad answer simple questions about your life and we do the rest. Costs of medicines and medical supplies;

Employing children in your practice. Ensure you claim all possible tax deductions many dentists have annual holiday parties especially in. However, we have produced a simple guide to let you know what you can claim for and what category it should be associated with.

Skalka cpa, anne, gregg, janice beth: Basically, any treatment to prevent or alleviate dental disease is considered tax deductible. It is not just your equipment expenses you are allowed to deduct.

With the correct structure a dentists working as a contractor can not only have thousands of dollars in additional tax deductions, but they can also contribute much more to a 401k plan than a employee. From simple to complex taxes, filing with turbotax® is easy. A section 179 tax deduction may allow dental practices to take a tax deduction for the cost of qualifying purchases, such as new equipment and technology, in the year it is purchased into service.

Training and courses for new skills; Section 179 can result in a 2022 tax deduction for up to $1,080,000, help lower your taxable income, and increase cash flow. It allows for investment in dental technology and while most professionals don’t think about this option until tax time, we discuss what it means, how dentists can use it and why compassionate finance can be.

100% deductible meals many doctors fail to separate the business meals that are 50% deductible from the ones that are 100% deductible. Below are some of the key tax deductions a dentists. There are many ‘grey’ area decisions as to whether an expense is really a ‘business’ expense at all.

This includes the following procedures: You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. Computer equipment and software as well as insurance to protect them;

Travel between surgery, hospital and patients in different surgeries. Fees paid to licensed doctors, dentists, other medical professionals (such as chiropractors and psychiatrists) and costs. 100% deductible meals include company picnics and parties, staff meetings, office snacks and other meals that are for “the convenience of the employer”.

You may have an opportunity to employ. Here are our top 5 strategies for dental practice owners to consider. Dental accountants are probably aware of the 179 deduction.

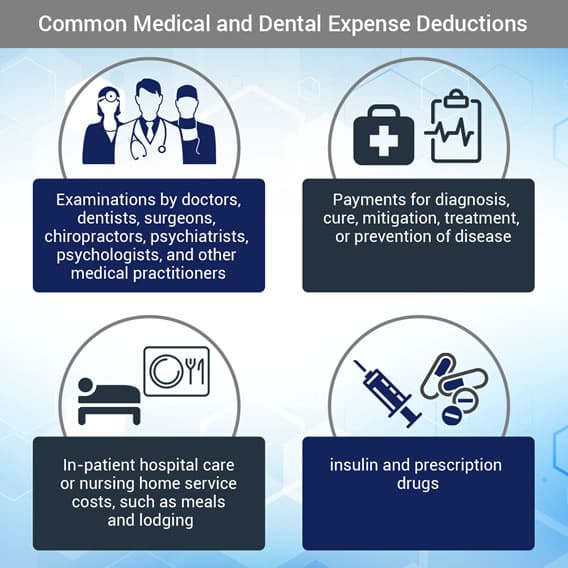

Common medical and dental expenses you may be able to claim a deduction for include: Medical and dental expenses you can deduct most expenses relating to medical or dental diagnosis, treatment or prevention as long as those expenses are in excess of 7.5 percent of your adjusted gross income (agi). The same holds true for lea you desks, computers, file cabinets and anything else that you buy for your dental office.

If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. Cra permits dental instruments below $500 to be written off as expenses. Income shifting enables you to deduct much of the income from the “c” corporation by using the tax code deductions guide.

Consider increasing contributions to an. Food, except in certain circumstances For example, the cra can decide that salaries paid to related persons are not needed to earn business income.

Tax write off on equipment year 1 year 2 year 3 year 4 old rules $2,000 $1,600 $1,280 $1,024 accelerated rules $3,000 $1,400 $1,120 $896 3. Dentists that work as independent contractors have a unique advantage when it comes to paying lower taxes. If you still need help, we’re specialist dental.

30 rows both typically require a dental practice spend money, but that is where it ends. Increasing retirement plan contributions can reduce taxable income.