It is currently worth up to $3,600 per child. Member of household or relationship test.

Exceptions dependent taxpayer test joint return test exception.

Tax deductions for dependents. Member of household or relationship test. At any age, if you are a dependent on another person�s tax return and you are filing your own tax return, your standard deduction can not exceed the greater of $1,100 or the sum of $350 and your individual earned income. Foreign students� place of residence.

This may have included yourself, your spouse and any qualifying dependents. Answer there are no specific credits available for disabled dependents. $1,100 or the dependent�s earned income (from work) + $350, not to exceed the standard deduction shown for dependent�s filing status in:

Standard deduction for dependents if someone else claims you on their tax return, use this calculation. Below are some of the most common deductions and exemptions americans can take. Although the exemption amount is zero, the ability to.

Your total medical deductions must add up to more than 7.5 percent of your adjusted gross income, and you can only deduct the costs above that figure. A dependency exemption is not authorized for yourself or your spouse. To meet this test, the person can�t be your qualifying child or another taxpayer�s qualifying child.

You may qualify for the child tax credit, which is a tax credit for your dependent children that is superior to a tax exemption in that it cuts your taxes dollar for dollar. Citizen or resident test exception for adopted child. However, there is a one special rule when it comes to claiming dependency exemptions for disabled family members.

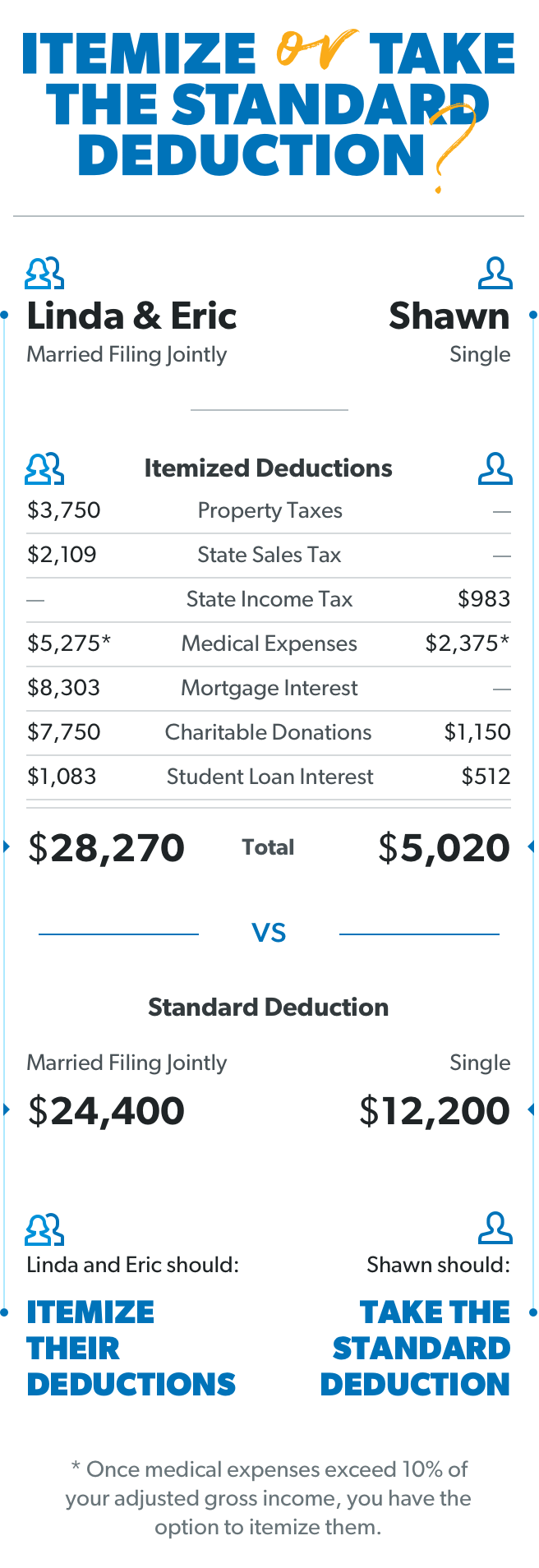

Table 1 if dependent is under age 65, or table 2 if dependent is age 65 or over and/or blind In addition to the tax rates, the irs upped many of the deductions and exemptions americans use to lower their taxable income calculation, and therefore their taxes. The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income.

Exceptions dependent taxpayer test joint return test exception. February 21, 2022 when filing their taxes, taxpayers with children can claim a dependent deduction for each child. There are two types of dependents, a qualifying child and a qualifying relative.

In the 2017 tax year, the exemption typically resulted in a $4,050 reduction of taxable income for each one you qualified for. When dealing with income taxes, the taxpayer is given credit for certain types of expenses.many times the credit is given as a flat amount, based on what the government considers to be reasonable costs for a particular. Dependents who do not qualify for the child tax credit may still qualify you for the credit for other dependents.

The person must live with you all year as a household member. (1) $1,100, or (2) your earned income plus $350 (but the total can�t be more than the basic standard deduction for your filing status). The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the tax cuts and jobs act.

The average working family can receive about a $3,584 credit for a qualifying child, a number that grows to $6,660 for families with three or more little ones. For a family that qualified for four exemptions, the total reduction of taxable income ended up being $16,200. The qualifying dependent must be a u.s.

Not eligible for the standard deduction Not a qualifying child test. A larger child tax credit (now worth up to $2,000 per qualifying child) a bigger additional child tax credit (up to $1,400 per qualifying child) as well as a new credit for other dependents, which is worth up to $500 per qualifying dependent (not to be confused with the child and dependent care credit) for your 2021 tax return that you will.

If you make $100,000 per year and receive a deduction of $20,000, then you can only be taxed on $80,000. However, these older children and other qualifying dependents may be eligible for a new tax credit of up to $500 called the credit for other dependents. If you have filed as head of family, you must have at least one qualifying dependent listed.

What are the tests for a qualifying relative? Eligibility for this deduction is dependent on several factors, such as the size of your family, tax filing status, and overall income, but it’s worth considering. Enter the larger of line 1 or line 2 here 3.

Qualifying child relationship test adopted child. For example, if 7.5 percent of your agi is $4,500, and if your total medical expenses for the year are $4,750, you can deduct $250. There is also an additional $500 tax credit for other dependents, and a dependent and child care tax credit.

You may be able to claim more dependent tax deductions and credits as a family than single. The child tax credit is better than the deductions because your taxes are. Tax deductions for claiming a dependent a deduction means less of your income can be taxed.

It is currently worth up to $3,600 per child.